Understanding the Value and Benefits of Umbrella Insurance

In today’s complex world, where uncertainties lurk around every corner, safeguarding your assets and financial well-being has never been more important. While many individuals and families rely on standard insurance policies such as auto and home coverage, there is an often-overlooked form of protection that can offer an extra layer of security: umbrella insurance. This supplemental policy can play a critical role in fortifying your financial defenses, providing peace of mind in the face of unexpected events and liabilities. In this article, we will explore what umbrella insurance is, its key benefits, and why it may be a valuable addition to your overall insurance strategy. Whether you’re a homeowner, a renter, or an avid traveler, understanding the nuances of umbrella insurance can help you make informed decisions to protect what matters most.

Table of Contents

- Exploring the Basics of Umbrella Insurance Coverage

- The Importance of Umbrella Insurance in Risk Management

- Key Benefits of Investing in Umbrella Insurance

- How to Choose the Right Umbrella Insurance Policy

- In Summary

Exploring the Basics of Umbrella Insurance Coverage

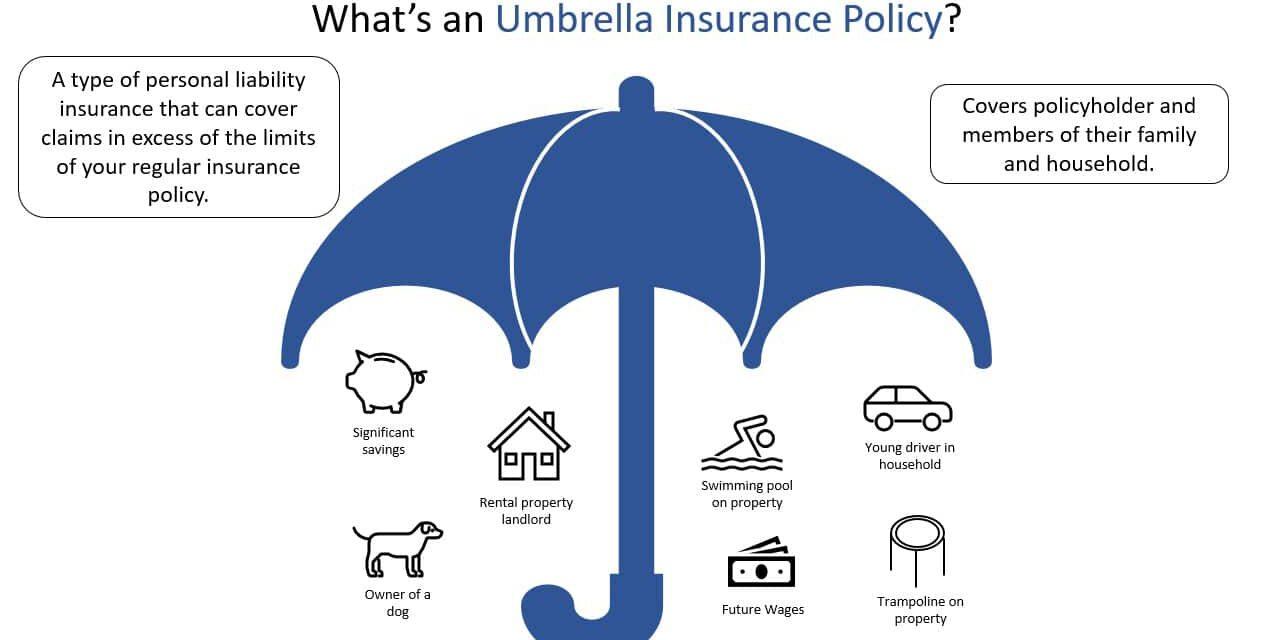

Umbrella insurance serves as an additional layer of protection that complements your existing insurance policies, such as auto or homeowners insurance. It can cover a wide range of liabilities, helping to safeguard your assets and future earnings from lawsuits and claims that can arise unexpectedly. This type of insurance is particularly valuable in a world where lawsuits are becoming more common, allowing you to enjoy peace of mind with the knowledge that you’re financially covered beyond your primary insurance limits.

Understanding what is included in umbrella insurance can enhance your appreciation for its benefits. Coverage typically includes:

- Personal Injury: Protects against allegations of slander, libel, or false arrest.

- Property Damage: Covers damages you might cause to someone else’s property.

- Bodily Injury: Offers extra protection if you’re responsible for an accident where others are injured.

- Home-Based Business: Provides coverage related to business operations conducted from home.

A small investment in umbrella insurance can lead to significant financial security. To illustrate the difference umbrella coverage can make, consider the following table:

| Insurance Type | Typical Coverage Limit | Potential Liability Exposure |

|---|---|---|

| Auto Insurance | $250,000 | $500,000+ |

| Homeowners Insurance | $300,000 | $1,000,000+ |

| Umbrella Insurance | $1,000,000+ | Unlimited Protection |

The Importance of Umbrella Insurance in Risk Management

In today’s unpredictable world, protecting your assets through comprehensive risk management strategies is crucial. Umbrella insurance serves as a safety net, extending beyond the limits of your primary insurance policies. It helps cover significant liabilities, offering peace of mind against unforeseen events that could threaten your financial stability. This type of insurance can be particularly beneficial in scenarios such as a serious car accident, a slip-and-fall incident on your property, or even a defamation lawsuit. While standard insurance policies have certain coverage caps, umbrella insurance provides additional layers of protection, ensuring that you’re not left vulnerable to substantial claims.

