When it comes to securing your financial future and protecting your loved ones, choosing the right life insurance policy is a crucial decision. With a myriad of options available, understanding the key differences between term and whole life insurance can feel overwhelming. Both types of policies offer unique benefits and potential drawbacks, making it essential to consider your personal circumstances, financial goals, and long-term needs. In this article, we’ll break down the core features of term and whole life insurance, helping you navigate the complexities of each option so that you can make an informed decision tailored to your situation. Whether you’re a first-time buyer or looking to reassess your current coverage, we’ve got you covered with the information you need to choose the right policy for you.

Table of Contents

- Understanding the Basics of Term and Whole Life Insurance

- Key Differences Between Term and Whole Life Policies

- Cost Considerations: Which Insurance Option Fits Your Budget

- Choosing the Right Coverage for Your Financial Goals

- Wrapping Up

Understanding the Basics of Term and Whole Life Insurance

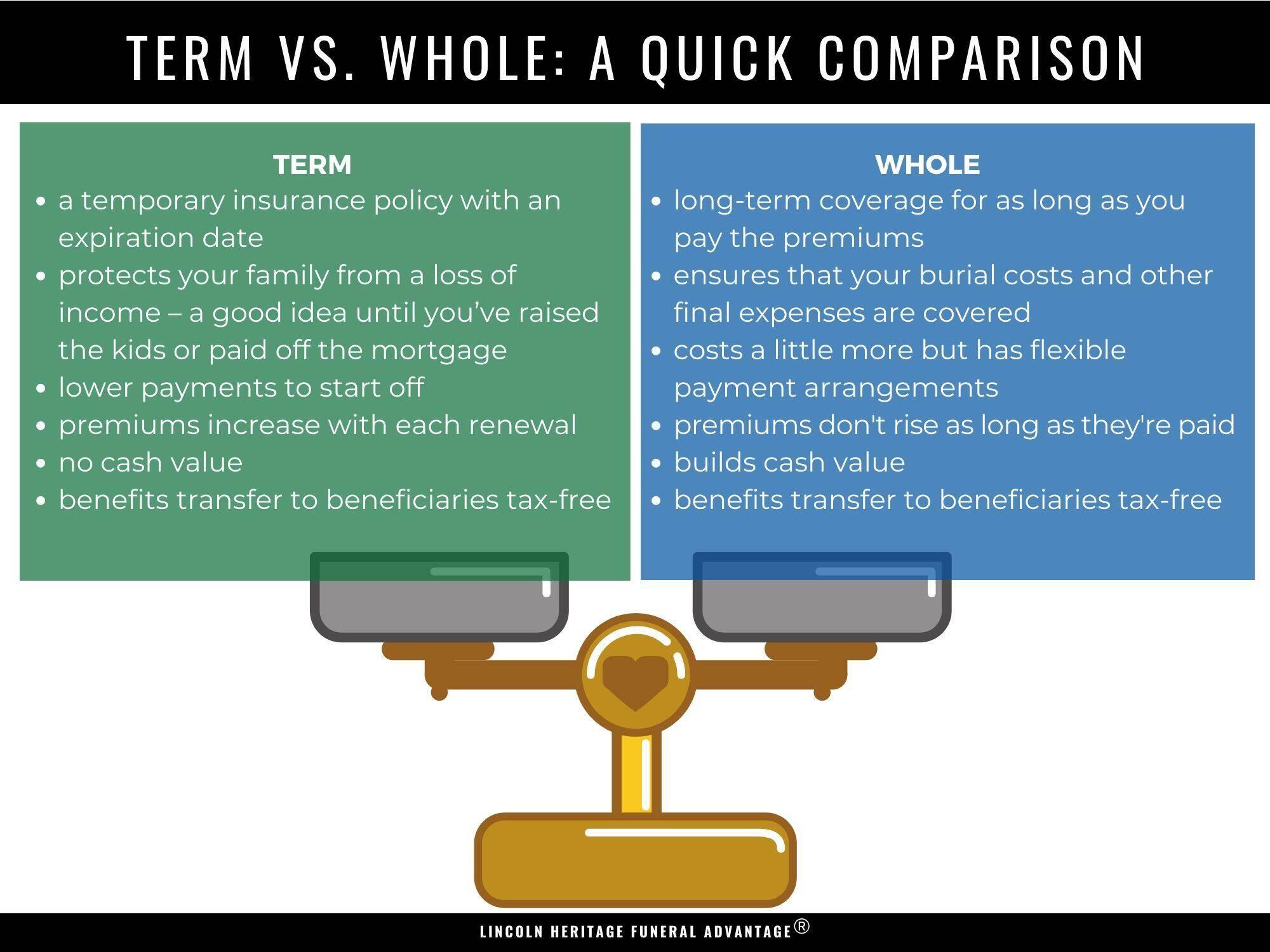

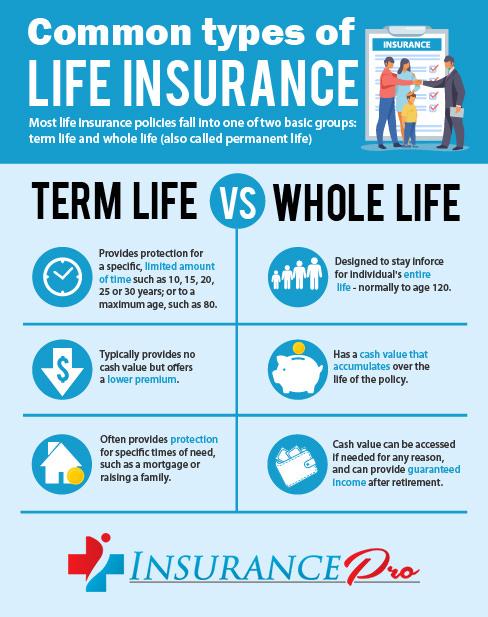

When considering life insurance options, it’s essential to grasp the fundamental differences between term and whole life insurance. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If the insured person passes away during this term, their beneficiaries receive a death benefit. However, if the term expires and the policyholder is still alive, there is no payout, and the coverage ends unless renewed. This option is often more affordable, making it an attractive choice for individuals looking to ensure financial security during critical years, such as raising children or paying off a mortgage.

On the other hand, whole life insurance offers a lifelong coverage guarantee as long as premiums are paid. This type of policy combines a death benefit with a savings component that builds cash value over time. The cash value can be borrowed against or withdrawn, providing added flexibility for the policyholder. While whole life policies typically have higher premiums compared to term policies, they offer the benefit of stability and the potential for growth, which can be particularly appealing for those looking to develop long-term financial strategies.

Key Differences Between Term and Whole Life Policies

When considering life insurance, it’s essential to grasp the fundamental distinctions between term and whole life policies. Term life insurance provides coverage for a specific duration, typically ranging from 5 to 30 years, making it a more affordable option for many. This type of policy pays out a death benefit only if the insured passes away within the coverage period, ensuring protection during critical life stages such as raising children or paying off a mortgage. However, once the term expires, policyholders may find themselves without coverage and may need to purchase a new policy at a potentially higher rate due to aging or changes in health.

In contrast, whole life insurance offers lifelong coverage, as long as premiums are paid. This type of policy builds cash value over time, providing an investment component that can be borrowed against or withdrawn. Here are some key features of each type of policy that highlight their differences:

