Title:

Introduction:

As we age, planning for the future becomes increasingly important, especially when it comes to healthcare needs. Long-term care insurance (LTCI) is a critical component of that planning for many seniors, providing a financial safety net for services like nursing home care, in-home assistance, and adult day programs. Yet, despite its significance, navigating the world of long-term care insurance can be overwhelming. With a variety of policies, terms, and options available, it’s essential to understand how to select the right plan for your unique situation. In this guide, we’ll break down the key aspects of long-term care insurance, helping you make informed decisions that align with your care preferences and financial goals. Whether you’re currently considering a policy or simply looking to expand your understanding of long-term care options, this article will serve as a helpful resource in your journey toward securing peace of mind in your later years.

Table of Contents

- Understanding Long-Term Care Insurance Options for Seniors

- Evaluating the Costs and Benefits of Long-Term Care Insurance

- Tips for Selecting the Right Policy for Your Needs

- Common Myths and Misconceptions About Long-Term Care Insurance

- To Wrap It Up

Understanding Long-Term Care Insurance Options for Seniors

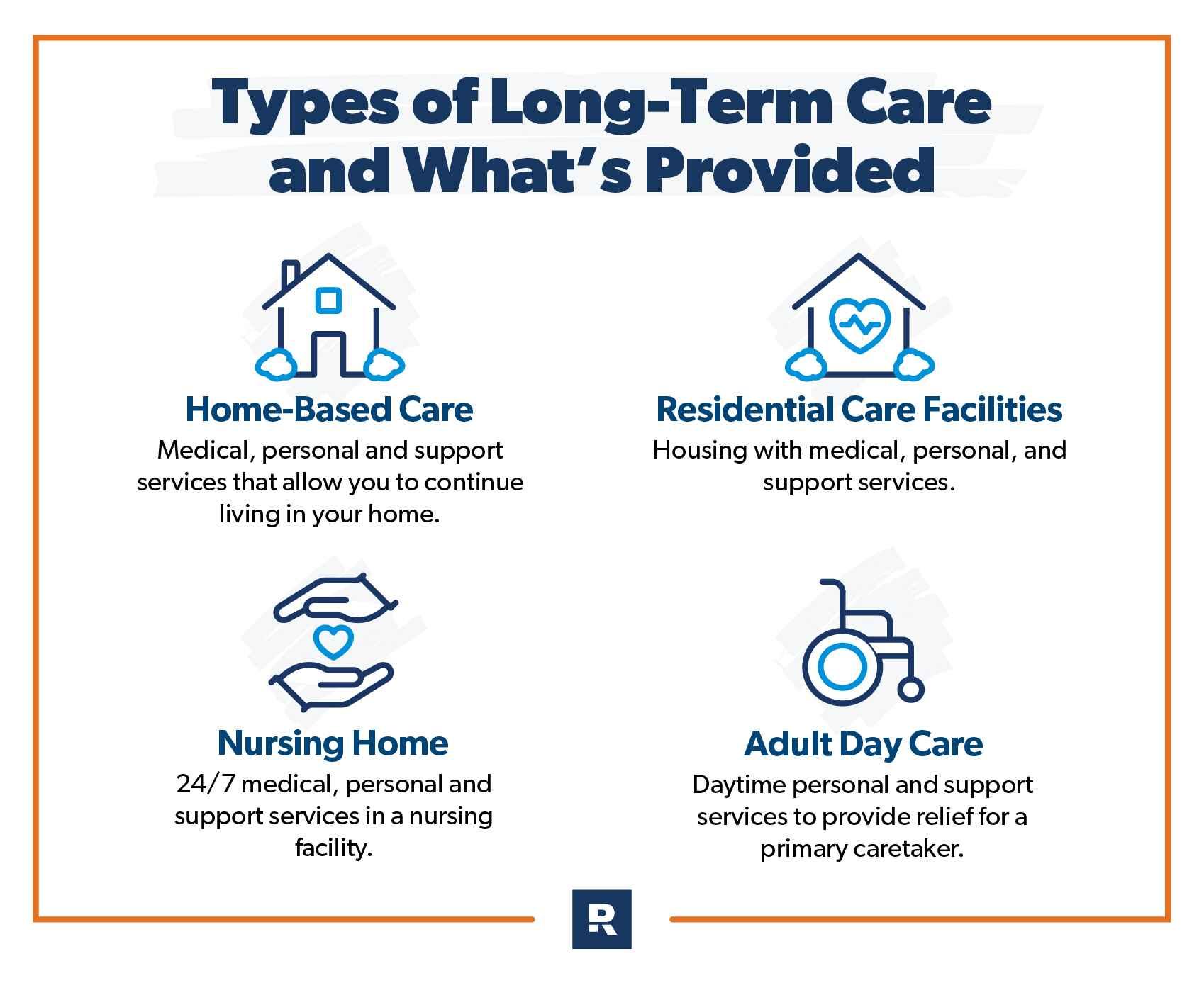

When considering long-term care insurance, it’s crucial for seniors to explore the different types available. Each option has unique features that cater to varying needs and preferences. Common types include:

- Traditional Long-Term Care Insurance: This type offers a range of services, including in-home care and nursing facilities, based on a pre-defined plan.

- Hybrid Policies: Combining life insurance with long-term care benefits, these policies provide financial security for beneficiaries while covering long-term care needs if necessary.

