When it comes to protecting your vehicle investment, understanding the ins and outs of insurance can feel overwhelming. Among the many types of coverage available, gap insurance often stands out as a lesser-known yet potentially crucial component for car owners, especially those who have financed or leased their vehicles. In this article, we’ll dive into what gap insurance is, how it works, and why it might be a smart choice for your individual circumstances. Whether you’re a first-time car buyer or a seasoned auto owner, grasping the essentials of gap insurance can help ensure you’re adequately protected in the event of an accident or theft. Let’s explore the key aspects that every car owner should consider.

Table of Contents

- The Basics of Gap Insurance and How It Works

- Common Scenarios Where Gap Insurance Becomes Essential

- Evaluating Your Need for Gap Insurance: Key Considerations

- Tips for Choosing the Right Gap Insurance Policy

- The Way Forward

The Basics of Gap Insurance and How It Works

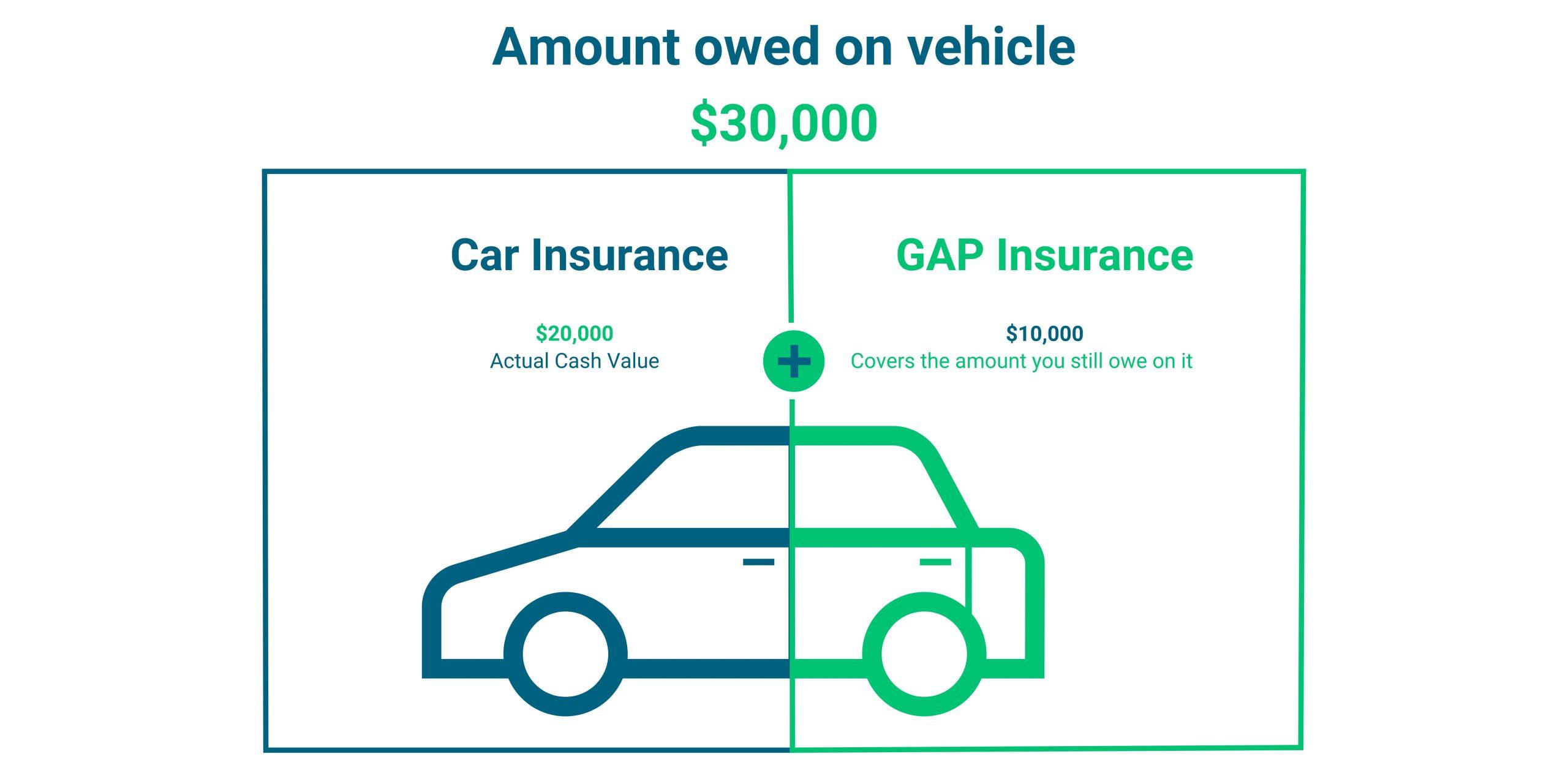

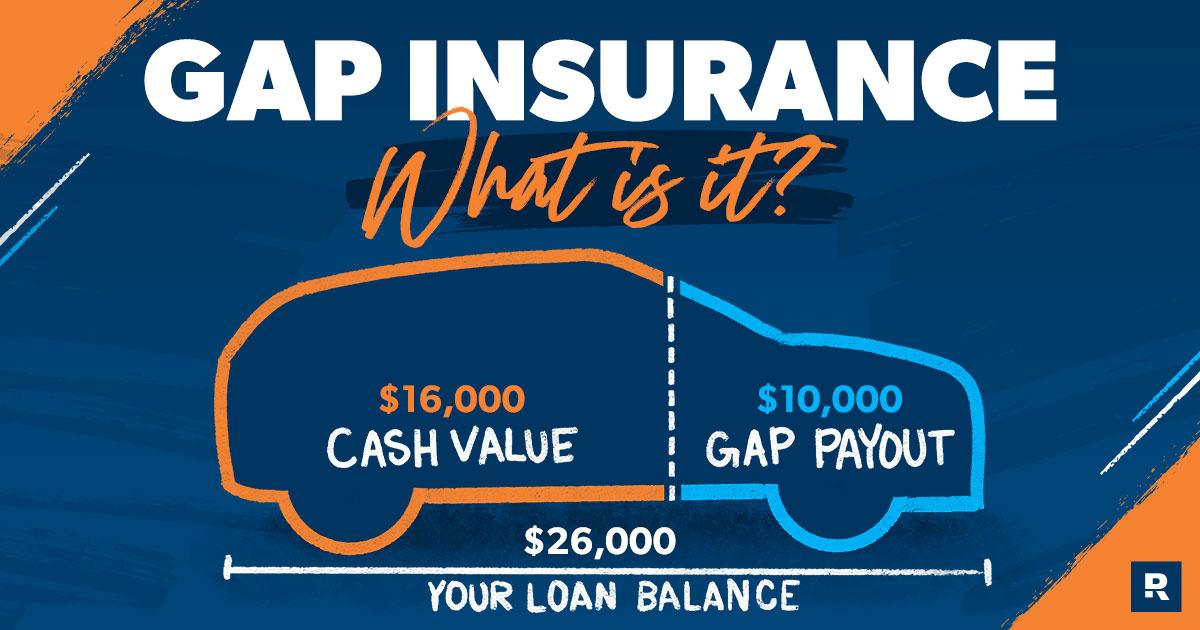

Gap insurance is a type of coverage designed to protect car owners from financial loss in the event their vehicle is totaled or stolen. This coverage can be particularly crucial for those who have financed or leased their cars, as the market value of a vehicle often depreciates faster than the loan balance. In such cases, the owner may find themselves owing more on their loan than the car is worth, leading to a financial gap that gap insurance is intended to bridge. Here are a few key features of gap insurance:

- Covers the difference between the amount owed on the car and its current market value.

- Typically optional but highly recommended for new cars, as they depreciate quickly.

- Can be purchased through insurance providers or as part of a financing agreement.

When considering gap insurance, it’s essential to assess not only your financial obligations but also your car’s depreciation rate. Not all vehicles experience the same depreciation, and certain factors such as brand, model, and market conditions can influence the time it takes for a car’s value to drop. Moreover, you should also consider the duration of your financing or leasing agreement to determine if gap insurance is necessary. Here’s a quick overview of how it works:

| Scenario | Loan Balance | Market Value | Gap Amount |

|---|---|---|---|

| New Car Accident | $25,000 | $20,000 | $5,000 |

| Stolen Vehicle | $30,000 | $22,000 | $8,000 |

| Used Car Loss | $15,000 | $10,000 | $5,000 |

Common Scenarios Where Gap Insurance Becomes Essential

Gap insurance is particularly advantageous for those who finance or lease their vehicles, as it covers the difference between the amount owed on the car and its actual cash value in the event of a total loss. This becomes crucial in various situations, such as when a new car is purchased with a loan that exceeds its current market value. When a vehicle is stolen or totaled in an accident, standard insurance may only cover the depreciated value, leaving the owner to pay the remaining balance out of pocket. This can lead to unexpected financial burdens that gap insurance effectively mitigates.

