In today’s unpredictable world, safeguarding our financial future is more important than ever. One of the key components of this security is disability insurance, a critical yet often overlooked element of personal finance. While we tend to focus on health insurance and retirement savings, the reality is that a sudden illness or injury could drastically impact our ability to earn an income. Disability insurance acts as a financial safety net, providing support during times when we may be unable to work. In this article, we’ll delve into the essential benefits of disability insurance, exploring how it works, who needs it, and why incorporating it into your financial planning is a wise decision. Whether you’re just starting your career or looking to reassess your current coverage, understanding these benefits can help you make informed choices for you and your loved ones.

Table of Contents

- Understanding Different Types of Disability Insurance and Their Coverage

- Evaluating the Importance of Disability Insurance for Financial Security

- How to Choose the Right Disability Insurance Policy for Your Needs

- Common Misconceptions About Disability Insurance Explained

- In Conclusion

Understanding Different Types of Disability Insurance and Their Coverage

Disability insurance is a crucial financial safety net, and understanding the various types can help you select the coverage best suited for your needs. Here are the main types:

- Short-term Disability Insurance: This provides coverage for a limited period, typically up to six months, joining the ranks of maternity leave or recovery from surgery.

- Long-term Disability Insurance: This offers extended coverage, often lasting several years or until retirement, designed for more serious, prolonged conditions.

- Employer-Sponsored Disability Insurance: Many companies provide disability coverage as part of their employee benefits package, offering peace of mind and often with lower premiums.

- Individual Disability Insurance: Purchased independently, this type of policy allows for customization to fit personal needs and circumstances.

When choosing a disability insurance plan, considering the variations in coverage and payout options is essential. Here’s a simplified table outlining key aspects:

| Type of Insurance | Coverage Period | Payout Percentage |

|---|---|---|

| Short-term | Up to 6 months | 60-70% |

| Long-term | Several years or until retirement | 50-80% |

| Employer-Sponsored | Varies by employer | Typically 60% |

| Individual | Customizable | Varies based on policy |

Evaluating the different options ensures that you can secure the financial wellbeing you need during challenging times. With the right knowledge, you can make informed decisions that will protect you and your family from potential income loss.

