In an increasingly interconnected world, understanding how different countries approach insurance can offer valuable insights into risk management and financial security. Insurance systems vary widely from one nation to another, shaped by cultural, economic, and regulatory factors unique to each locale. From the robust social safety nets of Scandinavia to the more market-driven approaches in the United States, each model reflects distinct priorities and strategies. In this article, we will take a closer look at various insurance systems around the globe, examining their structures, key components, and the challenges they face. Whether you’re an industry professional, a curious consumer, or simply someone interested in how different societies protect their citizens against risk, this exploration will provide a comprehensive overview of the diverse insurance landscapes that exist worldwide. Join us as we delve into the fascinating world of global insurance and uncover the lessons we can learn from each unique approach.

Table of Contents

- Examining Insurance Regulatory Frameworks Around the World

- Understanding Healthcare Insurance Models in Various Countries

- Comparative Analysis of Property and Casualty Insurance Practices

- Emerging Trends and Innovations in Global Insurance Markets

- The Conclusion

Examining Insurance Regulatory Frameworks Around the World

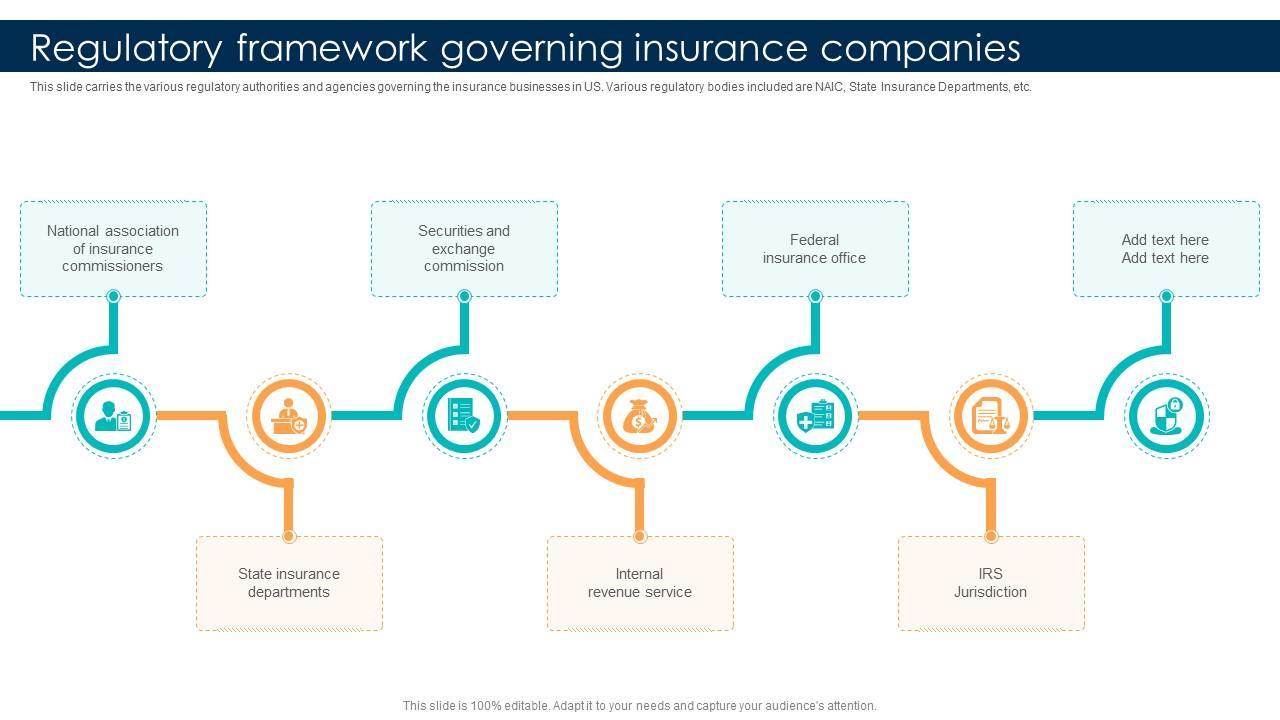

Globally, insurance regulatory frameworks vary significantly, shaped by the unique socio-economic contexts and legal environments of each nation. In the United States, the insurance sector is primarily regulated at the state level, with each state having its own set of rules and regulations. This decentralized approach allows states to address specific local needs but can also lead to discrepancies in coverage and compliance. Conversely, countries like Germany employ a federal system where regulations are harmonized nationally, allowing for a more uniform approach to consumer protection and financial stability. Other nations, such as Japan, blend these systems by incorporating elements of both state and federal oversight, ensuring that regulations keep pace with evolving market demands.

Additionally, the regulatory structure often includes key elements that define its effectiveness and adaptability. Common features include:

- Licensing Requirements: Designated authorities assess whether insurers meet certain operational standards.

- Capital Requirements: Insurers are expected to maintain minimum levels of capital to safeguard policyholders.

