Introduction

Navigating the world of insurance can often feel overwhelming. With a myriad of options available and an array of complex jargon to decode, it’s not uncommon for individuals to make missteps along the way. These mistakes can have significant consequences, leading to inadequate coverage, unexpected out-of-pocket expenses, or even denied claims when you need support the most. In this article, we’ll outline the top insurance mistakes to avoid, empowering you to make informed decisions and ultimately secure the coverage you deserve. Whether you’re a first-time buyer or revisiting your existing policies, understanding these common pitfalls is the first step toward achieving better protection for you and your loved ones. Let’s dive in and ensure you’re on the right path to safeguarding your future.

Table of Contents

- Common Misconceptions About Insurance Policies and Their Realities

- Understanding the Importance of Regular Policy Reviews

- The Value of Adequate Coverage: Avoiding Underinsurance

- Navigating Deductibles and Co-Pays: Making Informed Choices

- In Summary

Common Misconceptions About Insurance Policies and Their Realities

Many people hold common misconceptions about insurance policies that can lead to unexpected challenges during claims. One prevalent myth is that all policies cover the same risks. In reality, coverage can vary significantly based on the type of policy, provider, and specific terms included. For instance, while one homeowner’s insurance policy may include coverage for flooding, another might completely exclude it, making it essential for policyholders to thoroughly review their terms and conditions. Additionally, some individuals believe that the lowest premium ensures the best value; however, cheaper policies often come with higher deductibles or less comprehensive coverage, which can end up costing more in the long run.

Another misconception is that policy owners can rely on their insurance company to automatically keep them informed about necessary adjustments to their coverage. In reality, clients must take a proactive role in managing their insurance needs. Major life changes, such as marriage, home purchases, or the birth of a child, necessitate a review of existing policies to ensure adequate protection. Failing to update your coverage can leave you vulnerable or underinsured. To illustrate how different events can impact insurance needs, consider the following table:

| Life Event | Impact on Coverage |

|---|---|

| Buying a Home | Increased property coverage needed |

| Marriage | Combine policies for shared assets |

| Having a Child | Adjust life insurance and health coverage |

Understanding the Importance of Regular Policy Reviews

Regularly reviewing your insurance policies is a vital practice that can safeguard your financial interests and ensure you have the right coverage for your evolving needs. Life changes—such as marriage, the birth of a child, or a new job—can significantly impact your insurance requirements. Failing to reassess your policies may leave you vulnerable to unexpected risks or gaps in coverage. During a review, you may discover opportunities to adjust your limits or enhance your protection without significantly increasing your premium costs.

Additionally, the insurance landscape is continually evolving, with new products and regulations emerging regularly. This means that policies that once provided adequate coverage may no longer be appropriate. Keeping track of factors such as:

- Market trends: New discounts or coverage options may be available.

- Changes in laws: New regulations can affect your coverage needs.

- Personal circumstances: Life events can substantially change your risk profile.

By maintaining a proactive approach and scheduling annual policy reviews, you can ensure that you are always protected against potential pitfalls, while also making the most of your insurance investments.

The Value of Adequate Coverage: Avoiding Underinsurance

One of the most common pitfalls in the world of insurance is underinsurance, where individuals fail to secure adequate coverage for their needs. This can lead to severe financial repercussions in the event of a loss. By taking the time to assess personal and asset values, you can better understand the level of coverage required. Consider these key factors to avoid this mistake:

- Inventory Assets: Make a comprehensive list of your possessions, including their estimated values.

- Evaluate Needs: Take into account your lifestyle, family requirements, and financial obligations.

- Review Policy Limits: Ensure your current policies reflect the true value of what you wish to protect.

- Consult Professionals: Seek advice from insurance agents to tailor coverage to your specific situation.