| Feature | Term Life | Whole Life |

|---|---|---|

| Coverage Duration | Temporary (5-30 years) | Lifelong |

| Premiums | Lower initial premiums | Higher, fixed premiums |

| Cash Value | No cash value (pure insurance) |

Builds cash value over time |

| Flexibility | Less flexible (no changes after issue) |

More flexible (policy loans, dividends) |

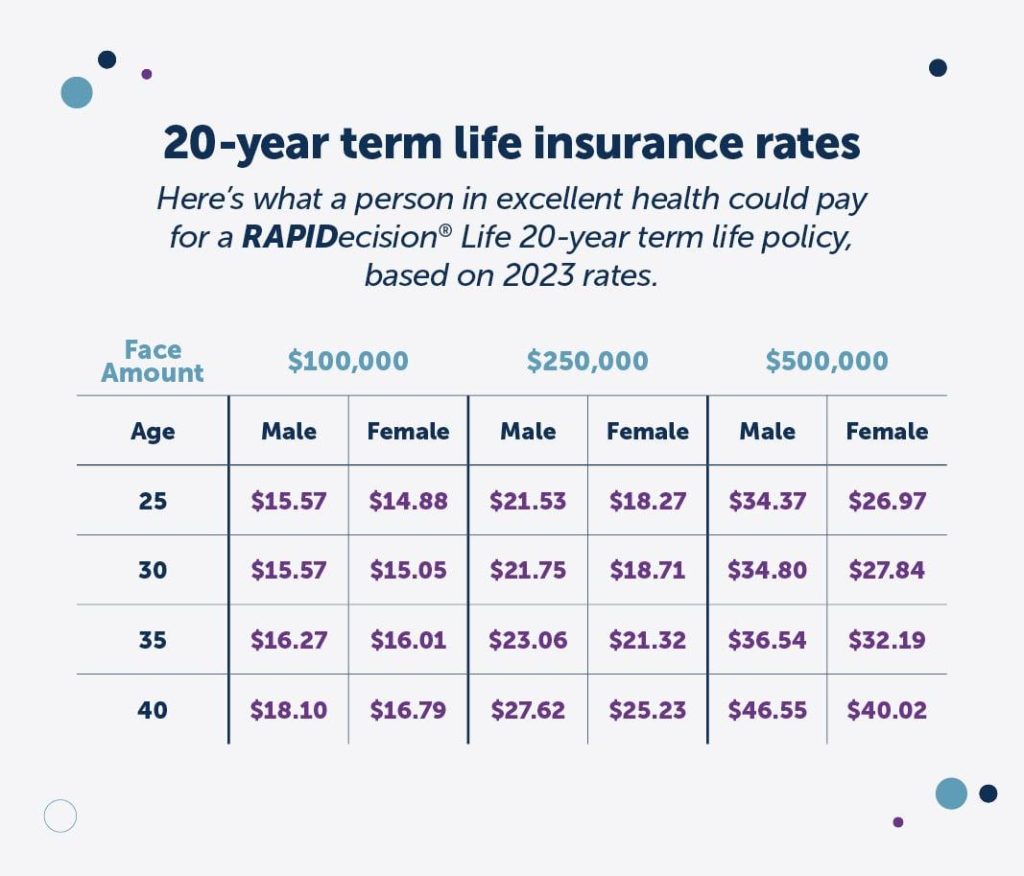

Cost Considerations: Which Insurance Option Fits Your Budget

When evaluating options for life insurance, understanding your budget is crucial. Term life insurance generally offers lower premiums compared to whole life insurance, making it a more accessible choice for those with tight financial constraints. With term policies, you pay for coverage over a specific period, often resulting in significant savings without sacrificing essential protection. Aspects to consider include:

- Length of coverage: Choose a term that aligns with your financial responsibilities.

- Premium affordability: Assess your current and future financial abilities.

- Renewal options: Be mindful of potential cost increases when renewing after the term ends.

On the other hand, whole life insurance provides lifelong coverage with additional investment benefits, which translates into higher initial premiums. This policy accumulates cash value over time, offering a potential financial resource for the policyholder. Important elements to consider include:

- Investment component: Cash value can grow tax-deferred, adding financial flexibility.

- Stable premiums: Premiums remain consistent, making long-term budgeting easier.

- Lifelong coverage: Ensures financial support for beneficiaries regardless of when you pass away.

| Factor | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Premiums | Lower initial cost | Higher initial cost |

| Coverage Duration | Specific term (e.g., 10, 20 years) | Lifelong coverage |

| Cash Value | No cash value | Accumulates cash value |

| Renewability | May require reapplication | Guaranteed for life |

Choosing the Right Coverage for Your Financial Goals

When considering life insurance options, aligning your choice with your financial goals is essential. Term life insurance offers coverage for a specified period—typically 10, 20, or 30 years. It is an excellent option for those looking for affordable premiums while ensuring financial protection during critical life stages, such as raising children or paying off a mortgage. Conversely, whole life insurance provides lifelong coverage, accumulating cash value over time, making it suitable for individuals seeking long-term security and a potential source of savings or investment.

To determine which policy best suits your needs, reflect on your financial priorities. Here are some factors to consider:

- Budget: How much can you allocate to premiums?

- Duration of Coverage: Do you need insurance for a limited time or for your entire life?

- Investment Growth: Are you looking to build cash value alongside your coverage?

Here’s a simple comparison of the two types:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10-30 years) | Lifelong coverage |

| Premiums | Lower, fixed for the term | Higher, fixed for life |

| Cash Value | No cash value | Accumulates cash value |

| Flexibility | Less flexible | Potentially versatile with loans |

Wrapping Up

choosing between term and whole life insurance ultimately comes down to your individual needs, financial goals, and personal circumstances. Term life insurance offers affordability and flexibility for those who need coverage for a specific period, while whole life insurance provides lifelong protection and a savings component that can be beneficial in the long run.

Before making a decision, consider evaluating your financial situation, long-term goals, and family needs. It’s also advisable to consult with a financial advisor or insurance professional who can help tailor a plan that best suits you.

Remember, the right choice for you today may change as your life evolves, so it’s important to regularly reassess your insurance needs. By being informed and proactive, you can ensure that your loved ones are protected and that your financial future is on solid ground. Thank you for reading, and we hope this article has provided you with the insights you need to make an informed decision about your life insurance options.