Navigating the world of insurance can be overwhelming, especially for first-time buyers. With a myriad of options and terms that often feel like a foreign language, it’s easy to feel lost in the sea of policies and coverage types. Whether you’re looking to protect your health, your home, your car, or even your loved ones, understanding the fundamentals of insurance is crucial to making informed decisions that best suit your needs. In this article, we’ll explore essential tips to guide you through the process of purchasing insurance for the first time, helping you to demystify the complexities and empowering you to choose the right coverage with confidence. From assessing your needs to comparing policies, we’ve got you covered every step of the way. Let’s dive in!

Table of Contents

- Understanding Your Insurance Needs

- Evaluating Different Types of Insurance Policies

- Comparing Premiums and Coverage Options

- Navigating the Application Process Effectively

- To Wrap It Up

Understanding Your Insurance Needs

Before diving into purchasing insurance, it’s crucial to assess your specific needs. Each individual’s situation is unique, influenced by various factors such as lifestyle, family size, income, and future plans. To get a clearer picture, consider the following aspects:

- Life stage: Are you single, married, or have children? Different life stages often necessitate different coverage types.

- Assets: Evaluate what you own. Home, car, and personal belongings are vital for determining the right levels of coverage.

- Health status: Your current health and any pre-existing conditions play a significant role in your insurance options and costs.

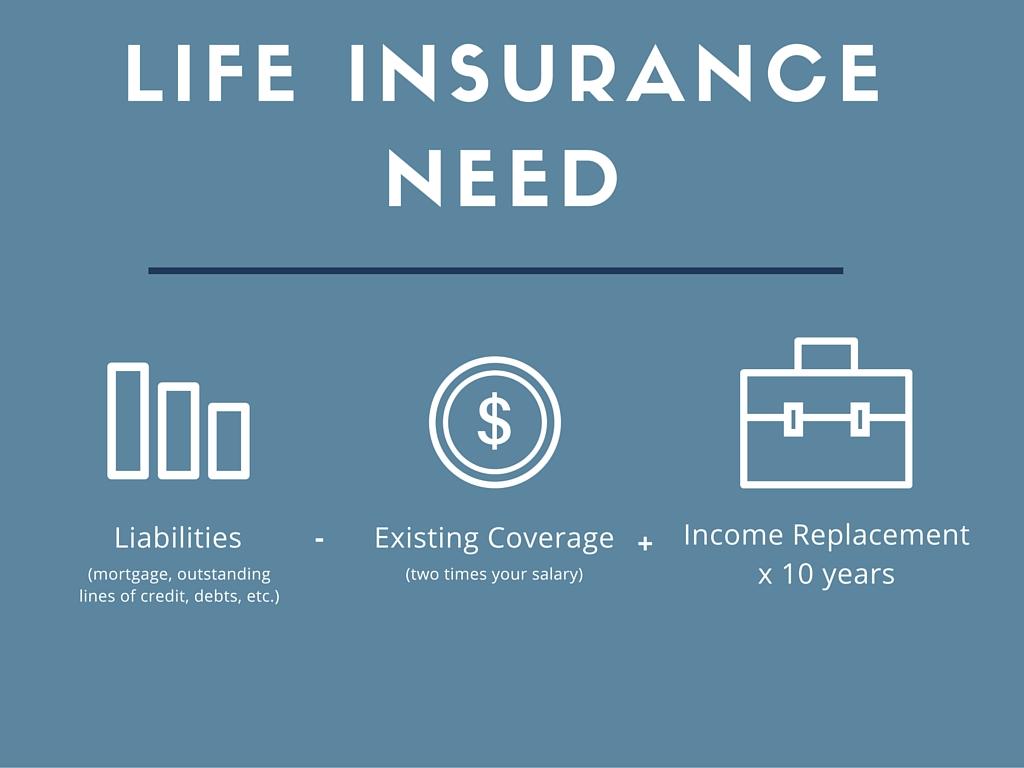

- Financial obligations: Identify any debts or future financial responsibilities, like children’s education or retirement planning.

