When it comes to securing your financial future and protecting your loved ones, choosing the right life insurance policy is a crucial step. Among the most popular options available are term life insurance and whole life insurance, each offering distinct benefits and features tailored to different needs. Whether you’re looking for affordability, flexibility, or lifelong coverage, understanding the key differences between these two types of policies can help you make an informed decision. In this article, we’ll explore the fundamental aspects of term and whole life insurance, highlighting their advantages and disadvantages to assist you in selecting the best option for your unique circumstances. Let’s dive into the details and clarify which policy might be the right fit for you.

Table of Contents

- Understanding Term Life Insurance Benefits

- Exploring Whole Life Insurance Features

- Comparing Cost and Value in Life Insurance Types

- Making an Informed Decision: Which Policy is Right for You

- Future Outlook

Understanding Term Life Insurance Benefits

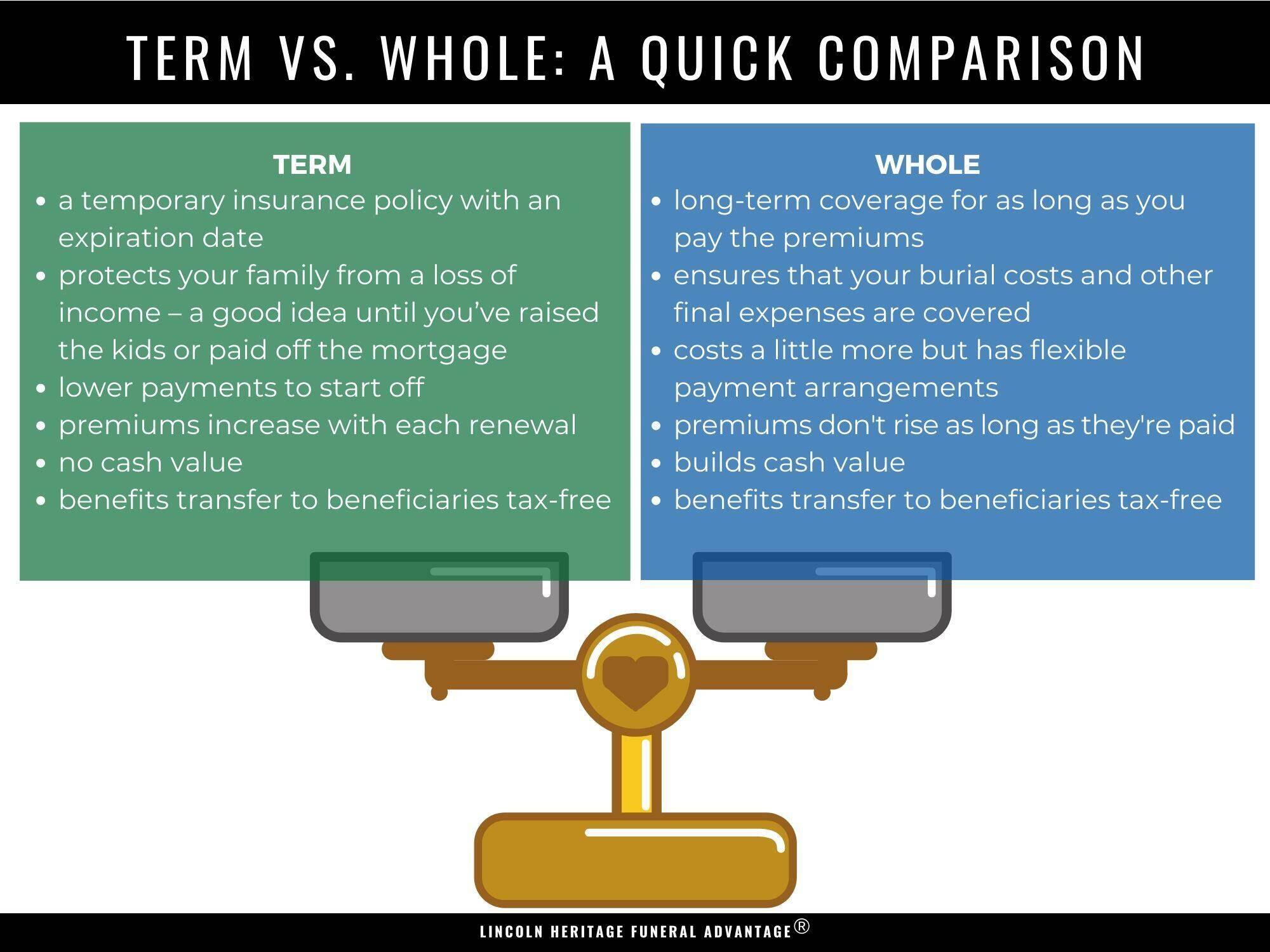

Term life insurance offers a range of benefits that cater to individuals seeking affordable coverage for a specified period. One of the primary advantages is that premiums are generally lower compared to whole life insurance, making it accessible for those who may be budget-conscious. Additionally, term policies can often be converted to whole life insurance without the need for additional medical underwriting, providing flexibility as life circumstances change. This feature is particularly useful for younger individuals who may start with a term policy and later transition to permanent coverage as their financial situation evolves.

