Navigating the world of insurance can often feel overwhelming, especially when it comes to filing a claim. Whether you’ve experienced damage to your property, a car accident, or unexpected medical expenses, understanding how to effectively manage your insurance claim is crucial. In this article, we will provide you with an essential step-by-step guide to help you through the entire process. From gathering necessary documentation to communicating with your insurance provider, our goal is to equip you with the knowledge and confidence needed to ensure that you receive the compensation you deserve. Let’s dive into the essential steps that will make your insurance claim experience as smooth and efficient as possible.

Table of Contents

- Understanding the Insurance Claims Process from Start to Finish

- Gathering Necessary Documentation for a Successful Claim

- Navigating Common Challenges and Roadblocks in Insurance Claims

- Tips for Following Up and Ensuring Timely Resolution of Your Claim

- Key Takeaways

Understanding the Insurance Claims Process from Start to Finish

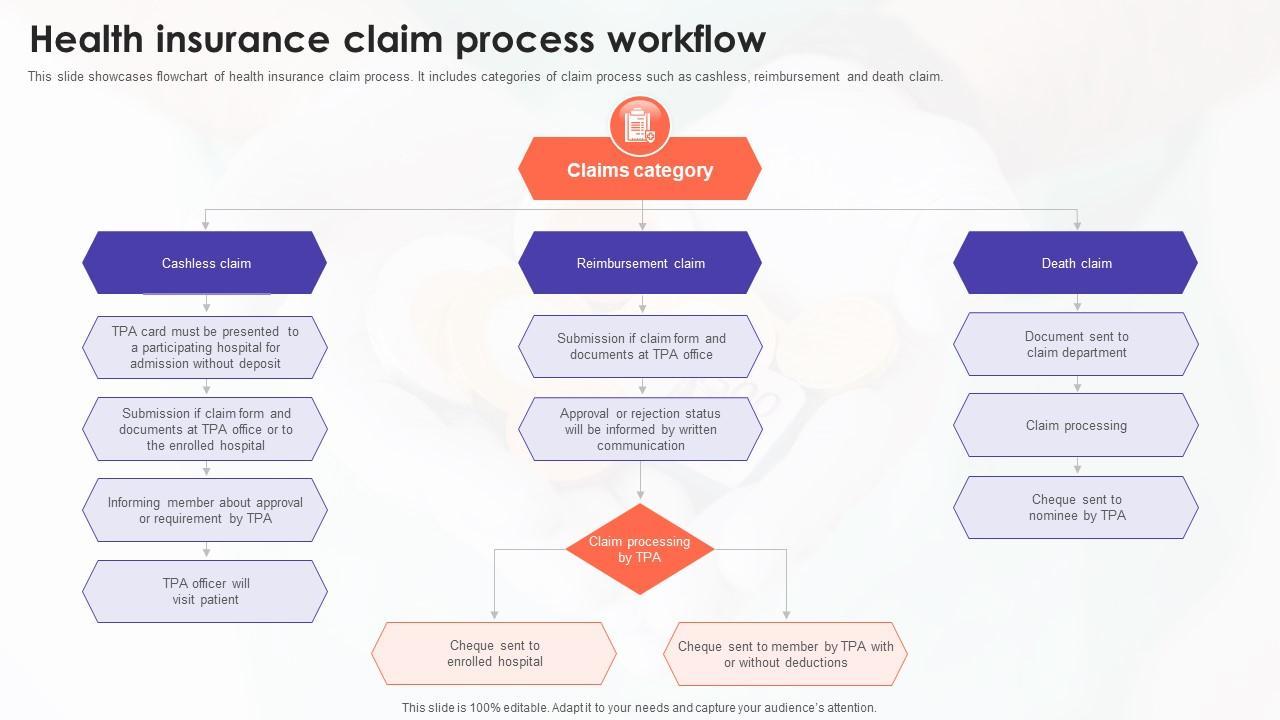

When it comes to navigating the intricacies of an insurance claim, understanding the process is crucial to ensuring a smooth experience. The first step typically involves notifying your insurance company about the incident that led to the claim. Whether it’s a car accident, a house fire, or medical expenses, gathering relevant details such as dates, times, and circumstances is essential. Insurers often provide a timeline for how long you have to file a claim, so it’s wise to act promptly. After notification, you’ll need to fill out a claim form, where accuracy is key to avoiding delays in processing.