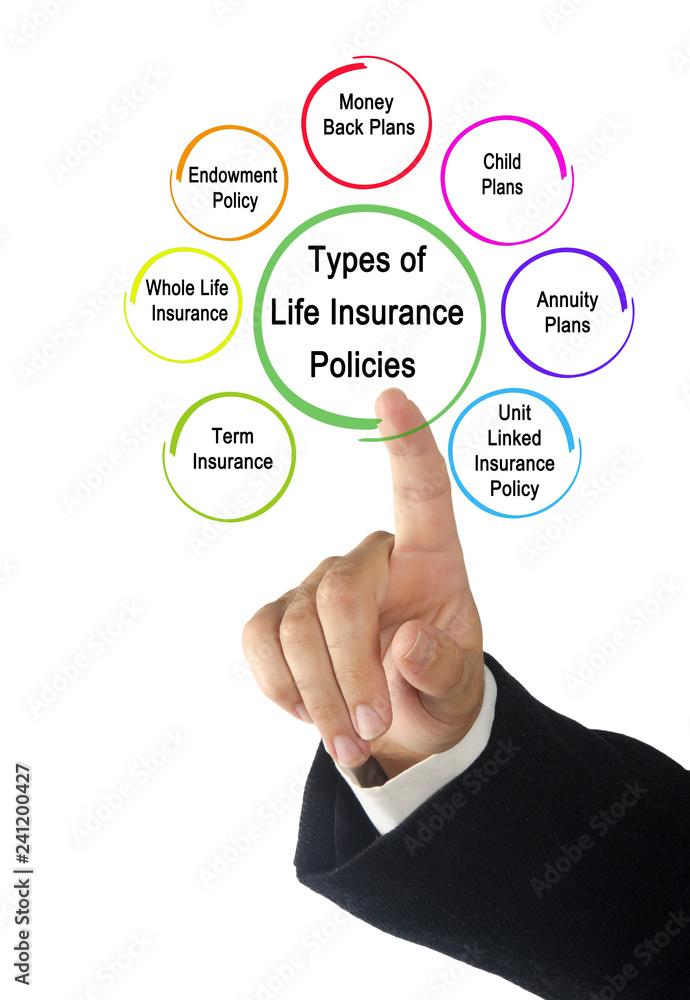

A thorough review of your insurance policies is essential for identifying gaps in coverage. Many individuals tend to select the lowest premiums without considering the possible limitations, leading to insufficient protection when it matters most. Implementing regular assessments of your coverage not only safeguards against underinsurance but also ensures that your policy evolves with your changing circumstances. Below is a simple comparison table outlining common types of coverage and their potential shortfalls when inadequate:

| Type of Coverage | Common Shortfall | Suggested Action |

|---|---|---|

| Homeowners Insurance | Insufficient dwelling coverage | Request a home appraisal |

| Auto Insurance | Low liability limits | Review state minimums |

| Health Insurance | Inadequate hospitalization coverage | Compare plans with extensive care options |

| Life Insurance | Low death benefit | Evaluate income replacement needs |

Navigating Deductibles and Co-Pays: Making Informed Choices

Understanding the intricacies of your health insurance policy can greatly affect your financial well-being. When assessing your plan, focus on two critical components: deductibles and co-pays. A deductible is the amount you pay for covered health care services before your insurance starts to pay, while a co-pay is a fixed amount you pay for a covered service, typically at the time of service. When choosing a plan, consider the following:

- Annual Deductible Amount: Compare how much you need to pay out-of-pocket before the insurance kicks in.

- Co-Pay Rates: Evaluate the co-pay for routine visits, specialists, and emergency services to budget your healthcare costs effectively.

- Network Providers: Ensure the doctors and facilities you prefer are in your plan’s network to minimize costs.

To illustrate the impact of these expenses, let’s look at a simple table comparing two hypothetical insurance plans:

| Plan | Annual Deductible | Co-Pay for Primary Care | Co-Pay for Specialists |

|---|---|---|---|

| Plan A | $1,000 | $25 | $50 |

| Plan B | $2,500 | $30 | $60 |

As evident in this table, choosing a plan with a lower deductible can save you money in the long run, especially if you anticipate frequent medical visits. However, higher monthly premiums may come with lower deductibles, leading to a trade-off between upfront costs and potential savings. Always calculate your expected healthcare usage to make informed decisions tailored to your needs.

In Summary

understanding and avoiding common insurance mistakes is essential for securing the best coverage possible. By taking the time to assess your needs, reviewing your policies regularly, and asking the right questions, you can ensure that you’re adequately protected without overpaying. Remember, insurance is not just about compliance; it’s about peace of mind and financial security. If you find yourself in doubt, don’t hesitate to consult with an insurance professional who can provide guidance tailored to your unique situation. By being proactive and informed, you can navigate the complexities of insurance with confidence, ultimately safeguarding your assets and ensuring a secure future. Thank you for reading, and here’s to making informed decisions for better coverage!