Life insurance is often perceived as a safety net for our loved ones in times of need, but it also provides a lesser-known financial advantage: tax benefits. Many individuals overlook the potential of life insurance policies as a strategic tool in their financial planning arsenal. From tax-free death benefits to potential deductions and cash value growth, understanding how these policies can lead to significant tax advantages is essential for anyone looking to maximize their financial future. In this article, we will explore various aspects of life insurance and uncover the tax benefits that can help you unlock greater financial security for both your beneficiaries and yourself. Whether you’re a seasoned investor or someone simply exploring your options, this guide aims to provide clarity on how life insurance can be a valuable component of your overall financial strategy.

Table of Contents

- Understanding the Tax Advantages of Life Insurance Policies

- How Tax Deferred Growth Can Benefit Your Financial Strategy

- Exploring Tax-Free Death Benefits and Their Impact on Estate Planning

- Maximizing Your Policy: Tips for Leveraging Tax Benefits Effectively

- Wrapping Up

Understanding the Tax Advantages of Life Insurance Policies

Life insurance policies offer unique tax advantages that can make them an attractive option for both individuals and families seeking financial security. One of the primary benefits is that the death benefit paid to beneficiaries is typically income tax-free. This means that when a policyholder passes away, their loved ones receive a financial windfall without the burden of taxes, allowing for greater peace of mind in difficult times. Additionally, if the policy builds cash value, that growth is also considered tax-deferred. Policyholders can access this cash value through loans or withdrawals without incurring immediate tax liabilities, as long as certain conditions are met.

Furthermore, life insurance can serve as an effective estate planning tool. The payout can cover estate taxes, ensuring that your heirs won’t have to sell assets to meet these obligations. By structuring your policy correctly, you can further enhance these tax benefits. Consider the following strategies when planning your life insurance policy:

- Ownership Structure: Placing the policy in an irrevocable life insurance trust (ILIT) can help keep it out of your taxable estate.

- Charitable Beneficiary: Naming a charity as a beneficiary can provide income-tax deductions.

- Policy Loans: Utilizing loans against the cash value instead of withdrawing it can help maintain its tax-deferred status.

