When it comes to securing our financial future and protecting our loved ones, life insurance is often a key pillar in our planning strategy. However, navigating the intricacies of insurance products can be daunting, especially with terms that may feel overwhelming to the average consumer. Among the vast options available, term life insurance and whole life insurance stand out as two of the most popular choices, each offering distinct advantages and features. In this comprehensive guide, we will decode the fundamentals of these two types of life insurance, helping you understand how they work, their benefits and drawbacks, and ultimately which might be the best fit for your unique financial situation. Whether you’re a newcomer to the concept of life insurance or looking to refine your understanding, our aim is to provide clear, concise insights that will empower you to make informed decisions about your life insurance needs. Let’s dive into the world of life insurance and unravel the complexities together.

Table of Contents

- Understanding the Core Differences Between Term and Whole Life Insurance

- Evaluating Your Insurance Needs: Which Policy is Right for You

- Financial Benefits and Considerations for Both Term and Whole Life Insurance

- Maximizing Your Coverage: Tips for Choosing the Best Policy for Your Situation

- To Wrap It Up

Understanding the Core Differences Between Term and Whole Life Insurance

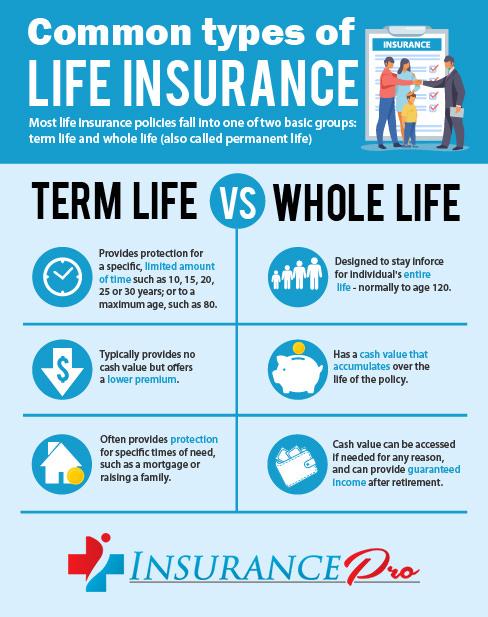

When comparing term and whole life insurance, it’s essential to recognize their fundamental distinctions, primarily in terms of coverage duration and cost. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. If the insured passes away within this timeframe, the beneficiaries receive a death benefit. However, if the term ends and the policyholder is still alive, the coverage expires, and there is no payout. Conversely, whole life insurance is designed to last for the insured’s entire life, as long as premiums are paid. This type also builds cash value over time, which can be borrowed against or withdrawn, making it a more flexible option in the long run.

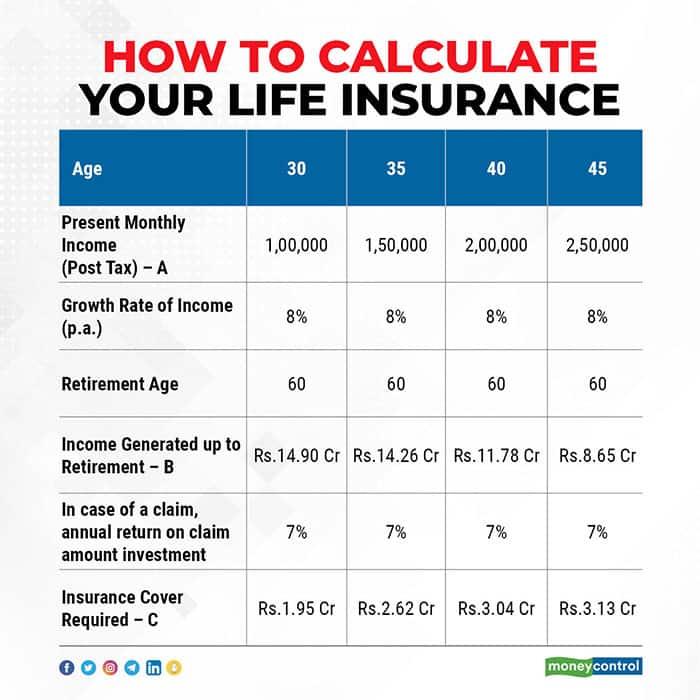

The differences in costs between these two types of insurance are significant. Generally, term life insurance premiums are much lower than those of whole life coverage, which makes it an attractive option for individuals seeking affordability. Here’s a quick comparison in table format:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Fixed term (10-30 years) | Lifetime coverage |

| Costs | Generally lower premiums | Higher premiums; builds cash value |

| Death Benefit | Payout only if insured dies during term | Payout at any time; guaranteed |

| Cash Value | No cash value accumulates | Cash value accumulates over time |

Choosing between these types of policies involves weighing these differences against personal financial goals and needs, ensuring a well-informed decision for long-term security.

Evaluating Your Insurance Needs: Which Policy is Right for You

Choosing the right insurance policy for your needs is a crucial decision that requires careful consideration of your personal circumstances and financial goals. Start by assessing your current situation, including factors like age, health, family obligations, and long-term plans. Term life insurance is often suitable for those who need coverage for a specific period, typically to protect their dependents during key financial years. It’s usually more affordable and straightforward, making it an attractive option for younger families or individuals who want coverage without a long-term commitment. Conversely, whole life insurance offers lifelong protection with a cash value component, which can be beneficial for those looking to build savings alongside insurance.