Evaluating the Importance of Disability Insurance for Financial Security

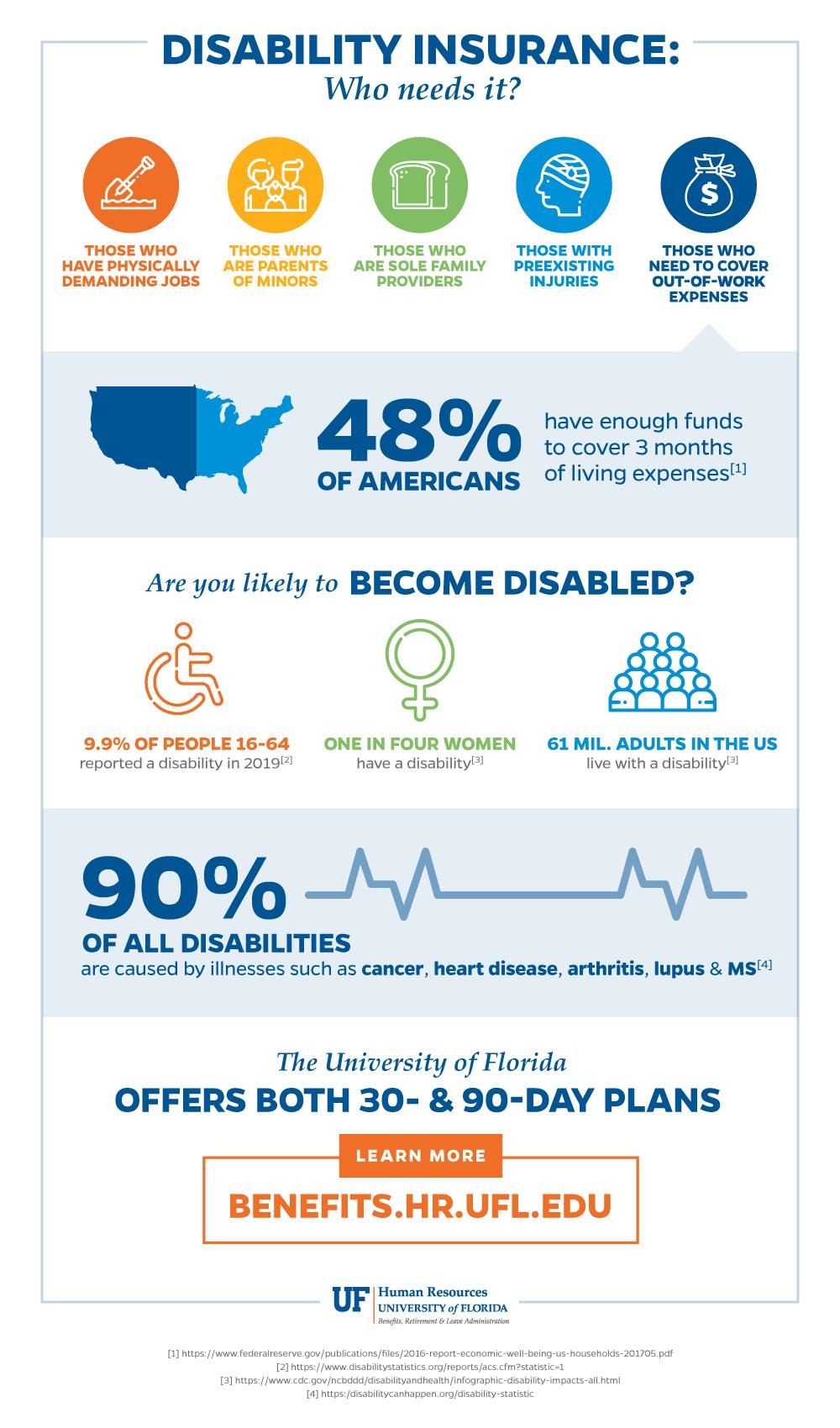

Disability insurance serves as a crucial safety net for individuals, offering financial stability in the event that a sudden illness or injury prevents them from working. Without this coverage, the sudden loss of income can lead to significant financial strain, affecting not only the individual but also their family. Key reasons to consider disability insurance include:

- Income Replacement: Provides a portion of lost wages to help cover essential living expenses.

- Long-Term Security: Offers peace of mind knowing that support is available for an extended period of disability.

- Protection Against Unexpected Events: Safeguards against unforeseen circumstances like accidents or serious health issues.

To further understand the benefits, examining statistical data reveals the prevalence of disabilities among working adults. A significant portion of the workforce may experience a disability at some point, making it essential to prepare financially. The following table shows the likelihood of disability by age:

| Age Range | Likelihood of Disability |

|---|---|

| 18-34 | 1 in 10 |

| 35-49 | 1 in 6 |

| 50-64 | 1 in 4 |

| 65+ | More than 1 in 2 |

This data underscores the importance of considering disability insurance as an integral part of a comprehensive financial plan. Ignoring the possibility of a health crisis can result in considerable financial hardship, emphasizing the need for protection in today’s uncertain world.

How to Choose the Right Disability Insurance Policy for Your Needs

Choosing the right disability insurance policy requires a thoughtful assessment of your personal and financial circumstances. Start by evaluating your current income, expenses, and any existing savings. Key factors to consider include the following:

- Coverage Amount: Ensure the policy provides sufficient income replacement.

- Benefit Period: Choose a duration for which you need coverage—short-term or long-term.

- Elimination Period: Identify how long you can wait before benefits begin and select a timeframe that suits you.

- Policy Definition of Disability: Understand how the policy defines disability, as variations can affect your benefits.

Next, it’s essential to compare different policies to find the best fit. Look for reputable insurers that offer flexible options that address your needs. Take note of the policy exclusions and ensure you comprehend the terms fully. To help simplify your comparison process, consider using the following table for reference on major policy features:

| Feature | Policy A | Policy B | Policy C |

|---|---|---|---|

| Coverage Amount | $3,000/month | $4,000/month | $5,000/month |

| Benefit Period | 5 years | 10 years | Until age 65 |

| Elimination Period | 30 days | 60 days | 90 days |

| Definition of Disability | Any Occupation | Own Occupation | Any Occupation |

Common Misconceptions About Disability Insurance Explained

Many individuals often harbor misconceptions about disability insurance, which can lead to poor financial decisions and inadequate planning for unexpected events. One of the most common misunderstandings is that disability insurance is only applicable to those with physical ailments. In reality, there are various conditions, including mental health issues, which can impede a person’s ability to work. It’s essential to recognize that disability insurance is designed to provide support regardless of the nature of the disability, as long as it significantly affects one’s capacity to earn an income.

Another prevalent myth is that all disability insurance policies offer the same level of coverage. In fact, policies can vary widely, with differences in terms of benefit duration, waiting periods, and coverage limits. It’s crucial to thoroughly research and understand the specific terms of a policy before purchasing it. Here’s a simple comparison of two common types of disability insurance:

| Type of Policy | Benefit Duration | Elimination Period |

|---|---|---|

| Short-Term Disability | Up to 6 months | 1 week to 2 weeks |

| Long-Term Disability | 2 years to Age 65 | 30 days to 6 months |

In Conclusion

understanding the essential benefits of disability insurance is crucial for anyone looking to secure their financial future in the face of unforeseen circumstances. While no one likes to think about the possibility of becoming disabled, being proactive in planning for such situations can provide peace of mind and financial stability. Disability insurance serves as a safety net, ensuring that you can maintain your standard of living and cover essential expenses even when you’re unable to work.

As you consider your options, take the time to evaluate your personal circumstances, and think about the level of coverage that aligns with your needs. Consulting with a financial advisor can also provide valuable insights tailored to your situation. By investing in disability insurance, you’re not just protecting your income—you’re safeguarding your lifestyle and well-being. Remember, it’s always better to be prepared than to face the unexpected unprotected. Thank you for reading, and we hope this article has helped clarify the importance of disability insurance in your financial planning.