When purchasing a vehicle, many people focus on the purchase price, financing options, and the best possible interest rates. However, one crucial aspect that often goes overlooked is gap insurance. As car owners, protecting our investment is paramount—especially considering how quickly vehicles can depreciate. Gap insurance acts as a safety net, covering the difference between what you owe on your car loan and its current market value in the event of a total loss. In this article, we will delve into the essential insights of gap insurance for cars, exploring how it works, who should consider it, and the potential benefits it can provide. Whether you’re a first-time buyer or a seasoned driver, understanding gap insurance could be a smart addition to your car buying journey.

Table of Contents

- Exploring the Basics of Gap Insurance and Its Importance

- Identifying When to Consider Gap Insurance for Your Vehicle

- Key Differences Between Gap Insurance and Standard Auto Insurance

- Tips for Choosing the Right Gap Insurance Policy for Your Needs

- The Way Forward

Exploring the Basics of Gap Insurance and Its Importance

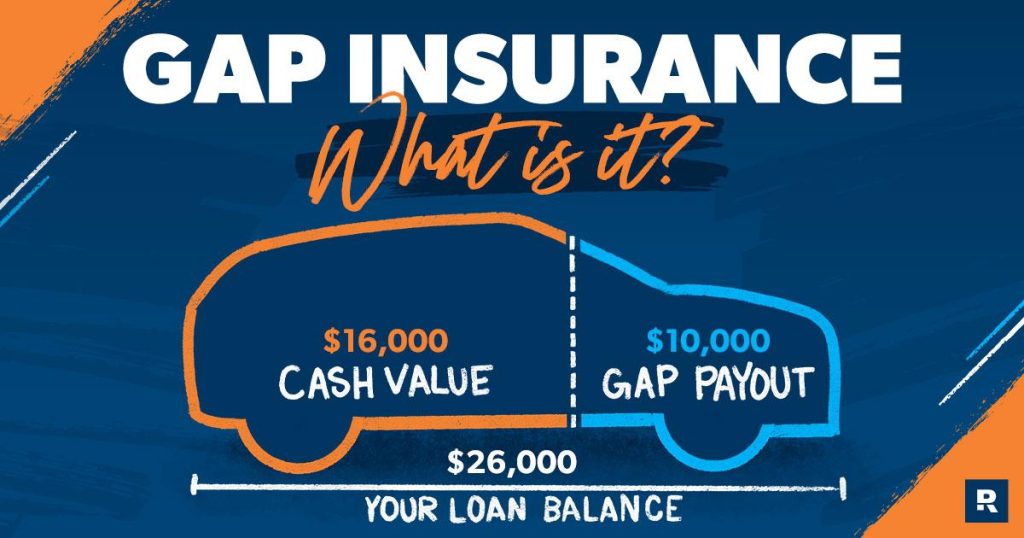

Gap insurance is a specialized type of coverage designed to fill the financial void that often arises when a car is totaled or stolen, especially when the outstanding loan or lease balance exceeds the actual cash value of the vehicle. Understanding this concept is crucial for car owners, as it provides essential protection against potential financial loss. Unlike typical auto insurance, which only compensates for the current market value of the car, gap insurance ensures that you won’t be left with a significant debt if the unexpected happens. This extra layer of security is particularly beneficial for those who finance their vehicles or lease them, as the inherent depreciation of cars can lead to considerable gaps in coverage.

Moreover, the importance of gap insurance cannot be overstated, as it acts as a safety net, safeguarding your financial well-being in the event of a loss. Consider the following reasons to invest in gap insurance:

- Protection Against Depreciation: Vehicles lose value quickly, making coverage essential.

- Peace of Mind: Knowing you’re covered financially reduces stress in a difficult situation.

- Loan Security: Avoid paying out-of-pocket on a car you can no longer drive.

