When it comes to car insurance, most drivers are familiar with the basics—liability, collision, and comprehensive coverage. However, there’s another type of insurance that often flies under the radar: gap insurance. Understanding gap insurance is essential for anyone financing or leasing a vehicle, as it can provide valuable financial protection in specific scenarios. In this complete guide, we’ll break down what gap insurance is, how it works, and whether it’s the right choice for you. Whether you’re a new car buyer or simply looking to expand your insurance knowledge, this article will equip you with the information you need to make informed decisions about your coverage. Let’s dive into the world of gap insurance and uncover its benefits and considerations.

Table of Contents

- Understanding the Basics of Gap Insurance and How It Works

- Key Benefits of Gap Insurance for New and Leased Vehicles

- Common Misconceptions about Gap Insurance Explained

- Tips for Choosing the Right Gap Insurance Policy for Your Needs

- Concluding Remarks

Understanding the Basics of Gap Insurance and How It Works

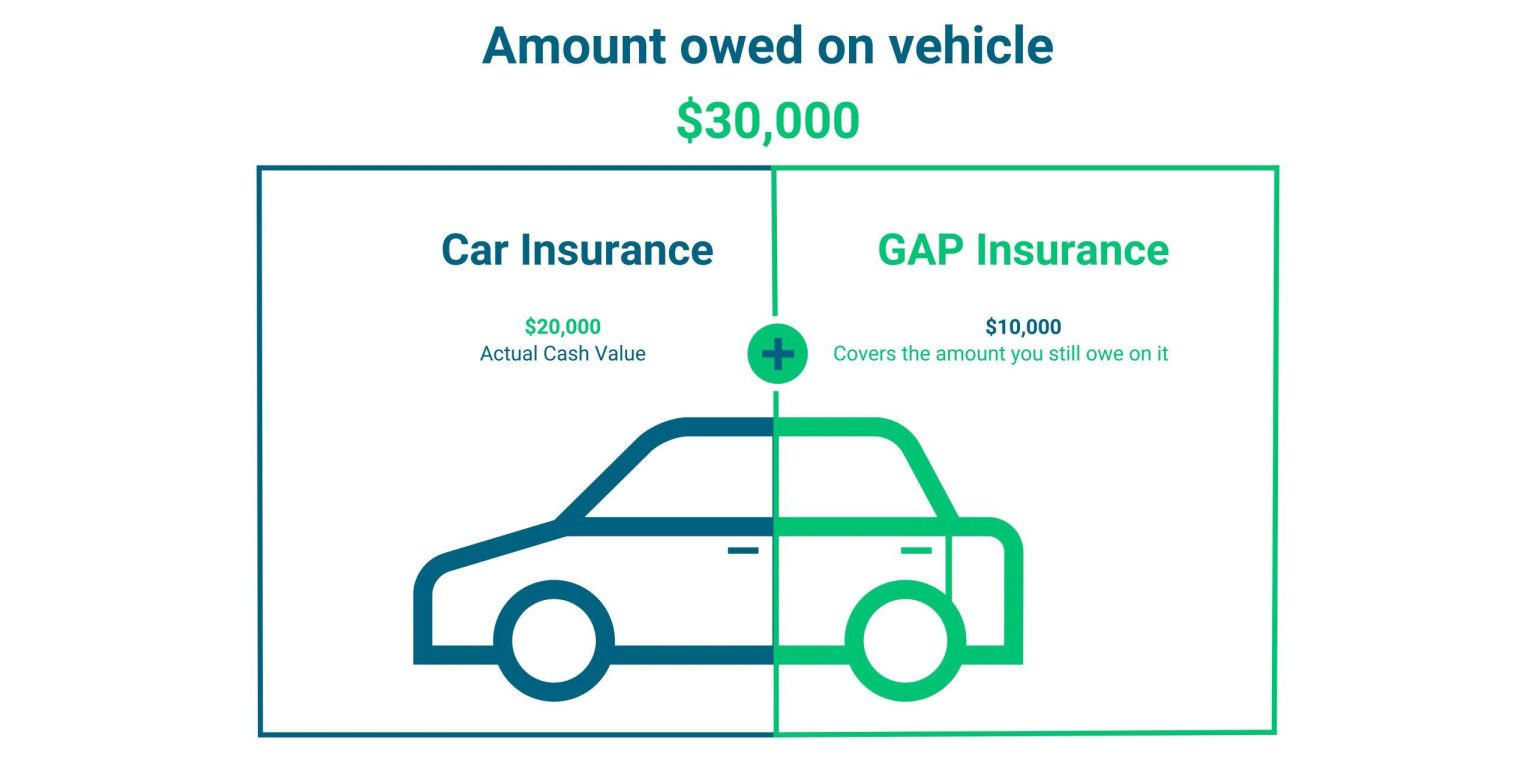

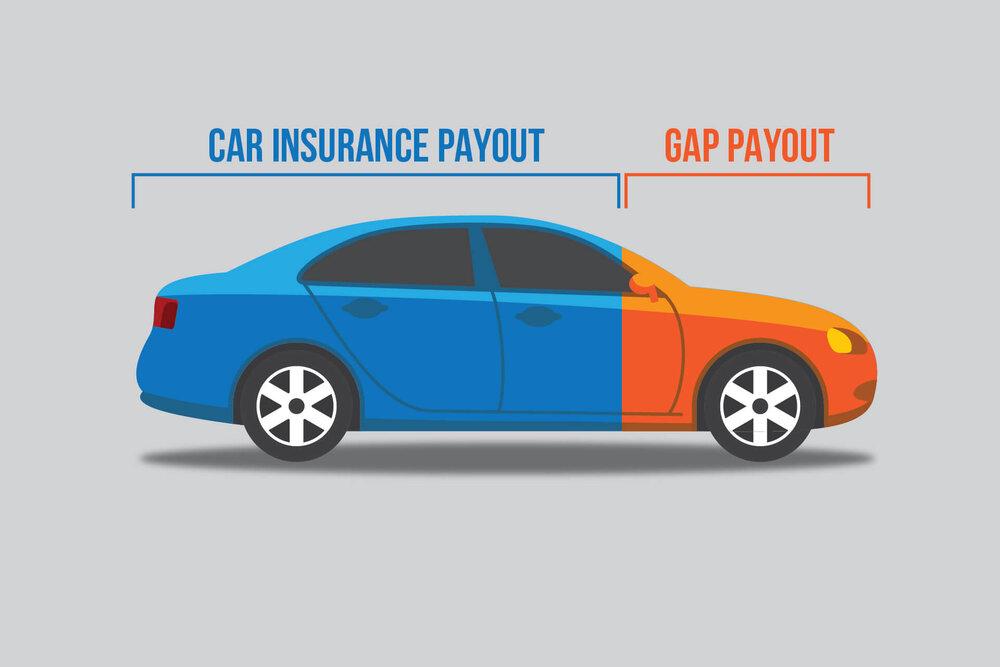

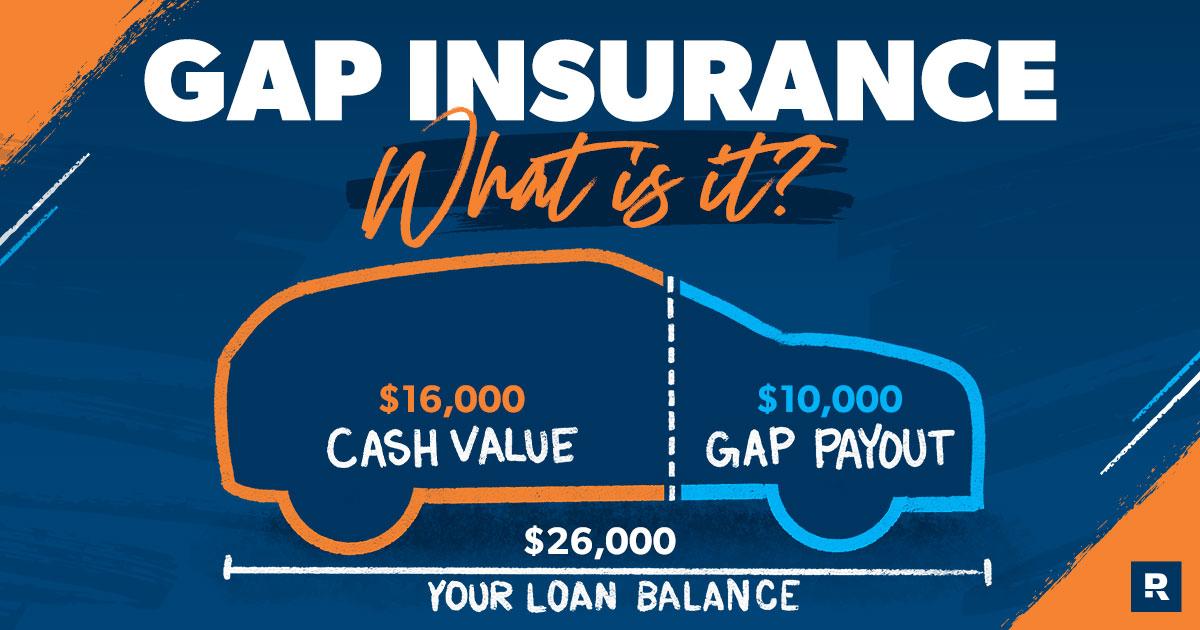

Gap insurance is designed to protect car owners from financial loss when their vehicle is totaled or stolen. Unlike standard auto insurance, which typically pays only the market value of a car at the time of loss, gap insurance covers the difference between what you owe on your vehicle and its current cash value. This is particularly useful for those who have a loan or lease, as depreciation can significantly reduce the value of a new car shortly after purchase. When you consider that new vehicles can lose up to 20% of their value within the first year, having this additional coverage can provide crucial peace of mind.

