In the complex tapestry of the insurance world, reinsurance plays a pivotal but often overlooked role. While most people are familiar with purchasing insurance policies to protect themselves from unexpected events, the concept of reinsurance — insurance for insurance companies — remains a mystery to many. As natural disasters become more frequent and the global economy faces uncertainty, the significance of reinsurance has never been more pronounced. This article aims to demystify reinsurance, exploring its functions, benefits, and why it is an essential pillar supporting the entire insurance ecosystem. Whether you’re an industry professional or simply curious about how insurance companies manage risk, understanding reinsurance is key to grasping the broader picture of financial protection and stability in our modern world.

Table of Contents

- The Fundamentals of Reinsurance and Its Importance in Risk Management

- Exploring Different Types of Reinsurance and Their Applications

- Strategies for Insurance Companies to Optimize Reinsurance Partnerships

- Future Trends in Reinsurance and Their Implications for the Industry

- The Conclusion

The Fundamentals of Reinsurance and Its Importance in Risk Management

Reinsurance plays a vital role in the insurance industry, serving as a safety net for primary insurers. By transferring a portion of their risk to reinsurers, insurance companies can better manage their exposure to large claims and unforeseen losses. This process enhances their capacity to underwrite new policies while maintaining financial stability. Key benefits of reinsurance include:

- Risk Diversification: Reinsurers spread out the risk across different lines of business and geographical areas, reducing the impact of localized disasters.

- Increased Capacity: By offloading risk, insurers can accept more policies and larger risks without significantly increasing their exposure.

- Stabilized Financial Performance: Reinsurance helps smooth out the financial volatility that can arise from catastrophic events or spikes in claims.

Furthermore, the importance of reinsurance extends beyond just financial safety; it fosters competition and innovation within the insurance market. Insurers are encouraged to introduce new products and services without the paralyzing fear of extreme losses. This dynamic is crucial for the growth of both the insurance sector and the wider economy. The collaboration between insurers and reinsurers can also foster better risk assessment and management techniques, leading to improved underwriting practices. reinsurance is not just a backup plan; it is an essential component of a robust risk management strategy that underpins the entire insurance industry.

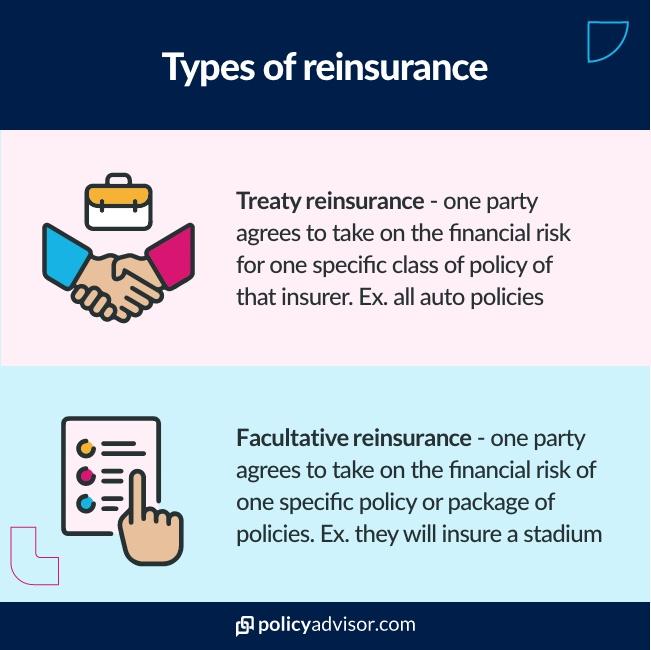

Exploring Different Types of Reinsurance and Their Applications

Reinsurance plays a pivotal role in stabilizing the insurance industry by allowing primary insurers to manage their risk exposure more effectively. Different types of reinsurance cater to various needs, including facultative reinsurance, which is negotiated on a case-by-case basis, giving insurers flexibility to cover specific risks. Alternatively, treaty reinsurance provides broader coverage where the reinsurer agrees to cover a certain pool of risks automatically, thereby streamlining the process for insurers. Both methods enable companies to maintain healthier balance sheets and ensure their ability to settle claims, demonstrating the versatility of reinsurance in varying market conditions.

