Navigating the world of insurance for the first time can be a daunting experience. With a myriad of options, complex terminology, and varying levels of coverage, it’s easy to feel overwhelmed. Whether you’re looking for health, auto, home, or life insurance, making informed decisions is crucial to protecting yourself and your assets. This article aims to guide first-time insurance buyers through the essential steps needed to understand their options, evaluate their needs, and ultimately make confident choices. From demystifying common insurance terms to highlighting key factors to consider during your search, we’ve compiled a list of tips to help you succeed in securing the right coverage for your unique situation. Let’s dive in!

Table of Contents

- Understanding Your Insurance Needs and Options

- Researching Policies and Providers for Smart Choices

- Deciphering the Fine Print: Key Terms and Conditions

- Budgeting for Insurance: Finding the Right Coverage at the Right Price

- Wrapping Up

Understanding Your Insurance Needs and Options

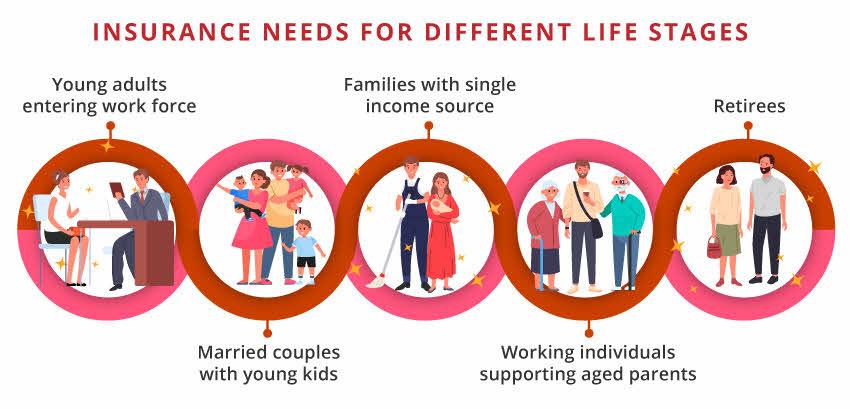

When navigating the world of insurance for the first time, it is essential to assess and understand your specific needs. Start by evaluating your personal circumstances, such as your income, family size, and lifestyle. Consider the following aspects:

- Type of Coverage: Determine whether you need health, auto, home, or life insurance.

- Financial Obligations: Analyze your debts and liabilities to understand the level of coverage required.

- Future Goals: Think about long-term goals, like purchasing a home or saving for retirement, which may influence your insurance choices.

Once you have a clear picture of your needs, it’s time to explore the various options available. Different providers offer distinct plans, so comparing them is key. Look for:

- Premium Costs: Assess what you can afford and what each provider charges.

- Coverage Limits: Ensure the policy limits align with your needs.

- Customer Service: Research reviews about the insurer’s reputation for handling claims.

Creating a simple comparison table can help in evaluating your options:

| Provider | Premium | Coverage Type |

|---|---|---|

| Provider A | $100/month | Health Insurance |

| Provider B | $80/month | Auto Insurance |

| Provider C | $120/month | Home Insurance |

Researching Policies and Providers for Smart Choices

When diving into the world of insurance, it’s vital to gather information on policies and providers that best fit your needs. Start by exploring various coverage options and understand the differences in plans. Key areas to focus on include:

- Coverage Limits: Understand what is covered and the maximum amounts.

- Premium Costs: Compare monthly premiums to find a balance between coverage and affordability.

- Deductibles: Know how much you’re willing to pay out-of-pocket before the insurance kicks in.

- Exclusions: Be aware of what is not covered under each policy.

- Claim Process: Investigate how easy it is to file a claim and how long it typically takes.

Once you have identified potential policies, the next step is to evaluate providers. Consider these factors when researching insurance companies:

- Financial Stability: Check ratings from independent rating agencies to assess their reliability.

- Customer Service: Look for reviews and testimonials from current and former clients.

- Availability of Local Agents: Determine if there’s support available in your area.

- Discount Offerings: Find out if they provide discounts for bundling or safe driving.

| Provider | Financial Rating | Customer Service Rating |

|---|---|---|

| Provider A | AA | 4.5/5 |

| Provider B | A+ | 4/5 |

| Provider C | A | 4.8/5 |

Deciphering the Fine Print: Key Terms and Conditions

When diving into the world of insurance, the fine print can often be overwhelming, yet it’s where the most crucial information lies. Familiarize yourself with key terminology to empower your decision-making. Here are some important terms to look out for:

- Premium: The amount you pay for your insurance policy, typically on a monthly or annual basis.

- Deductible: The sum you must pay out-of-pocket before the insurer covers the remaining costs.

- Exclusions: Specific conditions or circumstances that are not covered by your policy.

- Limit of Liability: The maximum amount an insurer will pay for a covered loss.

Understanding these terms is essential to avoid unexpected surprises down the line. Additionally, consider creating a comparison table to evaluate different policy features side by side. It can simplify the decision-making process:

| Feature | Policy A | Policy B | Policy C |

|---|---|---|---|

| Premium | $500/year | $600/year | $550/year |

| Deductible | $1,000 | $500 | $750 |

| Exclusions | Flood Damage | Natural Disasters | None |

| Limit of Liability | $100,000 | $200,000 | $150,000 |

Using this information and comparative analysis allows you to make informed choices that fit your needs and financial situation. Taking the time to decode these details will set you on the right path toward securing the best insurance coverage for your future.

Budgeting for Insurance: Finding the Right Coverage at the Right Price

When it comes to securing the right insurance, understanding your budget and coverage options is paramount. Begin by assessing your needs; consider the types of coverage essential for your situation, whether it’s health, auto, or home insurance. Take into account factors such as:

- Your lifestyle and activities: Are you an avid traveler, or do you own valuable items?

- Your financial situation: What can you comfortably afford in terms of premium payments?

- Your risk exposure: How much risk are you willing to assume before needing insurance assistance?

Once you have a clear picture of your needs and financial constraints, it’s time to shop around for the best rates. Use comparison tools to see how different providers stack up against each other. Don’t hesitate to ask for discounts based on various criteria like safe driving records or bundling multiple policies. A structured approach helps identify the best value:

| Provider | Monthly Premium | Coverage Limits | Discounts Available |

|---|---|---|---|

| Insurance Co. A | $100 | $500,000 | 10% for bundling |

| Insurance Co. B | $85 | $300,000 | 5% for safe driver |

| Insurance Co. C | $95 | $400,000 | 15% for annual payment |

Wrapping Up

In closing, navigating the world of insurance for the first time can feel overwhelming, but with the right knowledge and preparation, you can make confident choices that protect your future. Remember to thoroughly assess your needs, research different options, and never hesitate to ask questions. Each step you take not only enhances your understanding but also empowers you to make informed decisions that align with your financial goals. As you embark on this journey, keep these essential tips in mind, and you’re sure to set a solid foundation for your insurance needs. Thank you for reading, and here’s to your success as a savvy first-time insurance buyer!