Moreover, certain types of vehicles are prone to rapid depreciation, which further emphasizes the necessity of gap insurance. For instance, luxury cars, sports vehicles, or popular models with high demand often experience significant decreases in value shortly after purchase. Owners in these scenarios should consider investing in gap coverage to protect their financial interests. Even if your vehicle is paid off, unexpected life events like job loss or sudden financial emergencies could make the extra peace of mind that comes with gap insurance worthwhile.

| Scenario | Importance of Gap Insurance |

|---|---|

| Financing a New Car | Protects against owing more than the car’s worth. |

| Leasing a Vehicle | Covers potential gaps in lease obligations. |

| Rapidly Depreciating Vehicles | Reduces financial risk from sudden value drops. |

| High-Risk Areas | Safeguards against theft and damage. |

Evaluating Your Need for Gap Insurance: Key Considerations

When considering whether to invest in gap insurance, it’s essential to evaluate your personal financial situation and driving habits. This type of insurance serves a critical purpose for those who have financed or leased a vehicle, as it covers the difference between what you owe on your car and its actual cash value in the event of a total loss. Here are some key factors to consider:

- Loan Amount: If you financed your car, particularly with a small down payment, gap insurance might be beneficial.

- Vehicle Depreciation: New cars typically depreciate faster, often losing significant value within the first year.

- Lease Agreements: Many lease agreements require gap insurance, making it a necessary consideration.

- Your Financial Cushion: Assess if you could comfortably cover the remaining loan balance without the insurance.

Additionally, it’s beneficial to reflect on your vehicle’s usage and replacement value. Cars that are driven extensively or are subject to high mileage may face quicker depreciation, increasing the risk of owing more than the vehicle is worth. Consider how long you plan to own the car and whether you might be in a position where you could prefer to leave a gap. The following table breaks down these considerations:

| Consideration | Impact on Gap Insurance Need |

|---|---|

| High Loan Amount | Increases need for gap insurance |

| Frequent Drivers | Higher depreciation, thus a greater need |

| Short-Term Ownership | Possible reduced need depending on vehicle type |

| Leased Vehicles | Often a requirement |

Tips for Choosing the Right Gap Insurance Policy

When selecting the right gap insurance policy, it’s essential to assess your personal circumstances and vehicle needs carefully. Start by comparing coverage options from different providers. Each insurer may offer varying levels of coverage, so be sure to scrutinize the details of what is included. Pay attention to the following aspects:

- Policy Limits: Understand the maximum payout and whether it covers the full difference between the loan balance and the car’s actual cash value.

- Exclusions: Know what is not covered by the policy to avoid surprises in the event of a claim.

- Deductibles: Check if the policy has a deductible amount that could affect your payout.

Next, consider the cost of the policy in relation to your budget. Gap insurance premiums can vary significantly based on the vehicle’s make, model, and purchase price. To provide clarity, here’s a simple comparison of different policies:

| Provider | Monthly Premium | Coverage Limit | Deductible |

|---|---|---|---|

| Provider A | $15 | $5,000 | $500 |

| Provider B | $20 | $7,500 | $300 |

| Provider C | $10 | $4,000 | $1,000 |

By comparing the premium costs and understanding the coverage limits offered by various providers, you can make an informed decision that aligns with your financial situation and protects your investment.

The Way Forward

gap insurance serves as a valuable safety net for car owners, particularly in a world where vehicle depreciation can significantly impact your financial stability after an accident or theft. By understanding the nuances of gap insurance, including its benefits, limitations, and when it might be necessary, you can make informed decisions that protect your investment. Whether you’re financing a new car or leasing a vehicle, taking the time to evaluate your coverage options can save you from unexpected expenses down the line. If you have further questions about gap insurance or want to explore your options, consider reaching out to your insurance provider for personalized guidance. Staying informed is the first step in safeguarding your automotive investment and ensuring peace of mind on the road ahead. Thank you for reading, and drive safe!