Introduction:

In an increasingly interconnected world, understanding the nuances of global insurance systems has never been more essential. With each country offering its own unique approach to risk management and financial protection, the landscape of insurance is as diverse as the cultures and economies that shape it. From robust regulatory frameworks designed to protect consumers to innovative models that leverage technology for greater accessibility, the variations in insurance systems can reveal much about a nation’s priorities and challenges. In this article, we will embark on a comprehensive journey, analyzing insurance frameworks across different countries. Join us as we delve into the intricacies of global insurance systems, highlighting key features, comparing best practices, and uncovering insights that may inspire improvements in local markets. Whether you’re an industry professional, a policymaker, or simply curious about how insurance operates around the world, this exploration promises to shed light on one of the pivotal pillars of modern economies.

Table of Contents

- Emerging Trends in Global Insurance Markets

- Understanding Regulatory Frameworks Across Countries

- Evaluating the Role of Technology in Insurance Accessibility

- Best Practices for Enhancing Insurance Coverage Worldwide

- Future Outlook

Emerging Trends in Global Insurance Markets

The global insurance markets are undergoing a significant transformation influenced by various factors including technology, consumer behavior, and regulatory environments. Digitalization is at the forefront of these changes, with an increasing number of customers preferring online platforms for purchasing insurance products. The integration of Artificial Intelligence (AI) and big data analytics is enabling insurers to offer personalized products and improve risk assessment processes. Additionally, the popularity of InsurTech startups is fostering innovation, leading to the emergence of new business models that challenge traditional insurance paradigms.

Another key trend is the growing emphasis on sustainability within the insurance industry. As climate change and environmental risks become more pressing, insurers are adapting their portfolios to reflect this shift. This includes the development of climate-related insurance products and sustainable investing strategies. Furthermore, there is an increased focus on regulatory compliance as governments worldwide push for more transparent practices and greater consumer protection. The trend toward collaboration between insurers and technology firms is also noteworthy, as partnerships are essential for navigating the complexities of modern insurance landscapes.

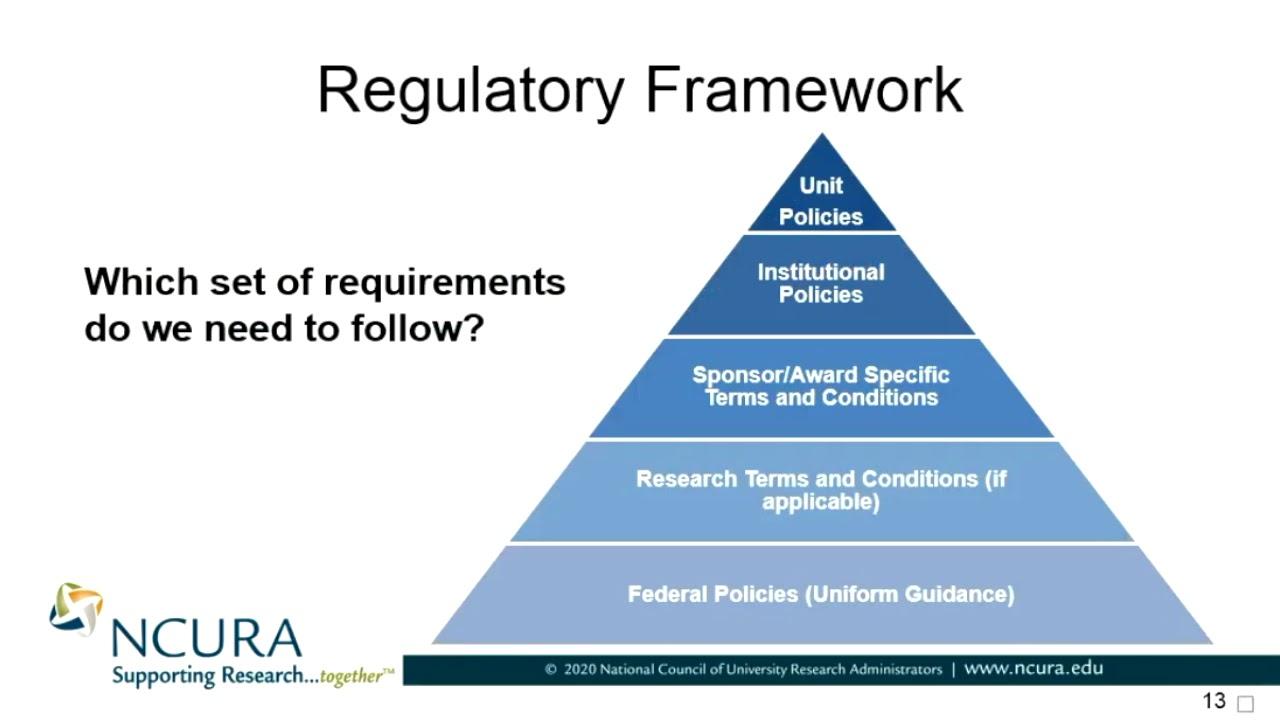

Understanding Regulatory Frameworks Across Countries

As the global insurance landscape continues to evolve, it becomes increasingly essential to understand the varied regulatory frameworks that shape these systems across different jurisdictions. Each country has developed its approach to insurance regulation, influenced by factors such as historical context, economic stability, and societal needs. Key elements of these frameworks often include:

- Licensing Requirements: Different countries have unique criteria that insurance companies must meet to operate legally within their borders.

- Consumer Protection Regulations: Various jurisdictions prioritize consumer safety, often imposing strict guidelines to ensure policyholders are treated fairly.

- Capital Requirements: Regulatory capital standards are established to ensure insurers maintain adequate reserves to cover potential claims.

- Market Conduct Rules: Many countries enforce rules governing how insurers interact with consumers and competitors to promote fairness and transparency.

The interplay of these elements can be illustrated through a basic comparison of select countries. For instance, while the United States leans toward a state-based regulatory approach, Europe often adopts a harmonized system through the Solvency II framework. Below is a simplified table highlighting some significant differences:

| Country | Regulatory Model | Focus Areas |

|---|---|---|

| United States | State-Based | Consumer Protection, Financial Solvency |

| Germany | National | Market Stability, Consumer Rights |

| United Kingdom | Integrated | Risk Management, Transparency |

| Japan | Integrated | Investor Protection, Fair Trade |

Evaluating the Role of Technology in Insurance Accessibility

The integration of technology into the insurance sector has transformed accessibility, allowing a broader audience to engage with and purchase insurance products. Online platforms and mobile applications have streamlined insurance processes, making it easier for individuals to compare policies, submit claims, and communicate with providers. Key advancements in this area include:

- Digital Platforms: Websites and apps that facilitate user-friendly interactions.

- Big Data Analytics: Leveraging data to customize offerings and manage risk.

- Artificial Intelligence: Chatbots and automated systems that assist customers 24/7.

Despite the progress, challenges remain in ensuring equitable access. Certain demographics, especially in underdeveloped regions, may find themselves excluded due to limited internet access or technological literacy. To address this, insurance companies are now exploring innovative solutions such as:

- Community Workshops: Educating the public about insurance and technology.

- Partnerships with Local Organizations: Bridging the gap between insurers and underserved communities.

- Mobile Insurance Solutions: Targeting populations without stable internet access through SMS and offline tools.

Best Practices for Enhancing Insurance Coverage Worldwide

Enhancing insurance coverage on a global scale requires a multifaceted approach that addresses local needs while accommodating international standards. It is crucial for insurers to invest in technology-driven solutions that streamline processes and improve customer experience. This can involve implementing AI and big data analytics for risk assessment, creating user-friendly digital platforms for policy management, and adopting automated claims processing systems. Additionally, fostering partnerships with local providers can enhance market understanding and client relations, ensuring that products are tailored to specific risks and regulatory landscapes.

Education and awareness also play vital roles in improving coverage. Insurers should focus on developing informative campaigns aimed at educating clients about the importance of comprehensive coverage and potential risks. Engagement with communities through workshops and online resources can help clients make informed decisions. Moreover, establishing transparent communication channels will enable clients to voice their concerns and access assistance readily. Ultimately, the goal should be to create a robust insurance ecosystem where risk management is prioritized, ensuring that all stakeholders are protected.

Future Outlook

As we conclude our exploration of global insurance systems through a country-by-country lens, it becomes evident that the landscape of insurance is as diverse as the nations themselves. Each system we’ve examined reflects the unique cultural, economic, and regulatory nuances of its respective country, highlighting the importance of context in understanding how insurance operates worldwide.

From the comprehensive, state-supported frameworks of some nations to the more privatized and competitive models found elsewhere, we see that there is no one-size-fits-all solution when it comes to insurance. These varying approaches not only provide valuable insights into risk management and coverage but also illustrate the ongoing challenges and opportunities faced by insurers and policyholders alike.

As globalization continues to shape our world, the interconnectivity of insurance practices across borders will only grow. Keeping an eye on these trends can empower consumers, inform policy discussions, and inspire innovations in insurance that benefit everyone.

Thank you for joining us on this journey through the complex world of global insurance systems. We hope this analysis has deepened your understanding and sparked your interest in the intricacies of how insurance operates around the globe. Feel free to share your thoughts or experiences in the comments below!