To illustrate the potential discrepancy between loan balances and vehicle values, consider the following table:

| Scenario | Loan Balance | Car’s Actual Cash Value | Potential Gap |

|---|---|---|---|

| 1 Year After Purchase | $25,000 | $18,000 | $7,000 |

| 3 Years After Purchase | $20,000 | $12,000 | $8,000 |

| 5 Years After Purchase | $15,000 | $6,000 | $9,000 |

In each of these scenarios, the gap insurance would cover the difference, ensuring that car owners are not financially burdened when facing the unfortunate loss of their vehicle.

Identifying When to Consider Gap Insurance for Your Vehicle

Gap insurance may not be on your radar when you first purchase a vehicle, but it can be a crucial safety net in specific situations. Understanding the financial implications of your vehicle’s depreciation can guide your decision on whether to invest in this type of coverage. Consider the following scenarios where gap insurance could be beneficial:

- High Loan Amount: If you’ve financed the purchase of your car with little to no down payment, the loan amount may exceed the car’s market value shortly after you drive it off the lot.

- Leased Vehicles: Leasing often requires gap insurance, as your monthly payments may not cover the total value of the car if it’s totaled in an accident.

- Rapid Depreciation: Some vehicles lose value more quickly than others; if you own one of these models, gap insurance can help cover the difference when you need to file a claim.

Another important factor to consider is your overall financial situation. If you have limited savings or the potential to face significant financial strain after an accident, gap insurance can play a vital role in maintaining your peace of mind. Evaluate your exposure in the following scenarios:

- Emergency Expenses: An unexpected loss could lead to additional costs that you might not be prepared for without gap insurance.

- Vehicle Replacement Costs: If you’re driving a vehicle that is particularly expensive to replace, gap insurance could alleviate the burden of additional expenses.

- Insurance Coverage Limits: Ensure that your standard auto insurance adequately covers the amount you owe on your car if it’s damaged or stolen.