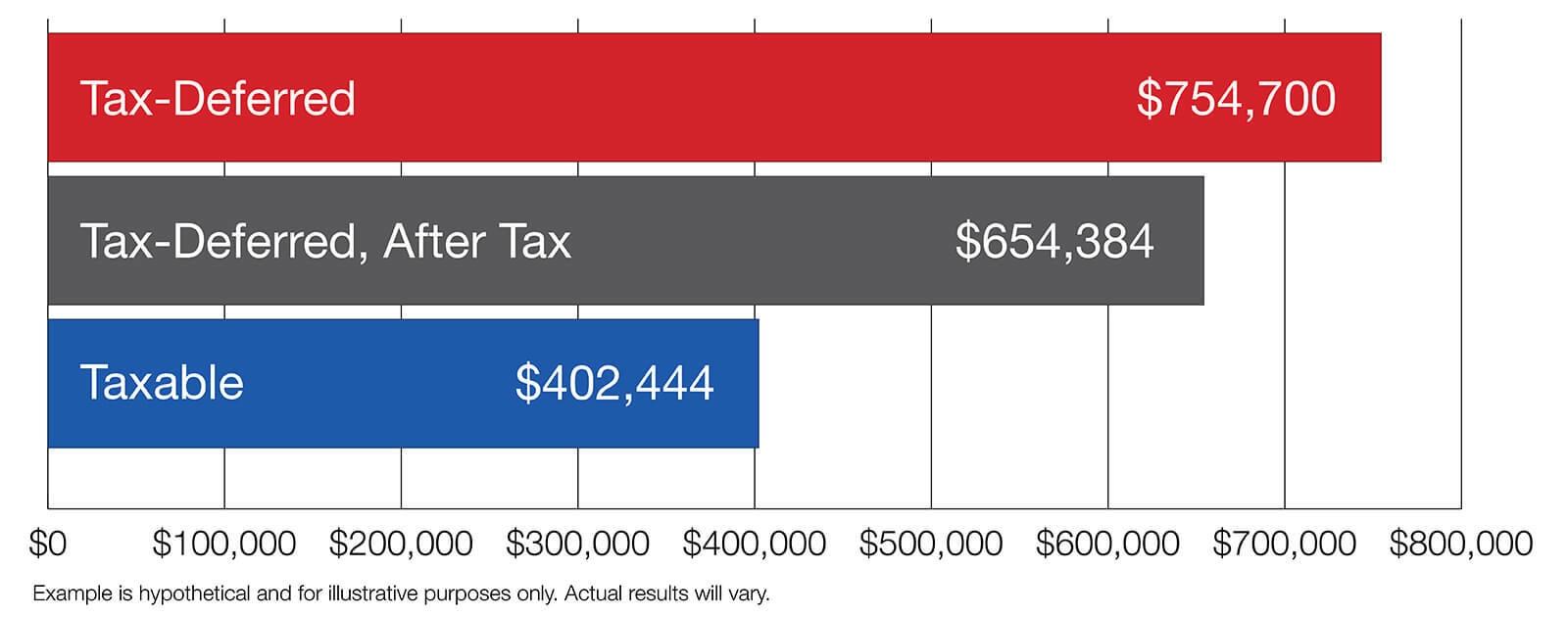

How Tax Deferred Growth Can Benefit Your Financial Strategy

The concept of tax-deferred growth is a powerful tool that can significantly enhance your financial strategy. By utilizing life insurance policies, policyholders can watch their investments accumulate value without immediate tax liabilities, giving their funds the opportunity to grow more effectively. This allows individuals to leverage their earnings without the ongoing burden of taxation, which can often eat into investment returns. With a structured approach, the cash value of the life insurance can be used for various financial needs, providing liquidity while maintaining the integrity of the investment.

Some key advantages of harnessing tax-deferred growth through life insurance include:

- Compound Growth: Earnings are reinvested tax-free, leading to exponential growth over time.

- Flexible Access: Policyholders can borrow against the cash value, providing funds for emergencies or investments.

- Legacy Planning: Death benefits remain tax-free for beneficiaries, ensuring that wealth is transferred effectively.

Consider the following comparison of traditional taxable investments versus a life insurance policy with tax-deferred growth:

| Feature | Taxable Investment | Life Insurance Policy |

|---|---|---|

| Tax on Earnings | Applicable annually | Deferred until withdrawal |

| Access to Funds | May incur penalties | Tax-free loans available |

| Tax upon Death | Subject to estate tax | Paid out tax-free |

Exploring Tax-Free Death Benefits and Their Impact on Estate Planning

When it comes to estate planning, understanding the nuances of tax-free death benefits can significantly influence how you structure your assets and protection for loved ones. Life insurance policies provide a unique advantage by offering benefits that are typically exempt from federal income tax for the beneficiaries. This means that upon the policyholder’s death, the lump sum received by beneficiaries can be used without the burden of taxation, ensuring that the intended financial support or legacy is fully realized. Key benefits of incorporating tax-free death benefits into your estate plan include:

- Preservation of Family Wealth: Allows for seamless transfer of assets without tax consequences.

- Supplementing Retirement Plans: Provides added security for dependents while maintaining tax advantages.

- Covering Estate Taxes: Can be used to pay estate taxes, ensuring more of the estate goes to heirs.

Furthermore, it’s crucial to consider how the beneficiary designations and ownership structures of policies can affect overall estate tax liability. By strategically naming beneficiaries and possibly placing life insurance in an irrevocable life insurance trust (ILIT), you can further shield the cash value and death benefit from estate taxes. This proactive measure not only enhances the protection of your assets but also provides an organized method for wealth distribution. Effective strategies for utilizing life insurance in estate planning include:

| Strategy | Benefits |

|---|---|

| Naming an Irrevocable Trust as Beneficiary | Removes death benefits from taxable estate |

| Annual Gift Exclusion Contributions | Helps to reduce overall estate size |

| Policy Loans for Cash Flow | Utilize cash value while preserving benefits |

Maximizing Your Policy: Tips for Leveraging Tax Benefits Effectively

Understanding how to optimize your life insurance policy for tax benefits requires a proactive approach. One effective strategy is to borrow against your policy’s cash value. This allows you to access funds without triggering a taxable event, as long as the policy remains in force. Additionally, consider designating your heirs as beneficiaries directly to ensure that the death benefit is paid out tax-free. This strategic planning can significantly enhance the financial legacy you leave behind.

Moreover, it’s essential to stay informed about the different types of life insurance policies available, each providing unique tax advantages. For instance, permanent life insurance policies typically come with a cash value component that grows tax-deferred, while term policies may offer less flexibility. To illustrate the benefits, here’s a simple comparison of policy types concerning tax implications:

| Policy Type | Taxation on Cash Value | Death Benefit Taxation |

|---|---|---|

| Term Life Insurance | N/A | Tax-Free |

| Whole Life Insurance | Tax-Deferred | Tax-Free |

| Universal Life Insurance | Tax-Deferred | Tax-Free |

Utilizing these strategies effectively will not only help you maximize your life insurance policy’s benefits but also contribute to greater financial stability for you and your beneficiaries.

Wrapping Up

understanding the tax benefits of life insurance policies can significantly enhance your financial planning strategy. By recognizing how these policies can serve as a tax-advantaged asset, you can make informed decisions that align with your long-term goals. Whether you’re considering life insurance for protection, investment, or estate planning purposes, being aware of the potential tax implications can help you maximize your benefits and secure a more stable financial future. As with any financial decision, it’s advisable to consult with a tax professional or financial advisor to tailor your approach to your unique circumstances. By unlocking the tax advantages of life insurance, you’re not just protecting your loved ones; you’re also optimizing your financial legacy. Thank you for reading, and we hope this article has provided valuable insights into enhancing your financial well-being.