Understanding insurance can often feel like navigating a complex maze. With a plethora of options available, from health to auto to homeowners insurance, it’s easy to feel overwhelmed by the choices. However, having a solid grasp of the different types of insurance is essential for protecting yourself, your family, and your assets. In this comprehensive guide, we will break down the various types of insurance available, highlight their specific purposes, and help you determine which policies might be right for you. Whether you’re looking to safeguard your financial future or simply seeking to understand how insurance works, this article will provide you with the knowledge you need to make informed decisions. Let’s dive in and explore the world of insurance together!

Table of Contents

- Understanding the Essentials of Health Insurance Coverage

- Evaluating the Importance of Property and Casualty Insurance

- Navigating Life Insurance: Which Policy is Right for You

- Tips for Choosing the Right Insurance Provider and Plan

- Future Outlook

Understanding the Essentials of Health Insurance Coverage

Health insurance coverage is a cornerstone of financial protection against unforeseen medical expenses. It provides individuals and families with access to a range of healthcare services while minimizing out-of-pocket costs. Understanding the fundamental aspects of health insurance can help consumers make informed decisions about their coverage options. Here are some key components to consider:

- Premiums: The monthly payment required to maintain your health insurance policy.

- Deductibles: The amount you must pay out of pocket before your insurance begins to cover expenses.

- Copayments and Coinsurance: These are the costs you share with your insurer when receiving care, which may vary based on the service.

- Network Providers: Healthcare providers that have agreements with your insurance company to offer services at negotiated rates.

- Coverage Limits: The maximum amount your insurer will pay for a specific service or during a policy period.

When selecting a health insurance plan, it’s important to understand the differences between various types of coverage. The following table outlines the primary options available:

| Plan Type | Description | Ideal For |

|---|---|---|

| HMO | Requires members to choose a primary care physician (PCP) and get referrals for specialists. | Individuals seeking lower premiums and a coordinated care approach. |

| PPO | Offers a wider network of providers and the flexibility to see specialists without referrals. | Those who value choice and are willing to pay higher premiums for flexibility. |

| EPO | Similar to PPO but does not cover out-of-network care except in emergencies. | Individuals looking for a balance between cost and flexibility. |

Evaluating the Importance of Property and Casualty Insurance

Property and casualty insurance plays a crucial role in safeguarding individuals and businesses from unexpected events that could lead to significant financial loss. This type of insurance not only provides protection for physical assets—such as homes, vehicles, and commercial properties—but also covers liability that arises from injuries or damages caused to others. The primary objective is to offer peace of mind, knowing that you are financially protected against natural disasters, theft, vandalism, and accidents. Understanding the nuances of various policies can help you choose the right coverage tailored to your specific needs.

Several key factors determine the importance of having property and casualty insurance:

- Risk Mitigation: Coverage protects against unforeseen events that could devastate finances.

- Legal Requirements: Many states and lenders mandate certain types of insurance, such as auto liability or homeowner’s insurance.

- Asset Protection: Insurance ensures that your investments are safeguarded in the event of damage or loss.

- Liability Coverage: This protects against claims resulting from injuries and damages to other people or their property.

For a better understanding of the different types of property and casualty insurance and their respective benefits, consider the following summary:

| Type of Insurance | Typical Coverage | Primary Purpose |

|---|---|---|

| Homeowners Insurance | Property damage, personal liability, additional living expenses | Protect home and belongings |

| Auto Insurance | Liability, collision, comprehensive coverage | Protect vehicles and drivers |

| renters Insurance | Personal property, liability, additional living expenses | Protect tenants’ belongings |

