When it comes to navigating the world of insurance, one term that often surfaces is “deductible.” For many, this word can evoke confusion or uncertainty, as it plays a crucial role in determining how much you pay out-of-pocket in the event of a claim. Whether you’re dealing with health, auto, homeowners, or any other type of insurance, understanding deductibles is essential for making informed financial decisions. In this article, we will break down what insurance deductibles are, how they work, and what factors to consider when choosing the right deductible for your needs. By gaining a clearer understanding of this key aspect of insurance policies, you’ll be better equipped to protect yourself and your assets while ensuring that you choose coverage that aligns with your financial situation. Let’s dive in!

Table of Contents

- Understanding the Basics of Insurance Deductibles and Their Purpose

- Types of Deductibles: Which One is Right for You

- How Deductibles Impact Your Premiums and Claims

- Strategies for Managing Your Deductible Effectively

- The Conclusion

Understanding the Basics of Insurance Deductibles and Their Purpose

Insurance deductibles are a crucial aspect of your insurance policy that can significantly affect both your premium costs and your out-of-pocket expenses when you file a claim. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. The purpose of a deductible is twofold: it helps to reduce the overall cost of your premiums and encourages policyholders to share some of the risks associated with insuring their property. When you choose a higher deductible, you generally benefit from lower monthly premiums, but it also means that you will incur higher costs when making a claim.

Understanding how deductibles work can empower you to make informed decisions about your insurance coverage. Here are some key points to consider:

- Types of Deductibles: There are mainly two types of deductibles—fixed and percentage-based. Fixed deductibles are a set dollar amount, while percentage-based deductibles depend on the total insured value.

- Choosing the Right Amount: The best deductible for you balances affordable premiums and manageable out-of-pocket expenses.

- Frequency of Claims: If you anticipate making frequent claims, a lower deductible might be more beneficial, whereas a higher deductible can save money for those who rarely file claims.

Types of Deductibles: Which One is Right for You

When selecting an insurance policy, understanding the different types of deductibles can significantly impact your coverage choices. A fixed deductible is a set dollar amount that you must pay out of pocket before your insurance begins to cover the costs. This type offers predictability, making it easier to budget for expenses. On the other hand, a percentage deductible requires you to pay a specified percentage of the total claim amount. This approach can be beneficial for high-value claims, as it often results in a lower initial out-of-pocket cost, although it could lead to larger payouts in certain scenarios.

Another option is the per-incident deductible, commonly used in health and auto insurance. With this type, you pay a deductible amount for each individual claim you file, which can be advantageous if you expect multiple small claims throughout the year. Alternatively, an annual deductible covers all claims for a full year up to a specified limit, making it a suitable choice for those who prefer consolidation in their payments. To help you determine which deductible fits your needs best, consider the following factors:

- Your financial situation: Can you afford a higher up-front cost in case of a claim?

- Claim frequency: Do you anticipate filing multiple claims or only a few?

- Risk tolerance: Are you willing to take on more risk for potentially lower premiums?

How Deductibles Impact Your Premiums and Claims

When it comes to insurance, deductibles play a crucial role in determining both your premiums and the amount you’ll pay during a claim. Typically, insurance premiums are inversely related to your deductible amount; the higher your deductible, the lower your premium. This is because insurers are taking on less risk and expect you to cover more of the cost in case of a claim. Conversely, if you opt for a lower deductible, your premium increases as the insurer bears more risk, which can impact your budget significantly over time.

