When it comes to safeguarding your financial well-being, insurance plays a crucial role. While it provides the necessary protection against unexpected events, navigating the myriad of options and policies can feel overwhelming. In this article, we’ll explore essential insurance tips that not only help you save money but also ensure you’re adequately protected. Whether you’re looking to cut costs on premiums, understand the best coverage for your needs, or simply demystify the insurance process, our guide will provide you with practical insights to make informed decisions. Let’s dive in and empower yourself with the knowledge that will help you save and protect what matters most.

Table of Contents

- Understanding Different Types of Insurance Coverage for Better Financial Security

- Evaluating Your Insurance Needs to Identify Cost-Saving Opportunities

- Leveraging Discounts and Bundles to Maximize Your Insurance Savings

- Strategies for Regularly Reviewing and Adjusting Your Insurance Policies

- The Way Forward

Understanding Different Types of Insurance Coverage for Better Financial Security

Insurance can often seem overwhelming, but understanding the various types of coverage available can significantly enhance your financial security. Consider the following essential types of insurance:

- Health Insurance: Covers medical expenses, ensuring you don’t face financial strain during health crises.

- Auto Insurance: Protects against financial loss in the event of an accident, theft, or damage to your vehicle.

- Homeowners Insurance: Safeguards your home and possessions from unexpected events like fire, theft, and flooding.

- Life Insurance: Provides financial support to your family in the unfortunate event of your passing.

- Disability Insurance: Offers income replacement in case you become unable to work due to injury or illness.

Choosing the right mix of insurance can help you mitigate risks effectively. Here’s a simple breakdown of factors to consider:

| Coverage Type | Key Benefits |

|---|---|

| Health Insurance | Covers high medical bills |

| Auto Insurance | Protects your vehicle investment |

| Homeowners Insurance | Safeguards your personal assets |

| Life Insurance | Ensures family’s financial stability |

| Disability Insurance | Supports you during recovery |

Evaluating Your Insurance Needs to Identify Cost-Saving Opportunities

Understanding your insurance needs is crucial for both financial protection and potential savings. Begin by conducting a thorough inventory of your current policies, including health, auto, home, and life insurance. Assess each policy to determine its relevance, coverage limits, and costs. By identifying any redundancies or unnecessary coverages, you can streamline your insurance portfolio. Consider the following factors to evaluate your current situation:

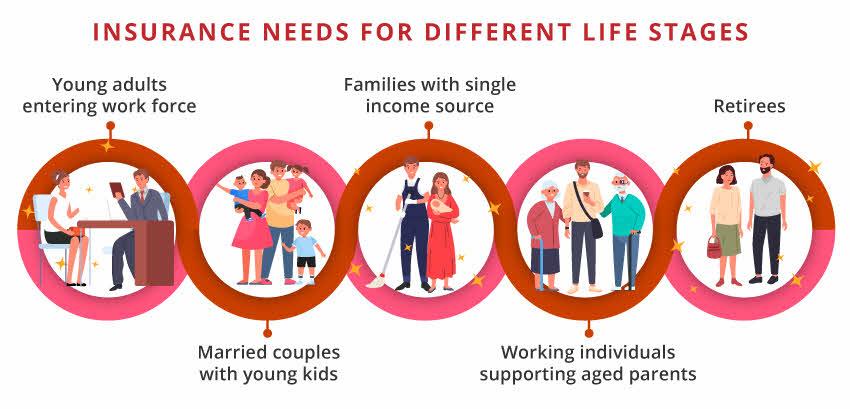

- Life Changes: Major life events such as marriage, a new job, or the birth of a child may necessitate adjustments in your insurance needs.

- Discount Opportunities: Many insurers offer discounts for bundling policies, having a good driving record, or maintaining a healthy lifestyle.

- Deductibles: Evaluate your current deductibles and whether a higher deductible could reduce your premium without significantly increasing your financial risk.

To explore additional savings, it’s wise to compare quotes from multiple providers. Analyzing different coverage options can help you find less expensive alternatives that still meet your needs effectively. Keep in mind that policy features vary widely, so a side-by-side comparison can be revealing. Consider using the following table to monitor key aspects of different insurance providers:

| Insurance Provider | Monthly Premium | Coverage Options | Discounts Available |

|---|---|---|---|

| Provider A | $120 | Basic, Comprehensive | Bundling, Safe Driver |

| Provider B | $110 | Basic, Enhanced | Multi-Policy, Loyalty |

| Provider C | $130 | Comprehensive | Health Improvement, Good Student |

Leveraging Discounts and Bundles to Maximize Your Insurance Savings

One of the most effective strategies to enhance your savings on insurance premiums is by taking advantage of discounts offered by various providers. Many insurers provide a range of discounts that can significantly lower your costs, such as:

- Multi-policy discounts: Save when you bundle different types of insurance, like home and auto.

- Safe driver discounts: Maintain a clean driving record to earn reductions on your car insurance.

- Loyalty discounts: Stay with the same insurer for a specified period to receive special rates.

- Home security discounts: Invest in safety devices to protect your home, which can also decrease your homeowner’s insurance premium.

By being proactive and asking about these available options, you can make the most of your insurance investments.

Besides individual discounts, bundling your insurance policies can be a strategic move. This allows you to manage your coverage more efficiently while also enhancing the potential for significant savings. Consider the following benefits of bundling:

| Benefit | Details |

|---|---|

| Cost Savings | Usually lowers your total premium when purchasing multiple policies from the same provider. |

| Simplified Management | One provider for multiple policies makes managing payments and claims easier. |

| Personalized Coverage | Insurance companies often tailor bundle options to better fit your needs. |

Integrating these elements into your insurance strategy will not only help you save money but also ensure you are better protected.

Strategies for Regularly Reviewing and Adjusting Your Insurance Policies

Regularly reviewing and adjusting your insurance policies is crucial for ensuring you have the right coverage at the best price. Start by setting a specific time on your calendar, such as annually or biannually, to evaluate your policies. During this review, consider the following factors:

- Life Changes: Have there been significant changes in your life, such as marriage, childbirth, or a new job?

- Market Trends: Are there new insurance products or better rates available in your area?

- Coverage Needs: Have your coverage needs changed based on property value or lifestyle changes?

Once you’ve made time for this review, create a simple table to compare your current policies with potential new ones. This can help you visualize any gaps in coverage or savings opportunities. Use the following sample structure:

| Policy Type | Current Premium | Alternative Premium | Coverage Amount |

|---|---|---|---|

| Auto Insurance | $120/month | $100/month | $20,000 |

| Home Insurance | $800/year | $750/year | $300,000 |

| Life Insurance | $50/month | $45/month | $500,000 |

After gathering this information, assess potential savings and ensure your current coverage aligns with your needs. Don’t hesitate to contact your insurance provider for a discussion or to explore updated options. Being proactive can lead to significant savings and better protection for you and your family.

The Way Forward

As we wrap up our exploration of essential insurance tips, it’s clear that making informed decisions can significantly impact both your finances and peace of mind. By understanding your coverage options, regularly reviewing your policies, and seeking out discounts, you can save money while ensuring you have the protection you need. Remember, the world of insurance doesn’t have to be overwhelming. With a bit of diligence and the right knowledge, you can navigate it with confidence. We encourage you to take these tips to heart and regularly assess your insurance needs. Your future self will thank you. Stay informed, stay protected, and don’t hesitate to reach out to professionals if you have questions or need guidance. Happy saving!