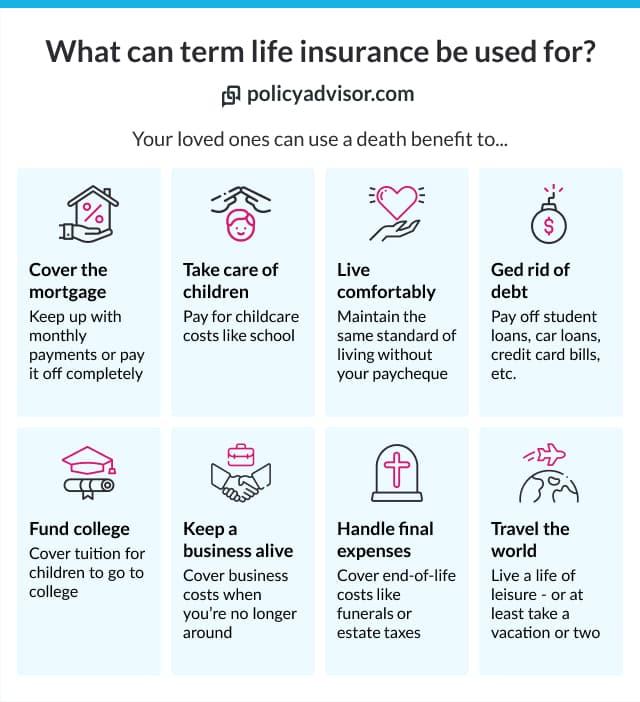

Another significant benefit is that term life insurance provides straightforward protection; you pay a premium for a predetermined coverage amount over a chosen term, typically ranging from 10 to 30 years. If the insured passes away within that term, beneficiaries receive the full coverage amount, which can be essential for covering ongoing expenses and financial obligations. Here are some key benefits to consider:

- Affordability: Lower monthly premiums compared to whole life.

- Flexibility: Options to convert to whole life insurance later.

- Simplicity: Easy to understand terms and coverage details.

- Specific needs: Ideal for temporary needs like mortgage or child education.

Exploring Whole Life Insurance Features

Whole life insurance offers a range of features that distinguish it from term life insurance, primarily through its unique structure and financial benefits. With whole life policies, policyholders are guaranteed lifelong coverage as long as premiums are paid, ensuring that beneficiaries will receive a death benefit regardless of when the insured passes away. Additionally, these policies build cash value over time, thanks to a portion of the premium being allocated to a savings component. This cash value grows on a tax-deferred basis, providing policyholders with the opportunity to borrow against it or even withdraw funds for emergencies or opportunities.

Some key features of whole life insurance include:

- Fixed Premiums: Whole life insurance offers stable premiums that remain constant throughout the policyholder’s life, allowing for better financial planning.

- Guaranteed Death Benefit: Unlike term insurance, whole life offers a guaranteed payout, providing peace of mind to policyholders and their families.

- Cash Value Accumulation: This feature allows policyholders to accumulate savings over time, which can be tapped into during their lifetime.

- Dividends: Some whole life policies are eligible to receive dividends, which can be used to enhance the cash value or purchase additional coverage.

Comparing Cost and Value in Life Insurance Types

When weighing the differences between term and whole life insurance, it’s essential to evaluate both cost and value. Term life insurance typically comes with lower monthly premiums, making it budget-friendly for those seeking temporary coverage. This type of policy provides a death benefit for a specified duration (such as 10, 20, or 30 years) and does not accumulate cash value. This means that while the upfront costs are lower, the policyholder won’t benefit from any investment growth over time. Key points to consider include:

- Affordability: Lower premiums than permanent policies.

- Temporary Coverage: Less suitable for long-term financial planning.

- Risk of Lapse: Coverage ends if the term expires and no renewal is chosen.

Conversely, whole life insurance typically demands higher premiums, but it offers lifelong coverage and builds cash value that grows at a guaranteed rate. This cash value component can serve as a financial asset, providing policyholders with the possibility of borrowing against it or cashing it out. Though the initial costs may seem steep, the long-term value can justify the investment for those who prioritize security and wealth accumulation. Consider these aspects:

- Lifelong Protection: Coverage continues for your entire life.

- Cash Value Component: Accumulates and can be accessed later.

- Stable Premiums: Rates remain fixed throughout the policyholder’s life.

| Aspect | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Length | Fixed term | Lifelong |

| Premiums | Lower | Higher |

| Cash Value | No | Yes |

| Investment Component | No | Yes |

Making an Informed Decision: Which Policy is Right for You

When considering life insurance, understanding the nuances between term and whole life insurance can significantly influence your financial future. Term life insurance typically offers coverage for a specified period, such as 10, 20, or 30 years, and is generally more affordable. It provides a death benefit to your beneficiaries if you pass away within the term period. However, once the term expires, your coverage ceases unless you opt for renewal, often at a higher rate. In contrast, whole life insurance provides lifelong coverage, as long as premiums are paid. Additionally, it accumulates cash value over time, which can be borrowed against or withdrawn, adding an investment aspect to your policy.

To help you compare these options more clearly, consider the following factors:

- Cost: Term life is usually cheaper than whole life, ideal for those on a budget.

- Duration: Term life is temporary, while whole life is permanent.

- Cash Value: Whole life policies build cash value; term does not.

- Flexibility: Term can be adjusted as needed, whereas whole life is more rigid.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term | Lifetime |

| Premiums | Lower initial cost | Higher, level premiums |

| Cash Value | No | Yes, grows over time |

| Renewability | Requires renewal | Automatic coverage |

Future Outlook

understanding the differences between term and whole life insurance is crucial for making an informed decision that aligns with your financial goals and personal needs. While term life insurance offers affordable coverage for a specified period, whole life insurance provides lifelong protection and a cash value component, albeit at a higher cost. Evaluating your unique circumstances—such as your financial responsibilities, budget, and long-term objectives—will help you choose the right policy for you. Remember, the best insurance is the one that fits seamlessly into your overall financial plan, giving you peace of mind for both today and the future. If you have further questions or need assistance, consider speaking to a financial advisor or insurance professional who can provide tailored guidance. Thank you for reading, and we hope this article has illuminated the essential differences between term and whole life insurance for you!