Title:

Introduction:

Navigating the world of insurance can often feel overwhelming, with an array of policies, terms, and regulations to consider. Whether you’re shopping for health insurance, auto coverage, or homeowners’ protection, making informed decisions is crucial to ensuring you have the right protection for your needs. However, even the most diligent consumers can fall prey to common pitfalls that may leave them underinsured or paying more than necessary. In this article, we’ll highlight some of the top insurance mistakes to avoid, guiding you toward better choices and ultimately helping you secure a more stable financial future. Read on to empower yourself with knowledge and strategies that can save you time, money, and unnecessary headaches.

Table of Contents

- Common Misconceptions About Insurance Coverage

- The Importance of Accurate Information When Comparing Policies

- How to Avoid Underinsuring Your Assets

- Understanding Policy Exclusions and Limitations

- The Conclusion

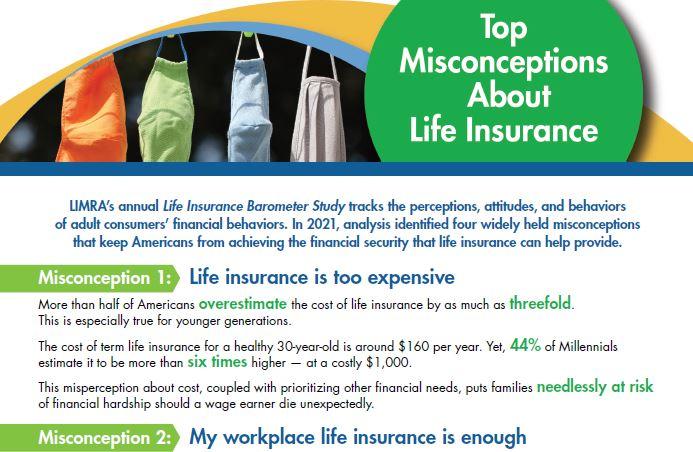

Common Misconceptions About Insurance Coverage

Many individuals tend to underestimate the importance of insurance, assuming that basic coverage will be sufficient for all situations. This misconception can lead to severe financial consequences during unexpected events. A common belief is that <employer-provided insurance> covers all personal needs, which often isn’t the case. It’s essential to evaluate your policies regularly and understand the exclusions and limits associated with them. Not seeking additional coverage where necessary may leave you vulnerable to significant out-of-pocket expenses.

Another prevalent myth is that insurance claims are always paid in full. In reality, the insurer may only cover a portion of your losses, especially if you have not chosen the right policy. Various factors can affect the payout, including deductibles, policy limits, and the specifics of the claim. To navigate this landscape effectively, consider the following points:

- Review your policy annually for changes in coverage.

- Consult your agent if you’re unsure about your coverage limits.

- Understand common exclusions in your insurance policy.

