As we navigate the complexities of the modern world, the insurance industry is poised for significant evolution in the coming years. With advancements in technology, shifting consumer expectations, and the ever-present challenges posed by climate change and global events, key trends are emerging that will shape the future of insurance. From the adoption of artificial intelligence and data analytics to the rising importance of sustainability and personalized coverage options, understanding these trends is essential for consumers, businesses, and industry professionals alike. In this article, we’ll explore some of the most notable insurance trends on the horizon, providing insights into how they may impact coverage, pricing, and overall service delivery in the years to come. Whether you are an insurance expert, a policyholder, or simply curious about the future of risk management, these trends are worth keeping an eye on as they unfold.

Table of Contents

- The Rise of Insurtech and Digital Transformation

- Emphasizing Sustainability and Ethical Practices

- The Evolution of Customer Experience in Insurance

- Adapting to Regulatory Changes and Compliance Challenges

- In Conclusion

The Rise of Insurtech and Digital Transformation

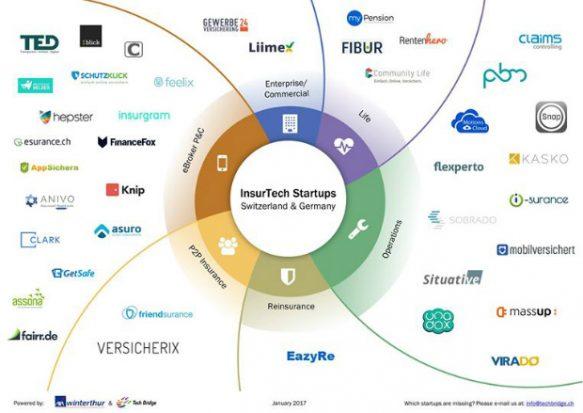

The insurance industry is undergoing a significant transformation driven by the emergence of insurtech companies that leverage technology for better efficiency and customer engagement. These startups are revolutionizing traditional models by offering innovative solutions such as automated underwriting and real-time claims processing. The shift towards digital platforms not only enhances customer experience but also streamlines operations, enabling insurers to reduce costs and improve service delivery. As a result, established companies are increasingly partnering with tech innovators or investing in in-house capabilities to stay competitive.

Moreover, the advent of advanced data analytics and artificial intelligence is reshaping risk assessment and pricing strategies. Insurers can now analyze vast amounts of data to gain insights into customer behavior and claim trends, allowing for more personalized products. This creates opportunities for dynamic pricing, where premiums adjust in real-time based on risk factors. The potential of such technologies to drive agility within the industry is enormous; hence, embracing digital transformation is not just a trend but a necessity for survival in a rapidly evolving marketplace.

Emphasizing Sustainability and Ethical Practices

As the global community becomes increasingly aware of environmental challenges, the insurance industry is responding with a renewed focus on sustainability and ethical practices. Insurers are now prioritizing green initiatives, integrating eco-friendly policies into their operations and product offerings. This transition involves adopting practices such as:

- Incorporating renewable energy sources

- Reducing waste and carbon footprints

- Encouraging sustainable business operations among clients

Additionally, ethical practices are gaining prominence, with companies adopting more transparent and responsible underwriting criteria. Insurers are seeking to align their investments with sustainability goals, creating a positive impact on communities and the environment. Many organizations are also introducing socially responsible investment options, making it easier for consumers to make choices that reflect their values. This trend not only boosts brand loyalty but also encourages a paradigm shift in how the industry operates.

The Evolution of Customer Experience in Insurance

The insurance industry is undergoing a profound transformation as customer experience becomes a central focus. Gone are the days of impersonal transactions and lengthy processes; today, insurance companies are leveraging technology to enhance client interactions. Key innovations such as AI-driven chatbots, predictive analytics, and personalized offerings are reshaping how clients interact with insurers. These advancements not only streamline processes but also provide customers with tailored solutions that meet their unique needs. As a result, customer satisfaction is significantly improving, creating a loyalty loop that benefits both parties.

Moreover, insurers are increasingly recognizing the importance of omnichannel strategies to provide seamless customer experiences. This entails integrating various touchpoints—such as websites, mobile apps, and social media—to ensure that customers receive consistent service regardless of how they engage with the brand. Customers now expect to communicate through their preferred channels, leading to greater engagement and more informed decision-making. To illustrate the progress in customer experience, here’s a concise table highlighting key factors driving this evolution:

| Factor | Description |

|---|---|

| Technology Adoption | Utilization of AI and automation for quicker service. |

| Personalization | Customized insurance products based on data analysis. |

| Omnichannel Engagement | Consistent communication across multiple platforms. |

| Feedback Loops | Real-time customer feedback mechanisms to enhance services. |

Adapting to Regulatory Changes and Compliance Challenges

As the landscape of insurance continues to evolve, companies must develop strategies to navigate regulatory shifts that directly impact their operations. Adapting to these changes is crucial not only for compliance but also for maintaining consumer trust and safeguarding market share. Insurers must stay informed about emerging regulations, focusing on areas such as data privacy, climate risk disclosures, and digital marketing practices. Key strategies include:

- Investing in Compliance Technology: Automation tools can help streamline adherence to new regulations.

- Continuous Staff Training: Regular updates and training sessions ensure teams are knowledgeable about regulatory requirements.

- Engaging with Regulatory Bodies: Building relationships can provide insight into upcoming changes and foster collaboration.

Furthermore, the shift towards a more regulated environment calls for robust risk management frameworks. Insurers should proactively assess their exposure to regulatory risks and develop contingency plans to address potential challenges. This approach includes monitoring industry trends and conducting regular compliance audits. Relevant areas for focus might include:

| Risk Area | Mitigation Strategy |

|---|---|

| Data Privacy | Implement strict data management protocols and ensure transparency. |

| Climate Disclosures | Integrate sustainability metrics into reporting practices. |

| Digital Compliance | Regularly review digital marketing campaigns for regulatory alignment. |

In Conclusion

As we look ahead to the future of the insurance industry, it’s clear that change is on the horizon. The trends outlined in this article – from advancements in technology and data analytics to the growing emphasis on sustainability and customer-centric services – are set to redefine how insurance operates in the years to come. Staying informed about these developments will be crucial for both consumers and industry professionals alike, as they navigate the evolving landscape.

Remember, whether you’re a policyholder seeking to optimize your coverage or a professional aiming to stay ahead of the curve, awareness of these trends can empower informed decisions. As the insurance sector continues to adapt and innovate, keeping an eye on these key shifts will ensure you’re well-prepared for what lies ahead. Thank you for reading, and stay tuned for more insights and updates on the crucial developments impacting the world of insurance.