Moreover, the applications of reinsurance extend beyond mere financial protection. Excess of loss, another type of reinsurance, is designed to protect insurers from significant losses that can arise from catastrophic events, allowing them to underwrite large policies without the fear of overwhelming claims. On the other hand, proportional reinsurance allows for a sharing of premiums and losses between the primary insurer and the reinsurer, which can enhance market competitiveness. Table 1 summarizes these types and their applications:

| Type of Reinsurance | Description | Application |

|---|---|---|

| Facultative | Case-by-case negotiation | Custom risk coverage |

| Treaty | Automatic agreement for a pool of risks | Streamlined operations |

| Excess of Loss | Protection against large losses | Catastrophic event coverage |

| Proportional | Sharing of premiums and losses | Market competitiveness |

Strategies for Insurance Companies to Optimize Reinsurance Partnerships

Effective collaboration between insurance companies and reinsurers is essential for sustaining profitability and managing risk. To enhance these relationships, insurers should adopt a data-driven approach that includes regular assessments of their portfolios. Utilizing analytics tools can provide insights into emerging risks and trends, enabling insurers to make informed decisions on reinsurance coverage. Additionally, establishing a framework for open communication with reinsurers can foster mutual understanding and alignment of goals, which ultimately leads to better pricing structures and policy design.

To further optimize these partnerships, insurers should consider diversifying their reinsurance programs. This can include engaging multiple reinsurers or exploring alternative risk transfer mechanisms, such as insurance-linked securities (ILS). By not relying on a single provider, insurance companies can enhance their resilience against market volatility. Other strategies may comprise:

- Tailored Reinsurance Solutions: Customizing reinsurance contracts to meet specific risk profiles.

- Joint Innovation Initiatives: Collaborating on technology advancements to streamline operations.

- Regular Training and Workshops: Investing in personnel development to strengthen reinsurance knowledge within the organization.

Future Trends in Reinsurance and Their Implications for the Industry

The reinsurance industry is poised for significant transformations in the coming years, driven by advancements in technology and shifting environmental dynamics. As climate change continues to escalate, reinsurers will need to adapt their models to account for increasingly unpredictable weather patterns. This adjustment will not only involve refining risk assessment methodologies but may also lead to the development of new products aimed at mitigating these risks. Additionally, as the demand for data-driven decision-making grows, reinsurers will increasingly rely on big data analytics and machine learning to improve their underwriting processes and enhance their predictive capabilities.

Furthermore, the rise of insurtech firms is creating a new competitive landscape within the reinsurance sector. These agile companies are challenging traditional insurers and reinsurers to innovate continuously. In response, established organizations are likely to pursue strategic partnerships and investments in technology to remain relevant. This shift could lead to a more collaborative environment where shareable data and innovative solutions drive efficiency. Among key trends to watch are:

- Increased digitalization of underwriting processes

- Emphasis on sustainability in product offerings

- Regulatory changes adapting to new market realities

| Trend | Implication |

|---|---|

| Use of AI | Enhanced risk assessment and pricing accuracy |

| Focus on ESG | Increased demand for socially responsible products |

The Conclusion

reinsurance serves as a cornerstone of the insurance industry, providing stability and risk management that benefits insurers and policyholders alike. By understanding its crucial role, we can appreciate how reinsurance not only helps mitigate the financial impact of catastrophic events but also fosters innovation and growth within the sector. As the landscape of risk continues to evolve, the relevance of reinsurance will only increase, making it imperative for industry professionals and stakeholders to stay informed about its developments. Whether you’re in the insurance business or simply looking to expand your knowledge, recognizing the significance of reinsurance is essential for navigating the complex world of risk management. Thank you for joining us in this exploration of reinsurance—here’s to informed decision-making in a rapidly changing environment!