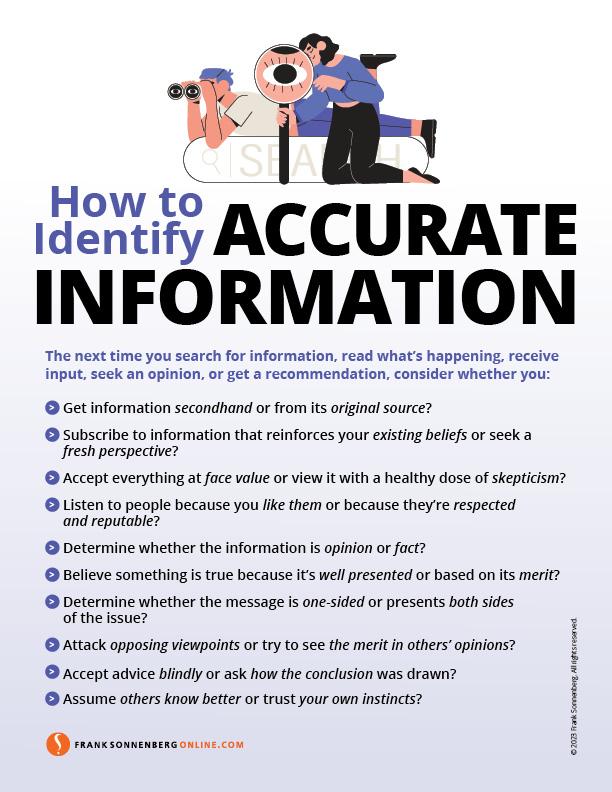

The Importance of Accurate Information When Comparing Policies

When it comes to comparing insurance policies, the accuracy of the information you use is crucial. Misunderstanding a coverage term or misreading a limit can lead to choosing a policy that either inadequately protects you or overcharges you for unnecessary coverage. In many cases, consumers may rely on generalized information or anecdotal experiences rather than factual details provided by the insurance companies. As a result, it’s essential to examine several key factors meticulously to make informed decisions:

- Coverage Limits – Ensure you understand the maximum amount your policy will pay out.

- Exclusions – Identify what accidents, events, or circumstances are not covered.

- Deductibles – Clarify the amount you’ll need to pay out-of-pocket before coverage kicks in.

- Premiums – Verify the costs involved to understand what you’ll be paying over time.

Moreover, utilizing tools such as comparison charts can streamline the process by offering clear, side-by-side views of different policy offerings. This can reveal significant disparities in coverage options and costs among various providers. Below is an example of how such a comparison might look:

| Policy Type | Coverage Limit | Premium | Deductible |

|---|---|---|---|

| Basic Plan | $100,000 | $75/month | $1,000 |

| Comprehensive Plan | $250,000 | $120/month | $500 |

| Premium Plan | $500,000 | $200/month | $250 |

How to Avoid Underinsuring Your Assets

Many individuals underestimate the value of their assets, which can lead to significant financial loss in the event of an incident. To prevent underinsurance, start by conducting a thorough inventory of all your possessions, from your home and personal belongings to business assets if you’re a business owner. Make sure to include the following items:

- Your home and its structural components

- Personal items such as electronics, jewelry, and art

- Business equipment and inventory

- Vehicles including cars, motorcycles, and specialty vehicles

Next, it’s vital to regularly update your coverage as the value of assets changes over time. A growing family or new purchases can increase your asset base significantly. Consider creating a schedule for reviewing your insurance policies—annually is a good standard. Additionally, consult with your insurance agent to ensure you’re utilizing appropriate coverage options such as:

| Coverage Type | Description |

|---|---|

| Replacement Cost Coverage | Covers the cost of replacing an item regardless of its current value. |

| Actual Cash Value | Pays out based on the item’s current value after depreciation. |

| Scheduled Personal Property | Provides extra coverage for high-value items. |

Understanding Policy Exclusions and Limitations

One of the most important aspects of understanding your insurance policy is recognizing the exclusions and limitations that may not be immediately obvious. Exclusions are specific conditions or circumstances under which your policy will not provide coverage. Being unaware of these can leave you vulnerable in case of a claim. Common exclusions might include:

- Pre-existing conditions: Issues that existed before the policy took effect may not be covered, especially in health insurance.

- Natural disasters: Policies may exclude damages from earthquakes or floods unless specifically added.

- Negligence: Acts that result from reckless behavior or failure to maintain safety standards can be excluded from coverage.

Similarly, limitations define the extent of coverage you can expect to receive. A limitation might refer to the maximum payout you could receive for a claim or specific caps on certain types of damages. Knowing these limitations can prevent nasty surprises when it’s time to file a claim. For example, some policies may include:

- Coverage limits: A fixed dollar amount that the insurer will pay for specific claims.

- Deductibles: The amount you need to pay out of pocket before coverage kicks in can dramatically affect your final payout.

- Time limits: Restrictions on when you can file a claim after an incident occurs.

The Conclusion

navigating the world of insurance can be complex, but avoiding these common mistakes can save you time, money, and stress. By staying informed and being proactive about your coverage, you can ensure that you’re adequately protected against unforeseen circumstances. Remember, it’s always beneficial to review your policies regularly and consult with a knowledgeable insurance professional if you’re unsure about any aspect of your coverage. By taking these steps, you can make confident decisions that contribute to your financial well-being. Thank you for reading, and may your insurance journey be smooth and fulfilling!