In our increasingly interconnected world, understanding the intricacies of insurance systems across different countries is more important than ever. Insurance not only plays a pivotal role in financial security for individuals and businesses but also reflects the economic, cultural, and regulatory nuances of each nation. From the comprehensive coverage offered in Scandinavian countries to the innovative insurtech solutions emerging in Southeast Asia, global insurance models vary widely, shaped by local needs and practices. In this article, we will embark on an insightful journey, exploring these diverse insurance frameworks country by country. Whether you’re a seasoned industry professional, a curious consumer, or simply interested in global finance, this guide will provide you with a clearer understanding of how insurance operates around the world and what lessons can be learned from each model. Join us as we navigate the fascinating landscape of global insurance, uncovering the strategies that different nations employ to protect their citizens and economies.

Table of Contents

- Understanding Insurance Frameworks Around the World

- Key Features of Successful Insurance Models in Different Countries

- Challenges and Opportunities in Global Insurance Markets

- Best Practices for Adapting Insurance Solutions Across Borders

- Insights and Conclusions

Understanding Insurance Frameworks Around the World

When examining global insurance structures, it’s crucial to recognize that each country’s model reflects its unique social, economic, and regulatory environments. In the United States, the insurance industry operates under a decentralized system where regulation is primarily managed at the state level, leading to a diverse array of products and practices tailored to local markets. In contrast, countries like Germany benefit from a more cohesive national framework, where health insurance is primarily mandated by law, resulting in a strong emphasis on universal coverage. This difference highlights how cultural values and governmental influence sculpt the insurance landscape.

Furthermore, examining emerging markets reveals innovative adaptations designed to improve coverage accessibility. For instance, microinsurance products in nations such as India aim to provide financial protection for low-income individuals against specific risks, often with affordable premiums. These models prioritize inclusivity, challenging traditional insurance norms and offering lessons on sustainability and adaptability. To illustrate these differences more clearly, the following table summarizes key elements of insurance frameworks across select countries:

| Country | Insurance Coverage | Regulatory Approach |

|---|---|---|

| United States | State-based diverse options | Decentralized |

| Germany | Universal health insurance | National mandate |

| India | Microinsurance for low-income | Emerging regulation |

| Japan | Universal healthcare | Strong national framework |

Key Features of Successful Insurance Models in Different Countries

Diversity in Coverage Options: One of the hallmarks of successful insurance models is their ability to offer a wide range of coverage options tailored to the needs of their citizens. Countries like Germany showcase a robust health insurance system that includes both public and private options, ensuring that everyone has access to essential medical services. In contrast, nations such as Japan implement an efficient combination of national health insurance and employer-based plans, resulting in 100% insurance coverage. Key features include:

- Comprehensive health services including preventive care.

- Options for customization allowing individuals to select plans based on specific needs.

- Low administrative costs which streamline the claims process.

Regulatory Framework and Consumer Protection: Effective regulatory frameworks play a crucial role in maintaining the integrity and trust in insurance systems. For instance, Australia emphasizes consumer protection laws, ensuring that policies are transparent and fair, which fosters customer confidence. Meanwhile, the South African insurance model features strict adherence to regulations that promote competition and fairness in pricing. Essential elements include:

| Country | Key Regulatory Features |

|---|---|

| Germany | Public-private insurance mix |

| Japan | Comprehensive national health coverage |

| Australia | Robust consumer protection laws |

| South Africa | Fair pricing regulations |

Challenges and Opportunities in Global Insurance Markets

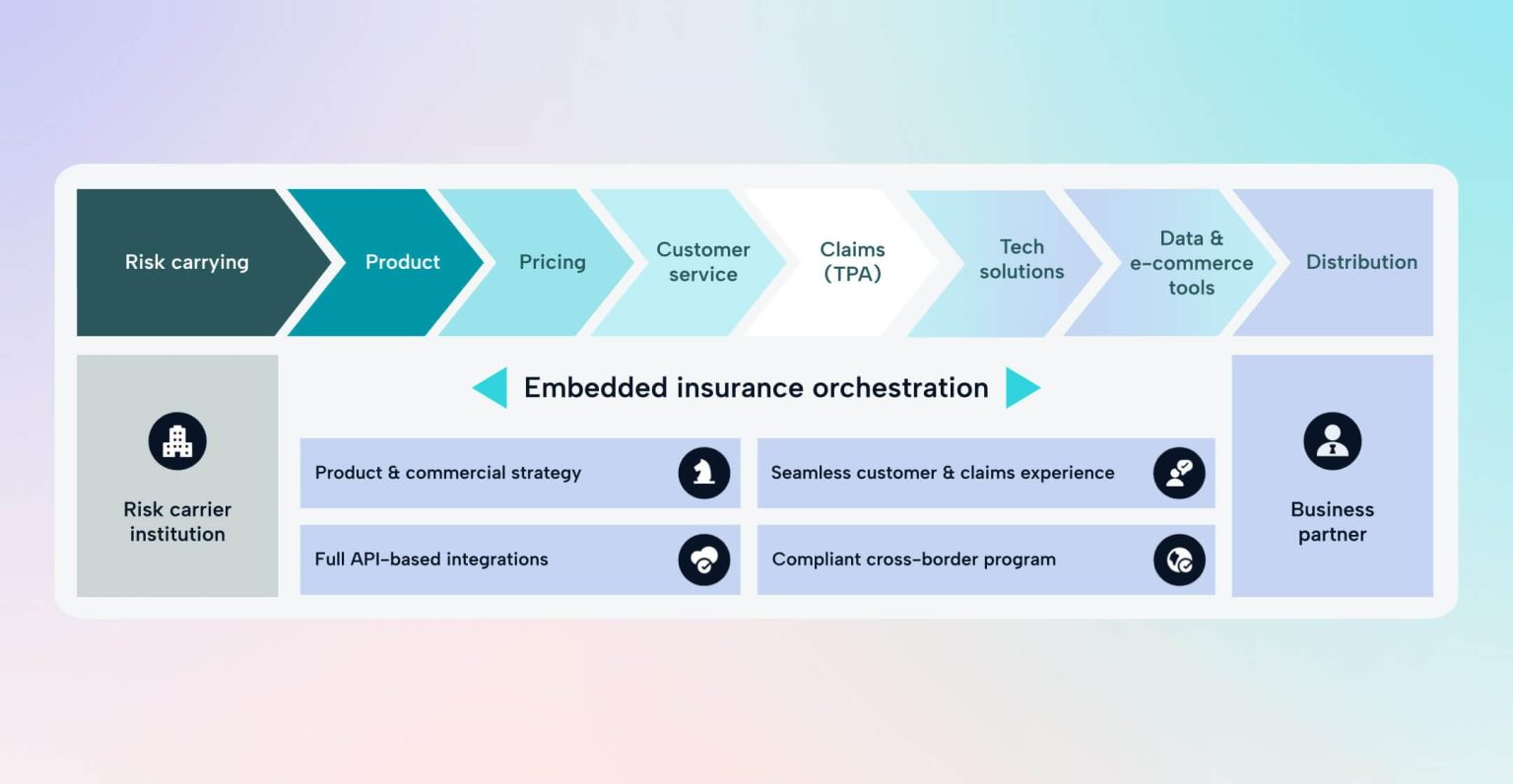

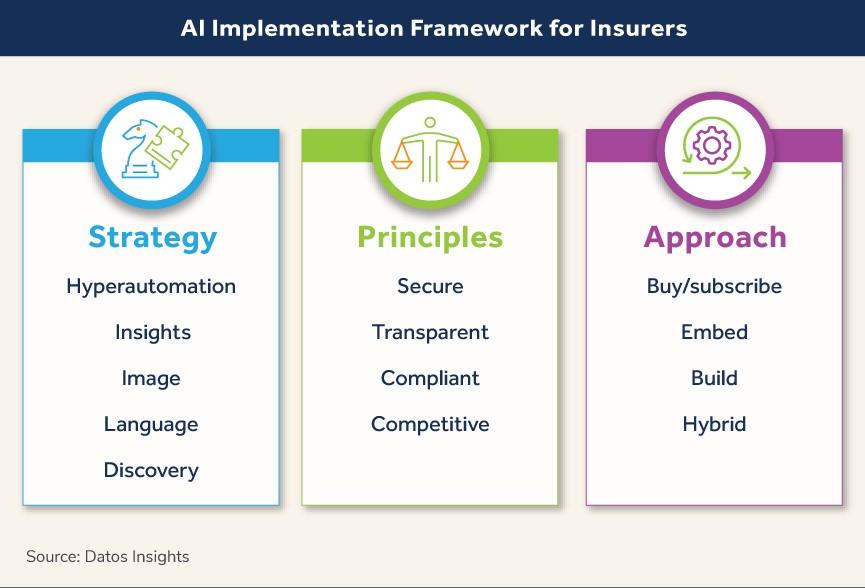

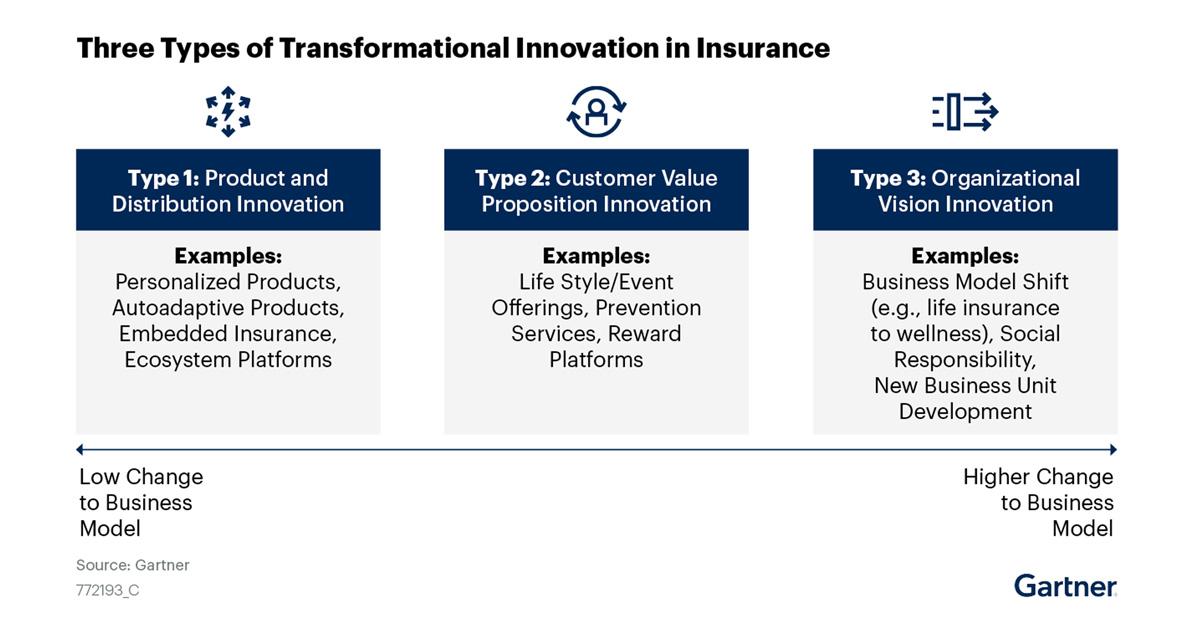

The global insurance landscape is fraught with various hurdles that both established companies and new entrants must navigate. Key challenges include regulatory complexity, as each country has its own set of rules and compliance requirements. Additionally, the rise of digital transformation pushes insurers to adapt quickly to technological advancements without compromising the quality of customer service or data security. These elements can strain operational resources and disrupt market stability. Furthermore, the ongoing threat of climate change poses risks for underwriting and claims, compelling insurers to rethink risk models and premium pricing strategies across different geographies.

Conversely, these challenges also pave the way for unique opportunities. Insurers can harness insurtech innovations to streamline processes and enhance user experience, thus attracting a broader customer base. By investing in data analytics, companies can better understand market trends and customer behaviors, allowing for more tailored products. Moreover, the emphasis on sustainability offers a chance for insurers to develop groundbreaking policies that meet the growing consumer demand for eco-friendly options. The convergence of globalization and local insights can lead to a more robust and diverse product portfolio, positioning insurers to thrive in an ever-evolving market.

Best Practices for Adapting Insurance Solutions Across Borders

When expanding insurance solutions across borders, it’s imperative to prioritize an understanding of local regulations and cultural nuances. Each country boasts its own legal frameworks governing insurance practices, which means that a one-size-fits-all approach may not be feasible. Key considerations include:

- Regulatory compliance: Familiarize yourself with the country-specific laws and guidelines to ensure all products meet local standards.