Once you’ve recognized these critical areas, it’s advisable to create a prioritized list of insurance types relevant to you. This might include:

| Insurance Type | Consideration |

|---|---|

| Health Insurance | Essential for medical expenses and preventive care. |

| Auto Insurance | Required for vehicle protection and liability coverage. |

| Homeowners/Renter’s Insurance | Protects property and belongings, along with liability protection. |

| Life Insurance | Important for financial security of dependents or paying off debts. |

By clearly identifying your personal requirements and the types of insurance that align with your needs, you can make informed decisions that will provide peace of mind as you navigate the complexities of insurance for the first time.

Evaluating Different Types of Insurance Policies

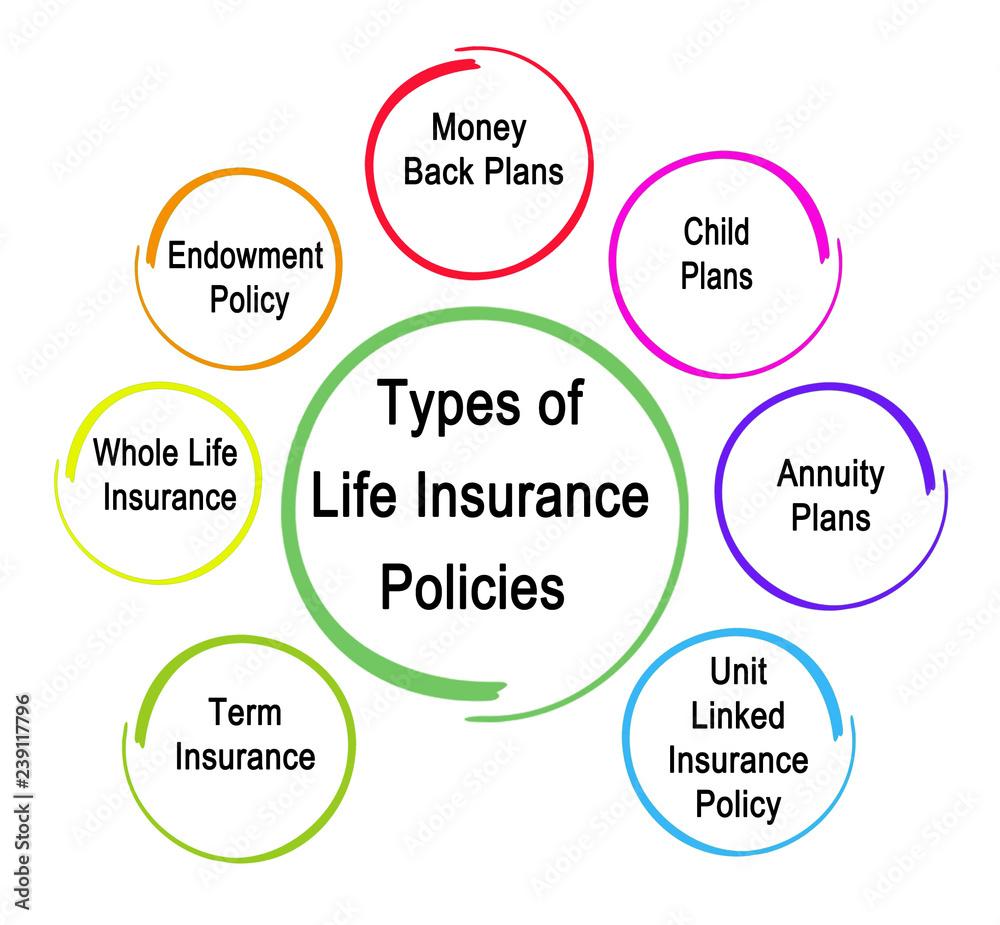

When diving into the world of insurance, it’s crucial to understand the various types of policies available to suit your needs. Each policy comes with distinct features, benefits, and potential drawbacks. Here’s a breakdown of common insurance types to consider:

- Health Insurance: Covers medical expenses and provides access to healthcare services.