When evaluating whether gap insurance is suitable for you, consider the following factors:

- Loan or Lease Balance: If you owe more than the car’s market value, you may benefit greatly from gap insurance.

- Vehicle Depreciation: New cars tend to depreciate faster than used ones, increasing the need for coverage.

- Insurance Coverage: Always check your current auto policy to understand what it covers and if there’s any potential coverage gap.

| Scenario | Gap Insurance Needed? |

|---|---|

| Loan Amount: $30,000 | Car Value: $25,000 | Yes |

| Loan Amount: $20,000 | Car Value: $20,000 | No |

| Loan Amount: $15,000 | Car Value: $18,000 | No |

Key Benefits of Gap Insurance for New and Leased Vehicles

Gap insurance is a crucial safety net for owners of new and leased vehicles, providing peace of mind in the unfortunate event of an accident or theft. When you purchase or lease a vehicle, its value depreciates rapidly, often leaving you with an outstanding balance on your loan or lease that exceeds the vehicle’s market value after a total loss. This is where gap insurance steps in. It covers the difference, or “gap,” ensuring that you are not financially responsible for the remaining balance once your primary insurance settles the claim. This protection is particularly valuable in the first few years of ownership, when depreciation is at its peak.

Additionally, gap insurance is not just about protecting your finances; it can also facilitate a smoother transition into a new vehicle. Key benefits include:

- Financial Security: Avoid the burden of loan payments for a vehicle you no longer own.

- Flexibility: Easily replace your vehicle without the worry of outstanding balances.

- Peace of Mind: Drive knowing you are financially protected against unexpected losses.

- Affordability: Often available at a reasonable cost, making it an accessible option for many car buyers.

Common Misconceptions about Gap Insurance Explained

When it comes to gap insurance, several misconceptions can cloud a buyer’s understanding of its benefits and limitations. One prevalent myth is that gap insurance is only necessary for new cars. In reality, any vehicle purchased through financing or a lease can benefit from gap insurance, especially if it depreciates rapidly. This type of coverage protects you against financial losses that occur when your car is deemed a total loss, helping you to cover the difference between the insurance payout and the remaining balance on your loan.

Another common misunderstanding is that gap insurance is the same as comprehensive or collision insurance. While comprehensive and collision insurance cover your vehicle against theft, damage, or accidents, gap insurance fills the gap between the amount you owe and your vehicle’s current market value. Additionally, many people believe that they must purchase gap insurance from the dealership, but this isn’t true. It’s available from various insurance providers, often at a more competitive rate, allowing consumers the flexibility to choose what suits their needs best.

Tips for Choosing the Right Gap Insurance Policy for Your Needs

When selecting a gap insurance policy, it’s essential to evaluate your specific circumstances and automobile financing situation. Here are some key factors to consider:

- Loan or Lease Amount: Calculate how much you owe on your vehicle to ensure you choose a policy that covers the full difference between your car’s value and your outstanding balance.

- Vehicle Depreciation: Research the typical depreciation rate for your car model to understand how quickly its value may decrease over time.

- Rental Car Coverage: Some policies might offer rental coverage while your vehicle is being repaired. Verify if this feature aligns with your needs.

It’s also important to assess the policy terms in relation to your driving habits. Look for policies that offer:

- Flexible Coverage Options: Ensure that you can adjust your coverage as your financial situation changes.

- Claim Process Clarity: A straightforward claims process can save you time and stress down the line.

- Affordability: Compare premiums from multiple providers to find a policy that fits your budget without sacrificing essential coverage.

Concluding Remarks

understanding gap insurance for cars is essential for any vehicle owner looking to protect their investment. Whether you’re financing a new car or leasing, gap insurance provides peace of mind by covering the difference between what you owe and your car’s current market value in the unfortunate event of a total loss. As we’ve explored, it’s important to assess your individual needs, budget, and the specifics of your insurance policy to determine if gap insurance is the right choice for you. We hope this guide has clarified some key concepts and helped you make an informed decision. Remember, being knowledgeable about your insurance options is a crucial step in safeguarding your financial future on the road. If you have any questions or need further clarification, feel free to reach out or check out more of our resources! Happy driving!