- Consumer Protection Laws: These regulations aim to ensure fair treatment for policyholders and proper claims handling.

Comparatively, many countries are moving towards more integrated regulatory approaches, aligning with international standards set by organizations such as the International Association of Insurance Supervisors (IAIS). This trend highlights the growing recognition of the need for collaboration in the global insurance landscape, ensuring that insurers can effectively manage risks that transcend national borders.

Understanding Healthcare Insurance Models in Various Countries

Healthcare insurance varies significantly across the globe, with each nation implementing its own unique model that reflects cultural values and economic realities. For example, in Canada, the universal healthcare system ensures that all citizens have access to medically necessary services paid for through taxes, promoting equity in healthcare access. Conversely, in the United States, a predominantly private insurance model emphasizes individual choice and competition among insurers, leading to a complex landscape where coverage can differ widely based on one’s plan and provider. This juxtaposition illustrates how the philosophy of healthcare delivery can influence public health outcomes and the overall efficiency of systems.

Other countries have adopted mixed approaches. In Germany, a system characterized by statutory and private health insurances allows citizens to choose between public plans offering comprehensive coverage and private plans that provide more personalized care and faster access to specialists. Meanwhile, in Sweden, healthcare is funded through taxes, but individuals can also opt for private insurance to shorten waiting times and gain access to additional services. The following table summarizes key features of healthcare insurance models in selected countries:

| Country | Insurance Type | Key Features |

|---|---|---|

| Canada | Universal | Tax-funded, equitable access |

| United States | Private | Employer-based, diverse plans |

| Germany | Mixed | Statutory and private options |

| Sweden | Universal with optional private | State-funded with supplemental choices |

Comparative Analysis of Property and Casualty Insurance Practices

The landscape of property and casualty insurance varies significantly across the globe, shaped by local regulations, cultural expectations, and economic conditions. In countries like the United States, policies often emphasize risk management and financial recovery, creating a complex system of private insurers that compete vigorously for market share. Conversely, countries such as Sweden and Norway embrace a more socialized approach, where government involvement substantially reduces individual liability and promotes public welfare. This division leads to differing practices in claims processing, with some countries prioritizing efficiency and customer service, while others focus heavily on regulatory compliance.

Furthermore, the alignment of insurance practices with technological advancements also differs globally. Nations like Japan and South Korea lead in integrating insurtech solutions, enhancing customer experiences through streamlined claims processes and personalized products. Meanwhile, developing nations face challenges in adopting such technologies, often relying on traditional methods that can lead to slower service and less transparency. The following table highlights key differences in property and casualty insurance practices across selected countries:

| Country | Primary Insurer Type | Technology Adoption | Customer Focus |

|---|---|---|---|

| United States | Private | High | Risk Management |

| Germany | Both | Moderate | Regulatory Compliance |

| Japan | Private | Very High | Customer Experience |

| Brazil | Public | Low | Affordability |

Emerging Trends and Innovations in Global Insurance Markets

The landscape of global insurance markets is continuously evolving, shaped by advancements in technology, changing consumer expectations, and regulatory reforms. Insurers are increasingly leveraging artificial intelligence (AI) and machine learning (ML) to enhance underwriting processes, assess risk more accurately, and streamline claims management. These innovations lead to faster service delivery and personalized insurance products tailored to the unique needs of customers. Additionally, the use of big data analytics allows insurers to gain insights into customer behavior, enabling them to predict trends and mitigate risks effectively.

Furthermore, the rise of insurtech companies is disrupting traditional business models by offering digital-first solutions that prioritize user experience. Emerging technologies such as blockchain are also making waves, enhancing transparency, and reducing fraud. The focus on sustainable practices has given birth to green insurance, catering to an environmentally conscious consumer base. Key trends include:

- Parametric Insurance: Automated payouts based on specific triggers rather than traditional claims processes.

- On-Demand Insurance: Flexible policies that allow consumers to purchase coverage for specific times or events.

- Telematics: Usage-based insurance (UBI) models, especially in auto insurance, that adjust premiums based on real-time driving behavior.

The Conclusion

As we wrap up our exploration of global insurance systems, it’s clear that the landscape is as diverse as the countries themselves. Each nation has developed its own approach to risk management, shaped by cultural, economic, and social factors. From the comprehensive frameworks of Scandinavian countries to the more fragmented systems seen in parts of Africa and Asia, these variations highlight the importance of context in insurance policy design.

Understanding these differences not only deepens our appreciation for the complexities of global markets but also offers valuable lessons that can be applied at home. As we navigate an increasingly interconnected world, there’s much to learn from the successes and challenges faced by different countries. Whether you’re an industry professional, a policymaker, or simply a curious reader, we encourage you to keep this dialogue open.

In future discussions, we hope to delve deeper into specific case studies and innovations that might inspire improvements within your own insurance landscape. Thank you for joining us on this journey through the world of insurance—let’s continue to explore how we can create a more resilient and inclusive future for all.