In a world where financial security is often a luxury, microinsurance emerges as a vital tool for millions around the globe. Born out of the need to bridge the protection gap for low-income individuals and families, microinsurance offers tailored insurance solutions that promise affordability and accessibility. Despite its increasing relevance, the concept can often be misunderstood or overlooked. This article delves into the fundamentals of microinsurance, exploring its purpose, key features, and the significant role it plays in poverty alleviation and community resilience. Whether you’re a policyholder, an insurer, or simply someone curious about the evolving landscape of insurance, this comprehensive overview will equip you with the knowledge needed to understand the impact and importance of microinsurance in today’s economy.

Table of Contents

- Understanding the Concept of Microinsurance and Its Importance

- Key Features of Microinsurance Products and Their Benefits

- Challenges in Implementing Microinsurance Solutions and How to Overcome Them

- Best Practices for Effective Outreach and Engagement in Microinsurance Markets

- Closing Remarks

Understanding the Concept of Microinsurance and Its Importance

Microinsurance is an innovative financial product designed to cater to the needs of low-income individuals and communities, often overlooked by traditional insurance providers. It offers affordable coverage that protects against specific risks such as health emergencies, natural disasters, and personal accidents. The key benefits of microinsurance include:

- Affordability: Premiums are significantly lower, making it accessible to those who may struggle with conventional insurance costs.

- Simplicity: Policies are straightforward, often with minimal documentation, allowing users to understand their coverage easily.

- Targeted Coverage: Microinsurance plans usually focus on specific risks relevant to the vulnerable populations they serve.

The importance of microinsurance extends beyond individual protection; it plays a pivotal role in enhancing the financial resilience of entire communities. By mitigating risks, microinsurance empowers families to recover from setbacks without depleting their savings or falling into debt. Furthermore, its widespread adoption can contribute to economic stability and growth in underserved regions. An examination of its impact highlights key factors:

| Impact Factor | Explanation |

|---|---|

| Financial Inclusion | Enables low-income individuals to participate in the formal economy. |

| Improved Health Outcomes | Access to healthcare financing reduces the risk of catastrophic health expenditures. |

| Empowerment | Provides families with a safety net, fostering a sense of security and stability. |

Key Features of Microinsurance Products and Their Benefits

Microinsurance products offer a tailored insurance solution designed specifically for low-income individuals and communities. They are characterized by their affordability, accessibility, and simplicity. These products typically feature lower premium amounts, making them viable for those with limited financial resources. Additionally, microinsurance often employs streamlined processes for enrollment and claims, reducing bureaucratic hurdles that can discourage participation. Key features include:

- Small Coverage Amounts: Targeted at specific risks such as health emergencies, natural disasters, or crop failures.

- Community-Based Models: Many microinsurance products are offered through local organizations, fostering trust and understanding.

- Flexible Terms: Policies designed to meet the varied needs and capacities of clients, from pay-as-you-go models to annual plans.

These features contribute to substantial benefits for policyholders. For instance, having microinsurance can provide individuals with a financial safety net that mitigates the impact of unexpected events, enabling them to recover more swiftly. Moreover, microinsurance empowers communities by encouraging a culture of risk-sharing and collective responsibility. The following table highlights some of the core benefits:

| Benefit | Description |

|---|---|

| Financial Security | Helps families cope with emergency expenses without resorting to high-interest loans. |

| Improved Access to Healthcare | Increases the likelihood of seeking medical treatment through affordable health coverage. |

| Enhanced Resilience | Strengthens communities against economic shocks, fostering long-term stability. |

Challenges in Implementing Microinsurance Solutions and How to Overcome Them

The implementation of microinsurance solutions often encounters significant hurdles that can hinder their success in reaching underserved populations. Regulatory challenges pose a considerable barrier, as varying rules and policies across regions can complicate compliance for microinsurance providers. Additionally, lack of awareness and understanding among potential beneficiaries prevents widespread adoption, as many individuals do not fully grasp the benefits or workings of microinsurance products. Moreover, limited distribution channels can restrict access, particularly in rural areas where traditional insurance models are less effective.