- Short-Term Care Insurance: Designed to cover a limited period of care, this is often ideal for those recovering from surgeries or unexpected health events.

Evaluating these options involves more than just understanding the types; it’s also imperative to assess coverage limits, cost, and eligibility requirements. Here’s a simple table comparing essential features:

| Policy Type | Coverage Duration | Average Cost | Key Benefit |

|---|---|---|---|

| Traditional Long-Term Care | Varies (up to lifetime) | $2,000 – $3,000/year | Comprehensive care options |

| Hybrid Policies | Lifetime or set term | $3,000 – $5,000/year | Life insurance benefit |

| Short-Term Care | Up to 12 months | $1,000 – $2,000/year | Lower premiums for limited coverage |

Evaluating the Costs and Benefits of Long-Term Care Insurance

When considering long-term care insurance, it’s crucial to weigh the potential costs against the benefits it may provide. Premiums typically vary based on factors such as age, health status, and the level of coverage chosen. Many people find that premium costs can be a significant financial commitment, especially when considering the long duration for which they may need these services. However, it’s essential to recognize that long-term care can be immensely expensive, with average costs varying widely across regions. In the United States, for instance, an annual bill for nursing home care can reach upwards of $100,000, depending on location and facility quality.

On the other hand, the benefits of having long-term care insurance can far outweigh paying out-of-pocket for extensive care. With a strong policy, individuals can enjoy peace of mind knowing they have financial support to cover necessary services such as in-home care, assisted living, or nursing facility costs. Additionally, a comprehensive plan may provide features such as inflation protection, which ensures that benefits keep pace with rising care costs. Here’s a simple table comparing average annual costs against potential policy benefits:

| Care Type | Average Annual Cost | Potential Insurance Benefit |

|---|---|---|

| Nursing Home | $100,000+ | Up to full coverage |

| Assisted Living | $50,000+ | Partial coverage available |

| In-Home Care | $45,000+ | Flexible policy options |

Ultimately, analyzing your personal situation—including health, financial resources, and family expectations—will guide you in making an informed decision. By carefully evaluating the costs and benefits associated with long-term care insurance, seniors and their families can better prepare for the future, ensuring they maintain quality care when it’s needed most.

Tips for Selecting the Right Policy for Your Needs

When considering long-term care insurance, it’s essential to evaluate your unique situation and needs to select the right policy. Start by identifying the types of services that may be required, such as in-home care, assisted living, or nursing facility coverage. Assess your current health status and family medical history, as these factors can influence your future care needs. Additionally, contemplate the duration of coverage that suits you—some policies offer benefits for a set period, while others provide lifetime options. A checklist can be helpful in narrowing down your choices:

- Understand Coverage Limits: Ensure the policy covers a wide range of services.

- Examine Waiting Periods: Review how long you need to wait before benefits kick in.

- Consider Premium Costs: Compare premiums across various insurers.

- Assess Inflation Protection: Look for options that adjust benefits over time.

Another crucial factor is the insurer’s reputation and financial stability. Research various companies and read reviews from policyholders to gain insights into their customer service and claims process. A comparison table can be a great resource to visualize the differences between potential providers:

| Insurance Provider | Customer Rating | Claim Approval Time | Policy Options |

|---|---|---|---|

| Provider A | 4.5/5 | 30 days | In-home, Assisted Living |

| Provider B | 4.0/5 | 45 days | Nursing Home, In-home |

| Provider C | 4.8/5 | 20 days | All-inclusive |

Common Myths and Misconceptions About Long-Term Care Insurance

Many people hold incorrect beliefs about long-term care insurance, which can lead to misunderstandings and misinformed decisions. One common myth is that Medicare fully covers long-term care services. In reality, Medicare mainly covers short-term stays in skilled nursing facilities and does not pay for custodial care, which is often needed for personal assistance with daily activities. Additionally, some assume that Medicaid is an easy alternative when needing care; however, qualifying for Medicaid can be difficult and may require depleting assets to meet income and resource limits.

Another prevalent misconception is that long-term care insurance is unnecessary if you have savings or a family to rely on. While it’s true that personal funds can be a fallback, the costs of long-term care can be astronomical, and relying solely on savings can lead to financial strain. Consider the following points:

- Average cost of assisted living: varies by state but can exceed $4,000 per month.

- In-home care rates: often start around $25 per hour, quickly adding up for extensive care needs.

- Care duration: many people may need care for years, not just months.

| Type of Care | Average Monthly Cost |

|---|---|

| Assisted Living Facility | $4,500 |

| Nursing Home (Semi-Private Room) | $7,500 |

| In-Home Care | $4,000 |

To Wrap It Up

navigating the world of long-term care insurance can be a daunting task for seniors and their families. However, with the right information and resources, you can make informed decisions that will benefit your health and financial future. By understanding the various types of policies available, evaluating your personal needs, and considering the costs involved, you can find a plan that provides peace of mind.

Remember, it’s not just about preparing for the unexpected; it’s about ensuring that you or your loved ones receive the care they deserve when the time comes. Take your time to do your research, consult with trusted advisors, and ask plenty of questions. With careful planning and a thoughtful approach, you can secure the support you need for a fulfilling and comfortable life as you age.

Thank you for reading our guide on long-term care insurance. We hope this information empowers you on your journey toward making the best choices for your future. Don’t hesitate to revisit this resource whenever you need a refresher, and feel free to share this article with others who might benefit from it. Here’s to healthy aging and well-informed decisions!