Title:

Life insurance is often perceived primarily as a safety net, providing financial security for loved ones in the event of an untimely death. However, many individuals overlook another significant aspect of life insurance: its potential tax benefits. Whether you are considering purchasing a policy or already have one, understanding the various tax implications associated with life insurance can help you make informed financial decisions. In this article, we will delve into the tax advantages that life insurance policies may offer, shedding light on how they can be an integral part of a comprehensive financial strategy. From death benefits to cash value accumulation, let’s explore how life insurance can not only offer peace of mind but also contribute to your financial well-being in a tax-efficient manner.

Table of Contents

- Understanding the Tax Advantages of Life Insurance Premiums

- How Cash Value Accumulation Can Enhance Your Tax Strategy

- Navigating Tax Implications on Death Benefits for Beneficiaries

- Maximizing Tax Efficiency: Policy Types and Their Benefits

- Final Thoughts

Understanding the Tax Advantages of Life Insurance Premiums

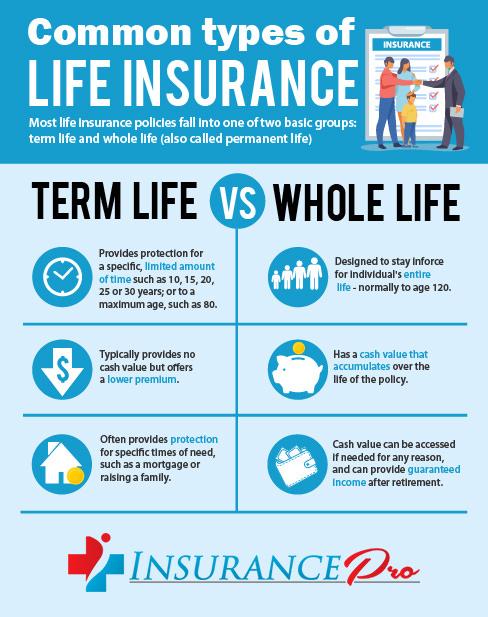

One of the most appealing aspects of life insurance policies is their potential tax benefits, which can significantly enhance the overall value of these financial products. When policyholders pay premiums, they may be able to deduct a portion of these amounts from their taxable income, depending on the type of policy and individual circumstances. This can lead to reduced tax liabilities, essentially making the premiums cost less in the long run. Additionally, the death benefit received by beneficiaries is generally income tax-free, providing added financial security without the burden of taxation during a difficult time.

Moreover, certain types of life insurance, such as whole life or universal life, accumulate cash value over time. This cash value grows tax-deferred, which means that policyholders do not owe taxes on the earnings until they are withdrawn. This feature allows individuals to leverage their policy for loans or withdrawals without immediate tax implications, creating a unique opportunity for financial planning. Here are some key advantages to consider:

- Premiums may be deductible in specific circumstances.

- Death benefits are typically free from income tax for beneficiaries.

- Cash value accumulation is tax-deferred until accessed.

How Cash Value Accumulation Can Enhance Your Tax Strategy

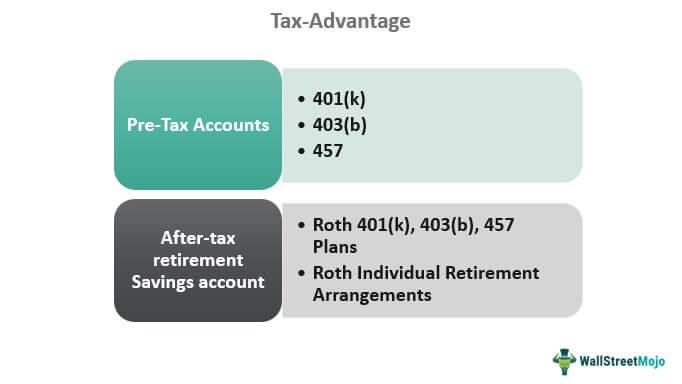

The cash value component of permanent life insurance policies can serve as a powerful tool in your overall tax strategy. Unlike traditional savings or investment accounts, the growth within these cash value policies accumulates on a tax-deferred basis. This means that, as you build your cash value over time, you can avoid immediate tax liabilities that come with capital gains. Additionally, policyholders can often access these funds through loans or withdrawals without triggering a taxable event, as long as the policy remains in force. This unique characteristic allows you to effectively utilize your accumulated cash value for various financial needs while maintaining tax advantages.

Furthermore, the cash value can play a significant role in retirement planning. If structured appropriately, it can provide a tax-free source of income in your retirement years. Consider the following benefits of incorporating cash value accumulation into your tax strategy:

- Tax-deferred growth: Your cash value grows without immediate tax implications.

- Tax-free loans: Funds can be borrowed against the cash value without incurring taxes.

- Death benefit protection: The death benefit can provide financial support to beneficiaries, further enhancing your overall financial strategy.

Navigating Tax Implications on Death Benefits for Beneficiaries

When a policyholder passes away, the death benefits paid out to beneficiaries can have important tax implications. Fortunately, in many cases, these benefits are received tax-free. This means that the full amount designated in the policy can be accessed by the beneficiaries without being subjected to federal income taxes, allowing them to use the funds as intended—be it for paying off debts, covering living expenses, or funding a child’s education. However, it’s crucial for beneficiaries to be aware of certain scenarios where taxes could apply, such as if the death benefit is part of the deceased’s estate, which might trigger estate taxes if the estate’s total exceeds federal thresholds.

In addition to understanding the tax-free status of life insurance payouts, beneficiaries should stay informed about potential taxes on any accumulated interest earned on the death benefit if it is left with the insurance company for a duration before withdrawal. To clarify these scenarios, consider the following points:

- Immediate Payment: Death benefits generally exempt from tax.

- Estate Inclusion: Death benefits may be taxed if the policyholder’s estate exceeds the exemption threshold.

- Interest Income: Any interest accrued on the death benefit may be taxable.

Maximizing Tax Efficiency: Policy Types and Their Benefits

Life insurance policies offer a unique avenue for maximizing tax efficiency, tailored not only for individuals seeking financial security but also for those looking to optimize their tax situations. Here are some key benefits you can leverage:

- Tax-Free Death Benefit: The proceeds from a life insurance policy are typically paid out to beneficiaries tax-free, providing a financial safety net without tax implications.

- Tax-Deferred Growth: The cash value component of permanent life insurance grows on a tax-deferred basis, allowing your investment to accumulate without immediate tax burdens.

- Loans Against Cash Value: Policyholders can borrow against the cash value of their life insurance without triggering tax consequences, as long as the policy remains in force.

Furthermore, the strategic use of life insurance can complement broader financial planning and estate management strategies. To better illustrate these advantages, consider the following table that outlines different types of life insurance policies and their respective tax benefits:

| Policy Type | Key Tax Benefits |

|---|---|

| Term Life Insurance | Tax-free death benefit; no cash value |

| Whole Life Insurance | Tax-deferred growth; borrow against cash value |

| Universal Life Insurance | Flexible premium payments; tax-deferred growth |

Final Thoughts

understanding the tax benefits associated with life insurance policies can play a pivotal role in your overall financial strategy. By harnessing these advantages, you not only secure your loved ones’ financial future but also enhance your own tax planning efforts. Whether you’re considering a permanent policy with its cash value growth or a term policy focused purely on protection, it’s essential to evaluate how these products fit into your financial goals. As always, consulting with a financial advisor can provide personalized insights tailored to your unique situation. We hope this exploration of life insurance tax benefits has shed some light on the potential opportunities available to you. Stay informed, plan wisely, and ensure that your financial foundation remains strong for years to come.