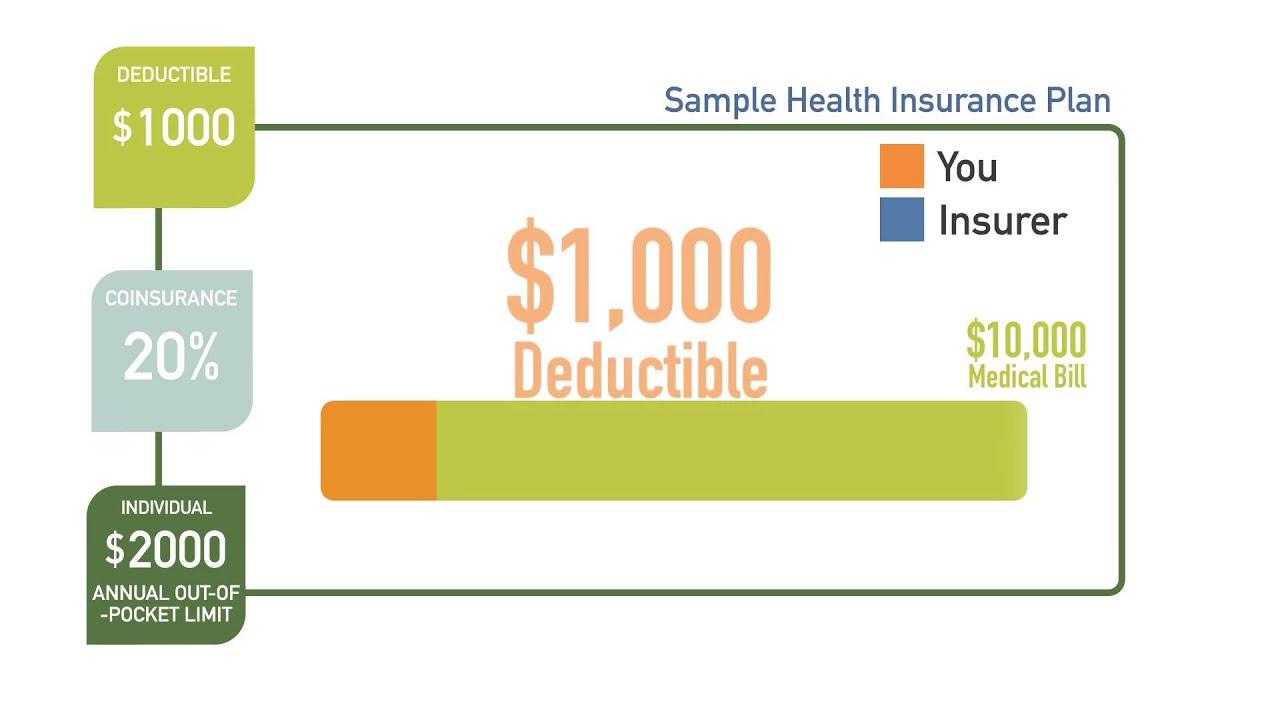

Understanding how deductibles affect your claims process is equally important. When you file a claim, you will need to cover the deductible amount before your insurance kicks in. For example, if your deductible is set at $1,000 and you incur $3,000 in damages, you’ll be responsible for the first $1,000, while your insurer will cover the remaining $2,000. Evaluating this relationship can help you make informed decisions about how to balance your monthly premiums with potential out-of-pocket expenses. Consider the following factors when choosing your deductible:

- Your financial capacity: Can you afford a high deductible in the event of a claim?

- Your risk tolerance: Are you comfortable taking on more risk for lower premiums?

- Your claims history: Have you frequently filed claims in the past?

| Deductible Amount | Monthly Premium | Claim Amount | Out-of-Pocket Expense |

|---|---|---|---|

| $500 | $150 | $5,000 | $500 |

| $1,000 | $120 | $5,000 | $1,000 |

| $2,000 | $100 | $5,000 | $2,000 |

Strategies for Managing Your Deductible Effectively

Effectively managing your insurance deductible requires a strategic approach. One of the first steps is to assess your financial situation and determine how much you can afford to pay out-of-pocket in the event of a claim. By understanding your budget, you can make an informed decision about whether to select a higher or lower deductible. High deductibles often come with lower premiums, but it’s crucial to ensure that you have enough savings to cover these costs if a claim arises. Consider setting aside a specific amount each month to build a dedicated emergency fund that corresponds to your deductible.

Another useful strategy involves reviewing your insurance policies regularly. This allows you to stay informed about any changes to your coverage or potential adjustments to your deductible. Additionally, it’s beneficial to shop around for different insurers. Not all companies value deductibles equally, and some may offer incentives or lower rates based on your claims history or loyalty. Keeping an organized log of your insurance needs and changes can aid in evaluating your options effectively. Here are some tips to remember:

- Evaluate the trade-offs between premiums and deductibles.

- Consult an insurance advisor for personalized guidance.

- Keep a record of your claims and payments to identify trends.

The Conclusion

understanding insurance deductibles is a crucial step in navigating your insurance policies effectively. Whether you’re dealing with health, auto, or home insurance, knowing how deductibles work can help you make informed decisions that align with your financial goals and coverage needs. Remember, the right deductible for you may depend on various factors, including your budget, risk tolerance, and specific policy details.

As you consider your options, take the time to review your current policies and assess whether your deductible is suitable for your circumstances. Don’t hesitate to reach out to your insurance provider for clarification or to explore different deductible amounts. Staying informed is key to maximizing your coverage and minimizing unexpected costs.

Thank you for taking the time to read our guide on insurance deductibles. We hope it has provided you with valuable insights that will empower you to navigate the world of insurance with confidence. Stay tuned for more articles that aim to simplify complex topics and support your financial well-being!