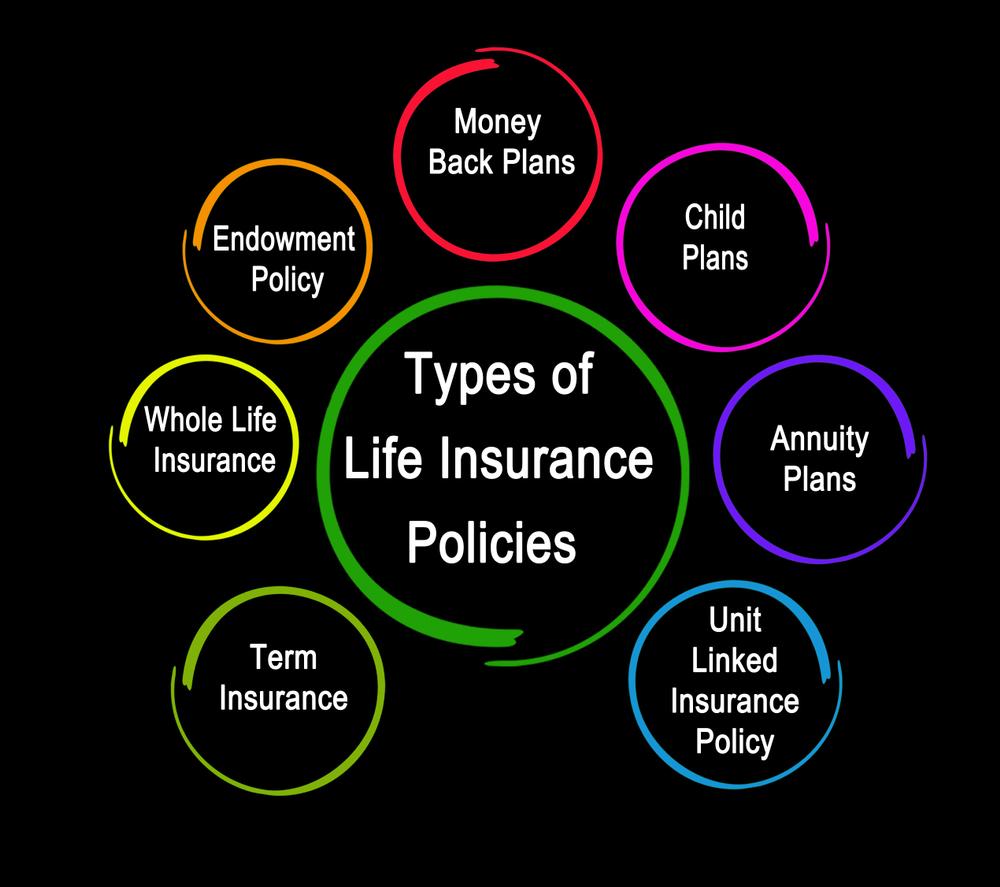

Navigating Life Insurance: Which Policy is Right for You

Choosing the right life insurance policy is a significant decision that can impact your financial security, and it often begins with understanding the options available. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years, making it a popular choice for those looking for affordable premiums. Whole life insurance, on the other hand, provides lifelong coverage and includes a cash value component which can accumulate over time. Another option, universal life insurance, combines the benefits of permanent coverage with flexible premium payments, giving policyholders greater control. Here are some important factors to consider when deciding:

- Your financial goals: Are you looking for pure protection or an investment component?

- Your budget: Determine how much you can afford to pay in premiums.

- Dependents’ needs: Consider how much coverage your loved ones would need in your absence.

- Health conditions: Your health status may influence the type and cost of coverage.

To further illuminate your choices, here’s a brief comparison of common life insurance types:

| Type of Insurance | Coverage Duration | Cash Value | Flexibility |

|---|---|---|---|

| Term Life | Fixed term | No | Limited |

| Whole Life | Lifetime | Yes | Low |

| Universal Life | Lifetime | Yes | High |

Tips for Choosing the Right Insurance Provider and Plan

When selecting an insurance provider, it’s essential to consider several factors to ensure you make the best choice for your needs. Start by researching the company’s financial stability and reputation through independent rating agencies. Look for customer reviews and testimonials that highlight the provider’s service quality, claims process, and customer support. It’s also beneficial to check if they are licensed in your state and whether they have a history of resolving complaints satisfactorily.

Once you’ve narrowed down your options, take the time to compare different plans by evaluating their coverage limits, deductibles, and premium costs. A comprehensive approach includes:

- Identifying your specific needs and risks to choose appropriate coverage types

- Understanding what is and isn’t covered under each plan

- Examining any additional benefits or discounts offered

Consider creating a simple comparison table to visualize the differences in coverage and costs between providers:

| Provider | Monthly Premium | Deductible | Coverage Limit |

|---|---|---|---|

| Provider A | $100 | $500 | $1,000,000 |

| Provider B | $120 | $750 | $900,000 |

| Provider C | $90 | $300 | $1,200,000 |

Future Outlook

navigating the world of insurance can often feel overwhelming, given the multitude of options and specific jargon. However, understanding the various types of insurance—whether health, auto, home, or life—empowers you to make informed decisions that best suit your needs and financial situation. Each type serves a unique purpose, offering protection against unforeseen events and providing peace of mind for you and your loved ones.

As you explore your insurance options, remember to assess your individual circumstances carefully and seek advice when necessary. Comparing policies, understanding coverage details, and evaluating premiums are crucial steps to ensure you find the right fit for your requirements.

With the insights presented in this guide, you are better equipped to venture into the insurance landscape and select the coverage that aligns with your life and goals. Stay informed, ask questions, and take proactive measures to safeguard your future. Thank you for joining us on this journey through the intricacies of insurance; we hope it helps you navigate these important decisions with confidence.