- Auto Insurance: Protects against losses related to vehicles, covering damages and personal injuries.

- Homeowners Insurance: Safeguards against damages to your home and personal property.

- Life Insurance: Offers financial support to beneficiaries upon the policyholder’s death.

- Renters Insurance: Protects personal possessions within a rented space from theft or damage.

As you evaluate these options, consider creating a comparison table to weigh your choices effectively. Here’s a simple framework:

| Insurance Type | Coverage | Premium Cost |

|---|---|---|

| Health Insurance | Medical Expenses | Varies by provider |

| Auto Insurance | Vehicle Damage / Liability | Varies by coverage |

| Homeowners Insurance | Home / Property Damage | Based on home value |

| Life Insurance | Death Benefit | Based on age & health |

| Renters Insurance | Personal Property | Generally affordable |

Comparing Premiums and Coverage Options

When purchasing insurance for the first time, it’s crucial to strike a balance between the premiums you pay and the coverage you receive. Understanding the intricacies of both is essential to making an informed decision. Premiums are the amounts you will regularly pay, while coverage options refer to the protection you get in return. To find the right mix, consider the following factors:

- Deductibles: Higher deductibles typically mean lower premiums, but consider whether you can afford to pay these out-of-pocket expenses in an emergency.

- Policy Limits: Assess whether the coverage limits meet your potential needs. Insufficient coverage can leave you vulnerable.

- Exclusions: Be aware of what isn’t covered in your policy, as this can vastly impact your out-of-pocket costs in the event of a claim.

To help clarify the relationship between premiums and coverage, you can compare different options side by side. Below is an example table illustrating how varying premium rates might correspond with different coverage levels. This will aid in visualizing what you get for your investment:

| Provider | Monthly Premium | Coverage Limit | Deductible |

|---|---|---|---|

| Provider A | $100 | $250,000 | $1,000 |

| Provider B | $75 | $200,000 | $2,500 |

| Provider C | $120 | $300,000 | $750 |

As you navigate your choices, remember that the goal is to find a policy that not only keeps your budget in check but also provides you with peace of mind. Comparing quotes from multiple providers can illuminate which plans offer the best value for your specific needs.

Navigating the Application Process Effectively

Embarking on your first insurance journey can feel daunting, but a well-organized approach can significantly ease the process. Start by clearly defining what type of insurance you need, whether it’s health, auto, home, or life insurance. With your needs in mind, gather essential documents such as identification, income verification, and any existing coverage information. This preparation will make discussions with agents or brokers smoother. Consider these key tactics to streamline your application:

- Research Providers: Compare different insurance companies to find the one that best fits your requirements.

- Ask Questions: Don’t hesitate to reach out to agents for clarifications on policy details and coverage options.

- Understand Terminology: Familiarize yourself with common insurance jargon to make informed decisions.

When you’re ready to initiate an application, it’s essential to be honest and precise in your disclosures. Any inaccuracies can lead to issues with your coverage later on. Feel free to request quotes from multiple insurers to gauge price variations and coverage levels. To help you compare, consider using the following table to illustrate the core aspects of your shortlisted policies:

| Insurance Provider | Coverage Type | Monthly Premium | Deductible |

|---|---|---|---|

| Provider A | Health | $250 | $1,500 |

| Provider B | Auto | $150 | $1,000 |

| Provider C | Home | $200 | $2,000 |

To Wrap It Up

navigating the world of insurance for the first time can be overwhelming, but it doesn’t have to be. By arming yourself with essential knowledge and tips, you can make informed decisions that best suit your needs and situation. Remember to assess your coverage requirements, compare various options, and ask questions until you feel confident about your choices. Insurance is not just a policy; it’s a safeguard for your future. So take your time, do your research, and don’t hesitate to seek advice from professionals if needed. As you embark on this journey, keep these tips in mind, and you’ll be well on your way to finding the right coverage that gives you peace of mind. Thank you for reading, and may your insurance-buying experience be a positive one!