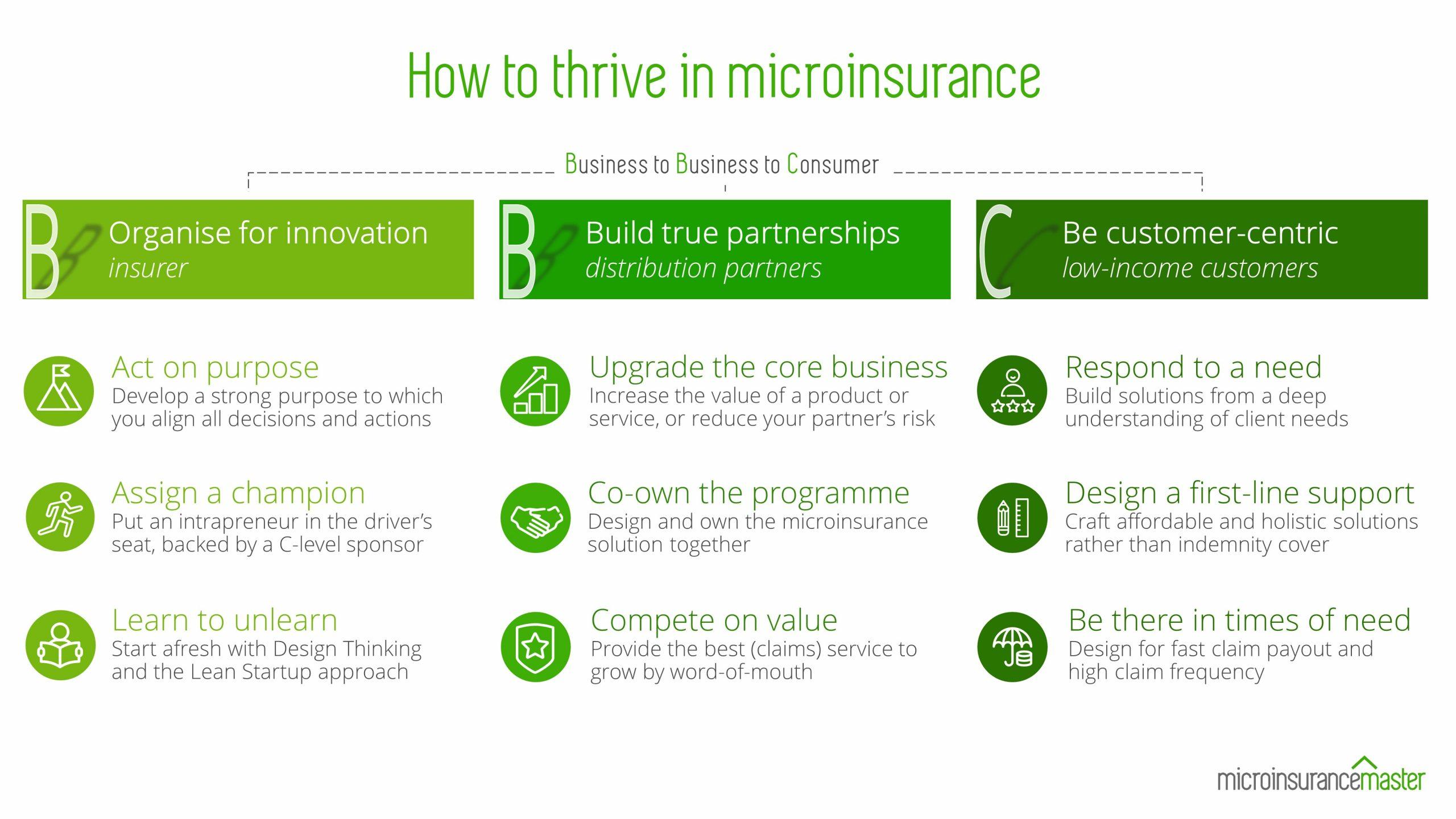

To effectively navigate these obstacles, stakeholders must adopt a multi-faceted approach. First, fostering partnerships with local organizations can enhance community engagement, educating potential beneficiaries about microinsurance and helping to build trust. Secondly, leveraging technology, such as mobile applications and digital platforms, can streamline processes and improve accessibility, particularly in remote locations. developing tailored products that cater to the specific needs and financial capabilities of the target market can significantly enhance uptake, ensuring that microinsurance solutions are not only available but also attractive to potential customers.

Best Practices for Effective Outreach and Engagement in Microinsurance Markets

Effective outreach and engagement in microinsurance markets hinges on understanding the unique needs of target communities. Conducting thorough market research is crucial to identify the demographics, financial habits, and risk perceptions of potential clients. This helps in tailoring products that resonate with their specific circumstances. Additionally, building strong community partnerships can enhance trust and credibility. Collaborating with local organizations, community leaders, and influencers can facilitate greater penetration of microinsurance products, ensuring that they reach those who need them most.

Moreover, leveraging technology can significantly amplify outreach efforts. Utilizing mobile applications and social media platforms for education and engagement can make information more accessible. It is also essential to implement feedback mechanisms where customers can express their opinions and experiences regarding microinsurance products. This two-way communication not only fosters loyalty but also enables companies to adapt their offerings based on real-time insights. Offering training sessions, workshops, and informational pamphlets in local languages can further bridge gaps in understanding and encourage widespread participation.

Closing Remarks

microinsurance stands as a pivotal solution for addressing the insurance needs of underserved populations. By providing affordable coverage tailored to the unique risks faced by low-income individuals and communities, microinsurance helps bridge the protection gap in many developing regions. As we move forward, understanding its intricacies not only empowers consumers but also guides policymakers and practitioners in creating frameworks that foster accessibility and sustainability.

As the microinsurance landscape continues to evolve, ongoing education and awareness will be key in ensuring that more people can benefit from its advantages. Whether you are a consumer seeking protection or a provider looking to develop offerings, staying informed will help you navigate this important sector. Together, we can contribute to a more inclusive insurance ecosystem that better serves all members of society. Thank you for joining us on this journey to understand microinsurance!