Investing in umbrella insurance can be viewed as a strategic approach to asset protection. By adding this coverage, you significantly reduce the risks associated with potential legal claims and liabilities. Here are a few reasons why it is essential:

- Extended Coverage: It fills the gaps left by other types of insurance.

- High Liability Protection: It offers higher limits than typical liability policies.

- Cost-Effective: It’s relatively inexpensive compared to the amount of coverage provided.

- Peace of Mind: It allows you to live your life without constantly worrying about legal risks.

| Aspect | Standard Insurance | Umbrella Insurance |

|---|---|---|

| Coverage Limit | Varies by policy | Typically starts at $1 million |

| Cost | Higher premiums for limited coverage | Low cost for extensive coverage |

| Protection Scope | Specific incidents | Wider range, including overseas claims |

Key Benefits of Investing in Umbrella Insurance

Investing in umbrella insurance offers significant advantages that can enhance your overall financial protection. One of the most notable benefits is its comprehensive coverage, which extends beyond your existing policies like auto or homeowners insurance. This means that if you face a large liability claim, your umbrella policy can cover expenses that exceed the limits of your primary insurance, effectively safeguarding your assets and future income. Moreover, umbrella insurance typically comes at a relatively low cost compared to the extensive coverage it provides, making it an affordable addition to your risk management strategy.

Additionally, umbrella insurance can provide peace of mind in an unpredictable world. It can cover various scenarios, such as personal injury claims, slander, libel, and certain legal expenses, ensuring you are equipped to handle unexpected challenges. This protection is especially valuable for individuals with higher public profiles, including business owners or those with substantial assets. To illustrate the potential financial impact, consider the following table which outlines the average costs of negligence claims against personal assets:

| Type of Claim | Average Cost |

|---|---|

| Car Accident | $15,000 |

| Dog Bite | $33,000 |

| Defamation | $50,000 |

| Injury on Property | $30,000 |

How to Choose the Right Umbrella Insurance Policy

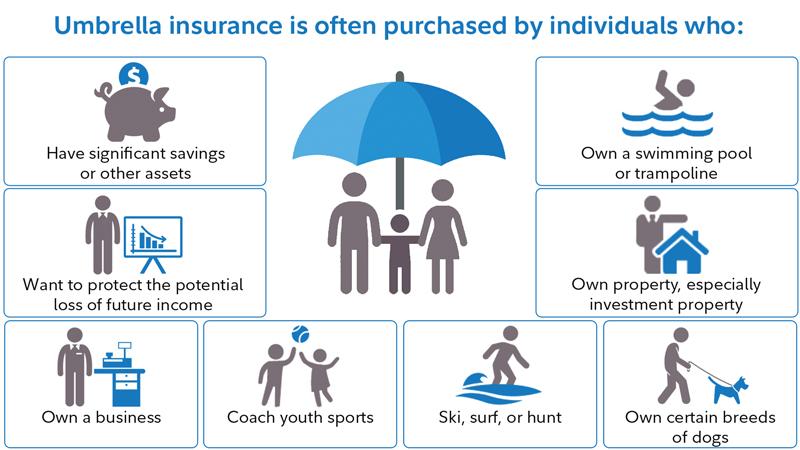

Choosing the right umbrella insurance policy involves evaluating several important factors to ensure it suits your unique needs. Start by assessing your total exposure to risks, which includes existing assets such as your home, savings, and investments. Understanding how much coverage you require can guide you in selecting a policy with adequate limits. It’s essential to consider your lifestyle as well; if you have significant public interactions or engage in activities that may lead to liabilities, you’ll want higher coverage limits. Consulting with an insurance expert can further clarify the level of risk you face and the appropriate coverage that fits.

Next, shop around to compare different insurance providers and their policies. Look for companies that offer comprehensive umbrella coverage while also maintaining competitive premiums. Pay attention to the limits, exclusions, and deductibles outlined in the policies. A side-by-side comparison can help in making an informed decision. Here’s a quick view of what to focus on:

| Factor | What to Look For |

|---|---|

| Coverage Limits | Ensure the policy covers at least $1 million for personal liability. |

| Exclusions | Be aware of any events or damages that may not be covered. |

| Premium Costs | Compare costs against the coverage offered for value and affordability. |

In Summary

umbrella insurance serves as a valuable safety net in today’s unpredictable world. By extending your coverage beyond the limits of your existing policies, it provides peace of mind and financial protection against unforeseen emergencies. As we’ve discussed, the benefits of this type of insurance can be significant, particularly for those with substantial assets to protect.

While it may not be necessary for everyone, taking the time to evaluate your unique circumstances can help you determine if umbrella insurance is a worthwhile investment for you. Ultimately, being proactive about safeguarding your financial future is a wise approach. If you have any questions or need assistance navigating the complexities of insurance, consider reaching out to a professional advisor who can help clarify your options. Thank you for reading, and stay secure!