When evaluating your options, consider the following key points:

- Duration of Need: How long do you need coverage?

- Budget: What can you realistically afford in premiums?

- Financial Responsibilities: Do you have dependents or significant debt?

- Investment Goals: Are you looking for an investment component in your policy?

| Policy Type | Duration | Investment Component | Premium Costs |

|---|---|---|---|

| Term Life | Fixed Period | No | Lower |

| Whole Life | Lifelong | Yes | Higher |

Evaluating these factors can guide you in selecting the policy that best aligns with your financial needs and life goals. Balancing your coverage needs with your budget and investment aspirations will empower you to make an informed choice, ensuring that you secure the financial stability for yourself and your loved ones.

Financial Benefits and Considerations for Both Term and Whole Life Insurance

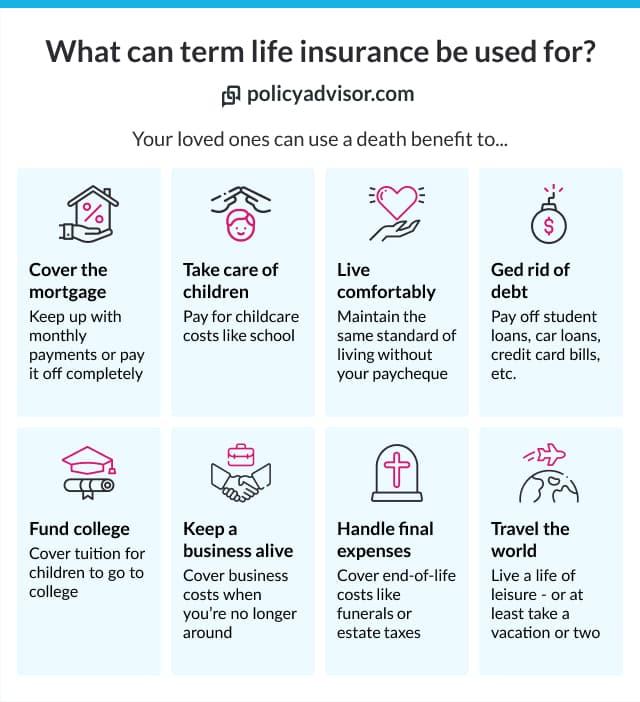

When assessing the financial implications of term and whole life insurance, it’s essential to consider several key factors. Term life insurance typically offers lower premiums, making it an attractive option for individuals looking to secure coverage without straining their budgets. The simplicity of this insurance type often appeals to younger families or individuals who may only need protection during specific financial milestones, such as raising children or paying off a mortgage. The downside, however, is that once the term expires, policyholders may face significantly higher rates for renewal or find it challenging to obtain new coverage due to age or health conditions.

On the other hand, whole life insurance comes with higher initial costs but provides enduring benefits, including a guaranteed death benefit and cash value accumulation. This cash value component allows policyholders to borrow against their policy or withdraw funds for unexpected expenses or investments. Additionally, the premiums remain consistent throughout the policyholder’s life, which can be a significant advantage for long-term financial planning. However, it’s crucial to weigh the higher costs against the benefits, as whole life insurance may not be the best fit for everyone, especially those who prioritize immediate budget constraints over long-term investment growth.

Maximizing Your Coverage: Tips for Choosing the Best Policy for Your Situation

Choosing the right insurance policy can feel overwhelming, but understanding your individual needs is the key to finding the coverage that suits you best. Begin by assessing your financial goals and obligations. Consider factors such as your current income, debt, and family size. A policy that offers sufficient coverage to pay off debts and provide for loved ones in the event of an unexpected loss is essential. Additionally, think about the duration of coverage you need. For instance, if you have young children, a term policy might provide the necessary security until they are financially independent, while a whole life policy could be beneficial for long-term financial planning and cash value growth.

When comparing different policies, pay attention to the nuances of each option. Make sure to evaluate the following aspects: premium costs, death benefits, cash value growth, and policy flexibility. Below is a simplified comparison to help you visualize your options:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Premium Costs | Generally lower | Higher premiums |

| Duration of Coverage | Set term (10-30 years) | Lifetime coverage |

| Cash Value | No cash value | Builds cash value over time |

| Policy Flexibility | Limited | More options for loans and withdrawals |

By understanding these elements and weighing the pros and cons based on your personal circumstances, you can make an informed decision that maximizes your coverage and aligns with your financial objectives.

To Wrap It Up

As we conclude our comprehensive guide to term and whole life insurance, it’s essential to remember that choosing the right policy is a deeply personal decision influenced by your individual circumstances, financial goals, and family needs. Understanding the key differences between these two types of insurance is the first step in making an informed choice that secures your loved ones’ financial future.

Whether you opt for the flexibility of term life insurance or the lifelong coverage and cash value aspect of whole life insurance, the most crucial factor is to evaluate your situation and consider your long-term objectives. We encourage you to take the time to research, consult with a professional, and reflect on what aligns best with your needs.

Ultimately, both term and whole life insurance serve unique purposes and can play vital roles in a sound financial strategy. Thank you for joining us on this journey to decode the complexities of life insurance. We hope you feel more empowered to navigate the options available to you and protect what matters most in your life. If you have further questions or need personalized advice, don’t hesitate to reach out to a trusted advisor. Until next time, stay informed and make wise choices for your financial future!