Once your claim is submitted, the insurer will initiate an investigation process to assess the validity of your claim. During this phase, they may require additional documentation or evidence, which could include photographs, witness statements, or police reports, depending on the nature of the claim. After thorough evaluation, the insurance company will make a determination on your claim. If it’s approved, they will outline the amount covered, any applicable deductibles, and the timeframe for compensation. Should your claim be denied, you’ll receive a detailed explanation, along with information on how to appeal the decision.

| Step | Action |

|---|---|

| 1 | Notify your insurance company. |

| 2 | Gather documentation and evidence. |

| 3 | Submit the claim form. |

| 4 | Cooperate with the insurer’s investigation. |

| 5 | Receive claim determination. |

Gathering Necessary Documentation for a Successful Claim

Before initiating your insurance claim, it’s crucial to gather all necessary documentation to support your case. In most instances, insurance companies require specific information to assess the claim effectively. Create a checklist to ensure you don’t overlook anything. Essential documents include:

- Claim Form: Complete the insurance company’s claim form with accurate details.

- Policy Information: Have your policy number and relevant details readily available.

- Proof of Loss: Collect photographs, receipts, or a written statement outlining the loss or damage.

- Witness Statements: If applicable, gather statements from witnesses to the incident.

- Medical Records: For health-related claims, collect any relevant medical documentation.

To streamline the process, consider organizing these documents in a dedicated folder—either physical or digital. Additionally, maintaining a log that includes important dates and contacts, such as the date of the incident, when you reported it, and any communication with the insurance provider, can be beneficial. Below is a simple table that summarizes key types of documentation:

| Document Type | Description |

|---|---|

| Claim Form | Official form to report a claim. |

| Proof of Loss | Documentation showing the details of the loss. |

| Policy Information | Details from your insurance policy. |

| Medical Records | Relevant health records for injury claims. |

Navigating Common Challenges and Roadblocks in Insurance Claims

When navigating the complex world of insurance claims, policyholders often encounter a variety of challenges that can delay or hinder their claims process. Understanding these hurdles is essential to achieving a successful outcome. Some common obstacles include:

- Lack of Documentation: Insufficient or missing paperwork can lead to claim denials.

- Misinterpretation of Coverage: Policyholders may misunderstand the specifics of their coverage, resulting in unexpected limitations.

- Delayed Responses: Insurance companies can sometimes take longer than anticipated to respond to claims, causing frustration.

- Complex Claim Processes: Navigating the intricacies of filing a claim can be overwhelming for many individuals.

To overcome these roadblocks, proactive measures can make a significant difference. Maintaining meticulous records and understanding your policy are crucial steps. You may also benefit from:

- Regular Follow-Ups: Contact your insurance provider for updates and communicate clearly.

- Utilizing Claim Advocates: Enlist the help of professionals who can assist in negotiating and navigating the claim process.

- Staying Informed: Educating yourself about your rights and the claims process helps empower you during challenging situations.

Tips for Following Up and Ensuring Timely Resolution of Your Claim

Staying proactive is key to ensuring your insurance claim progresses smoothly. After you’ve submitted your claim, it’s essential to maintain consistent communication with your insurance provider. Here are some effective strategies to keep your claim on track:

- Set Reminders: Schedule follow-up reminders on your calendar to check in on the status of your claim.

- Document Everything: Keep a detailed record of all correspondence, including dates, names of representatives, and what was discussed.

- Use Multiple Channels: Don’t hesitate to reach out via phone, email, or chat for updates, and choose the method that works best for you.

To further expedite the resolution process, consider preparing a simple table that summarizes your claim details and status updates. This can help clarify any points of confusion and allows you to present your information effectively to the claims adjuster.

| Claim Detail | Status |

|---|---|

| Claim Number | #123456 |

| Date Submitted | January 5, 2023 |

| Last Follow-Up | January 20, 2023 |

By maintaining a systematic approach to following up and keeping organized records, you can significantly increase the likelihood of a timely and favorable resolution to your claim. Remember, your diligence is your best ally in the claims process!

Key Takeaways

navigating the world of insurance claims can often feel daunting, but with a clear understanding and a systematic approach, you can streamline the process and enhance your chances of a successful outcome. By following the step-by-step guide outlined in this article, you’ll be better equipped to handle your claims confidently and efficiently. Remember to stay organized, keep thorough documentation, and communicate effectively with your insurer. Whether you’re dealing with a minor incident or a more complex situation, being proactive and informed will serve you well. We hope this guide empowers you to tackle your insurance claims with clarity and assurance. If you have any questions or personal experiences to share, feel free to leave a comment below – we’d love to hear from you!