- Cultural sensitivities: Recognize the cultural attitudes towards insurance; for example, in some regions, certain types of coverage may be more sought after than others.

- Language barriers: Utilize localized materials and customer support to accommodate diverse linguistic needs.

In addition to regulatory awareness, leveraging technology can streamline the adaptation process. With advancements in digitalization, insurers can customize their offerings more efficiently. Some effective strategies include:

- Data analytics: Employ data tools to gain insights into consumer behavior and preferences in different markets.

- A flexible platform: Use adaptable technology solutions that can accommodate various insurance products and services across borders.

- Collaborative partnerships: Partner with local firms to deepen market understanding and enhance distribution channels.

| Country | Regulation Type | Preferred Coverage |

|---|---|---|

| USA | State-specific laws | Health and auto insurance |

| Germany | Federal laws | Liability and health insurance |

| Japan | National insurance laws | Life and long-term care insurance |

Insights and Conclusions

As we conclude our journey through the diverse landscape of global insurance models, it’s clear that each country approaches risk management in its own unique way, shaped by cultural, economic, and regulatory influences. From the robust structure of Scandinavian welfare systems to the innovative insurtech solutions emerging in Asia, the variety of practices offers valuable lessons for both consumers and industry professionals alike.

Understanding these differences not only enhances our appreciation for the complexities of the insurance world but also empowers us to make more informed decisions, whether we are citizens navigating local insurance options or businesses looking to expand into new markets.

We encourage you to delve deeper into the specifics of your country’s insurance model and explore how it compares to global peers. As the industry continues to evolve with technological advancements and changing consumer needs, staying informed is key to ensuring adequate protection and peace of mind. Thank you for joining us on this exploration of global insurance models—may your insights guide you towards better understanding and navigating the insurance landscape.