Key Differences Between Gap Insurance and Standard Auto Insurance

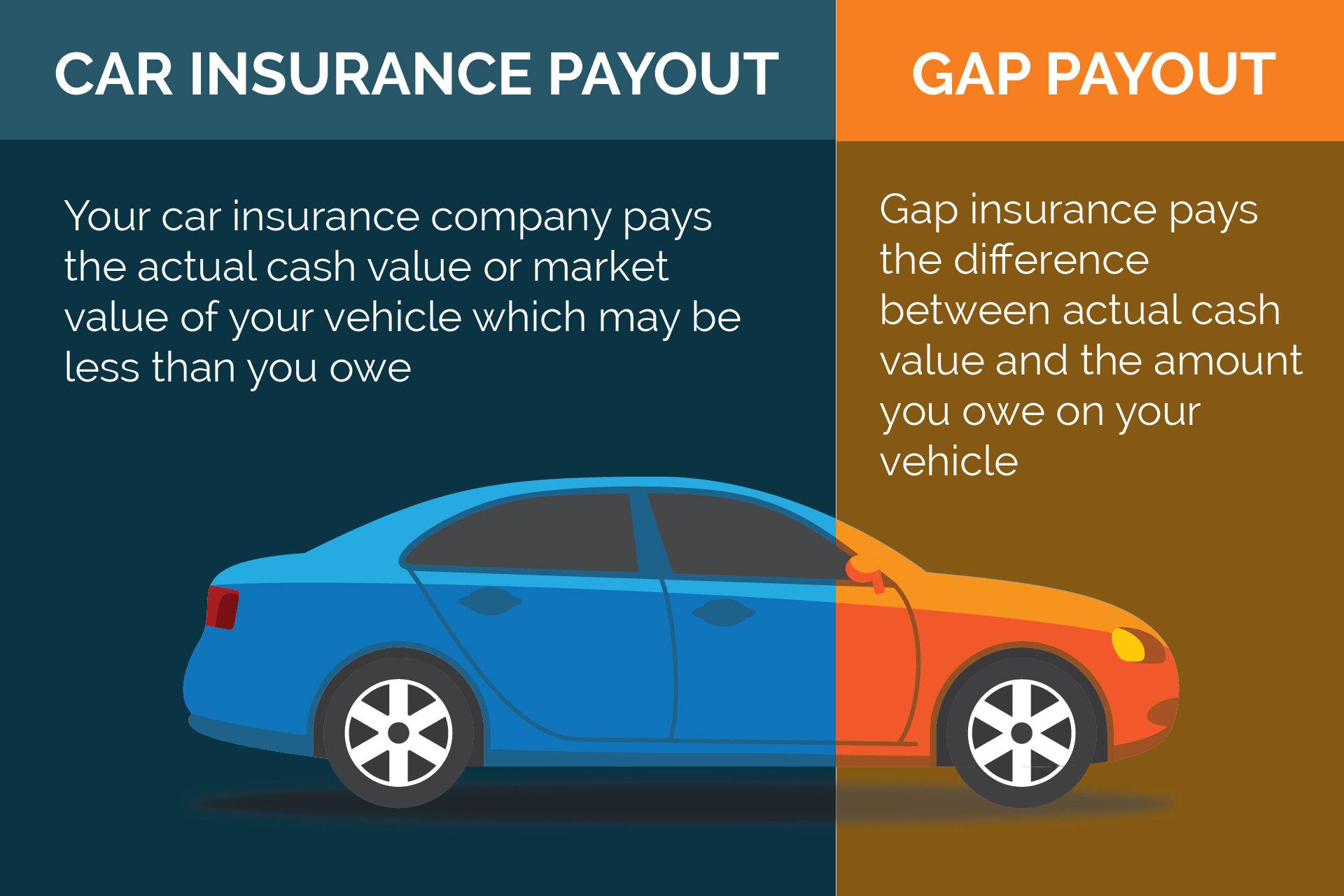

When comparing gap insurance to standard auto insurance, it’s essential to understand the distinct roles each type of coverage plays. Standard auto insurance serves as a fundamental safety net that protects drivers financially in the event of an accident or theft. Typically, it covers the cost of repairs or the market value of the vehicle. This means that if your car is totaled, the insurance payout will be based on the current market value, which may fall short of the outstanding balance on your auto loan. In contrast, gap insurance is designed specifically to bridge this gap between what you owe on your vehicle and its actual cash value at the time of a total loss.

Key benefits of gap insurance include:

- Loan Protection: Ensures you don’t owe money after a total loss.

- Financial Security: Offers peace of mind, particularly for new car buyers or those with high loan-to-value ratios.

- Supplemental Coverage: Complements your standard policy, filling in critical financial gaps.

| Coverage Type | Purpose | Typical Coverage Amount |

|---|---|---|

| Standard Auto Insurance | Repairs and market value compensation | Market value of the car |

| Gap Insurance | Difference between loan and market value | Outstanding loan balance |

Tips for Choosing the Right Gap Insurance Policy for Your Needs

When selecting a gap insurance policy, it’s essential to assess your specific needs and circumstances. Start by identifying the type of vehicle you own and its current market value. Here are some key factors to consider:

- Coverage Amount: Make sure the policy covers the difference between the car’s actual cash value and your loan balance.

- Deductibles: Look for policies with flexible deductibles that fit your budget.

- Duration of Coverage: Decide whether you need coverage for the entirety of your loan term or just for the initial months.

Additionally, it’s worthwhile to compare offerings from various insurers. Take the time to read customer reviews and check the company’s financial strength and reputation. You may want to look into:

- Policy Limitations: Understand any exclusions or limitations that may affect your coverage.

- Claim Process: How easy is it to file a claim? Check the average claim turnaround times.

- Customer Service: Excellent support can make a significant difference when you need assistance.

The Way Forward

understanding gap insurance is essential for any car owner looking to safeguard their financial investment. As we’ve explored, gap insurance can provide peace of mind in the event of an unfortunate accident, ensuring that you’re not left to cover a significant financial gap between what you owe on your vehicle and its actual cash value at the time of loss. Whether you’re purchasing a new car, leasing, or financing, considering gap insurance can offer valuable protection. As with any insurance product, it’s important to assess your individual situation, weigh the costs and benefits, and make an informed decision. By doing your research and understanding the nuances of gap insurance, you can drive confidently, knowing you’re better prepared for the unexpected. If you have any further questions about gap insurance or related topics, feel free to leave a comment below!