Navigating the world of insurance can often feel overwhelming, especially when it comes to high-risk insurance policies. Whether you’re a homeowner in a flood-prone area, a driver with a history of accidents, or an entrepreneur in a niche industry, securing the right insurance can sometimes pose significant challenges. High-risk insurance policies are designed to provide coverage for individuals and entities that fall outside the conventional parameters of what insurers deem “low risk.” In this comprehensive guide, we’ll break down the key elements of high-risk insurance, explore the various types available, and provide insights on how to identify the best options for your unique situation. By the end, you’ll have a clearer understanding of how high-risk insurance works and how to make informed decisions to protect your assets and peace of mind.

Table of Contents

- Exploring the Landscape of High-Risk Insurance Policies

- Identifying Common Types of High-Risk Insurance

- Navigating the Application Process for High-Risk Insurance

- Strategies for Managing Costs and Securing Coverage

- To Conclude

Exploring the Landscape of High-Risk Insurance Policies

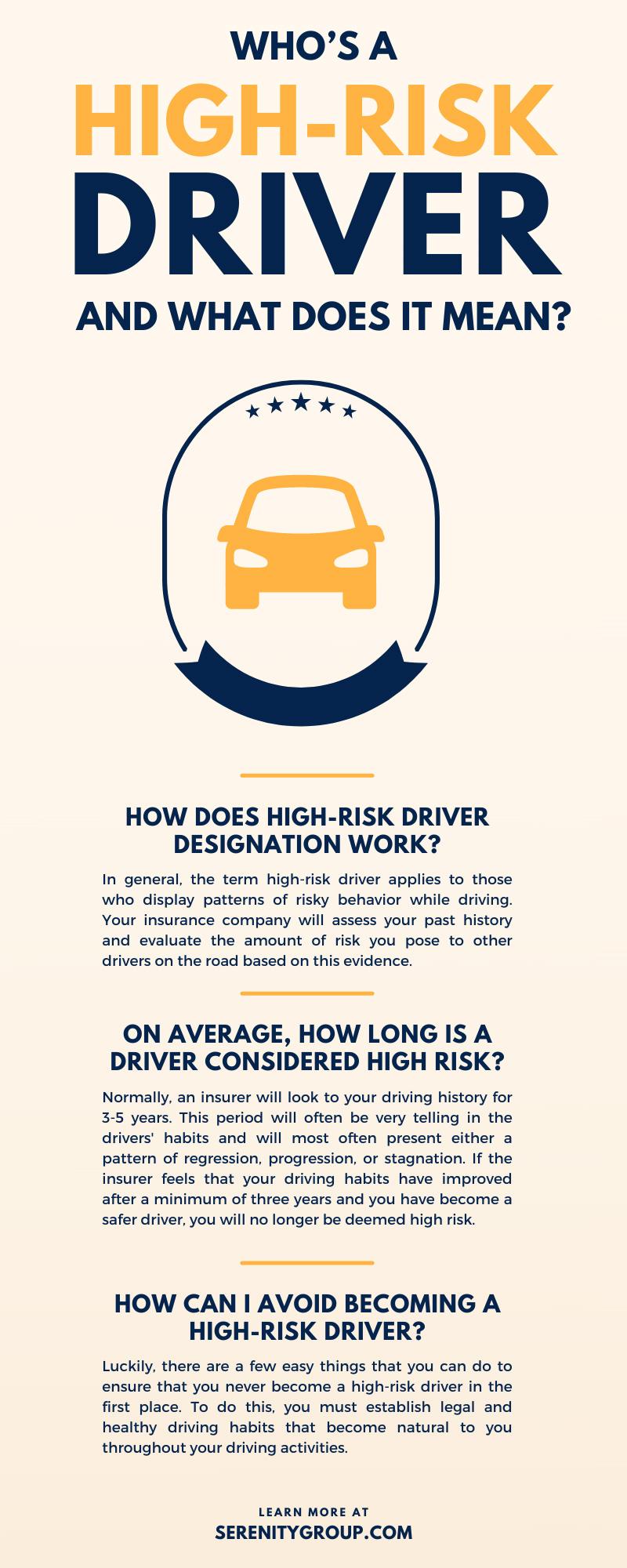

High-risk insurance policies are essential for individuals and businesses who find themselves in situations where traditional coverage options fall short. These policies cater to a variety of unique circumstances, such as drivers with poor credit histories, businesses in hazardous industries, or homeowners living in disaster-prone areas. Understanding the characteristics of high-risk insurance is vital for making informed decisions. Key factors influencing high-risk status include:

- Claims History: Frequent claims can result in higher premiums or denial of coverage.

- Occupation: Certain professions, like construction or mining, pose elevated risks.

- Location: Areas prone to natural disasters affect home insurance options.

While high-risk insurance often comes with higher premiums, it offers critical protection that is otherwise unavailable. Insurers use a variety of methods to assess risk, including underwriting processes and lifestyle assessments, and they may employ strategies to mitigate potential losses. Understanding the types of coverage available is key to finding the right plan. Consider the following common types of high-risk insurance:

| Type of High-Risk Insurance | Purpose |

|---|---|

| High-Risk Auto Insurance | Covers drivers with poor driving records or credit histories. |

| High-Risk Homeowners Insurance | Protects homes in flood or earthquake zones. |

| Specialty Business Insurance | Caters to businesses in high-risk industries, such as construction. |

Identifying Common Types of High-Risk Insurance

High-risk insurance policies cater to individuals and businesses that face unique challenges due to increased risk profiles. These policies often apply to those in specialized industries or individuals with a history that may suggest a higher likelihood of claims. Some of the common types include:

- Health Insurance – Particularly for individuals with pre-existing conditions or a history of serious illness.

- Auto Insurance – Drivers with multiple accidents or traffic violations who may pay higher premiums.

- Homeowners Insurance – Properties located in disaster-prone areas or with high claim frequency may fall into this category.

- Life Insurance – Policies for individuals who smoke, engage in extreme sports, or have significant health concerns.

- Business Insurance – Companies in high-risk sectors like construction or manufacturing that face greater liability exposures.

High-risk insurance is vital for ensuring coverage and financial protection in uncertain situations, albeit usually at a premium price. Within this realm, insurers often assess various factors to determine risk levels, which can also include:

| Insurance Type | Risk Factors |

|---|---|

| Health Insurance | Chronic illnesses, lifestyle choices |

| Auto Insurance | Driving history, age, vehicle type |

| Homeowners Insurance | Location, claims history, property condition |

| Life Insurance | Aging, health status, dangerous hobbies |

| Business Insurance | Industry type, claims history, employee safety measures |

Navigating the Application Process for High-Risk Insurance

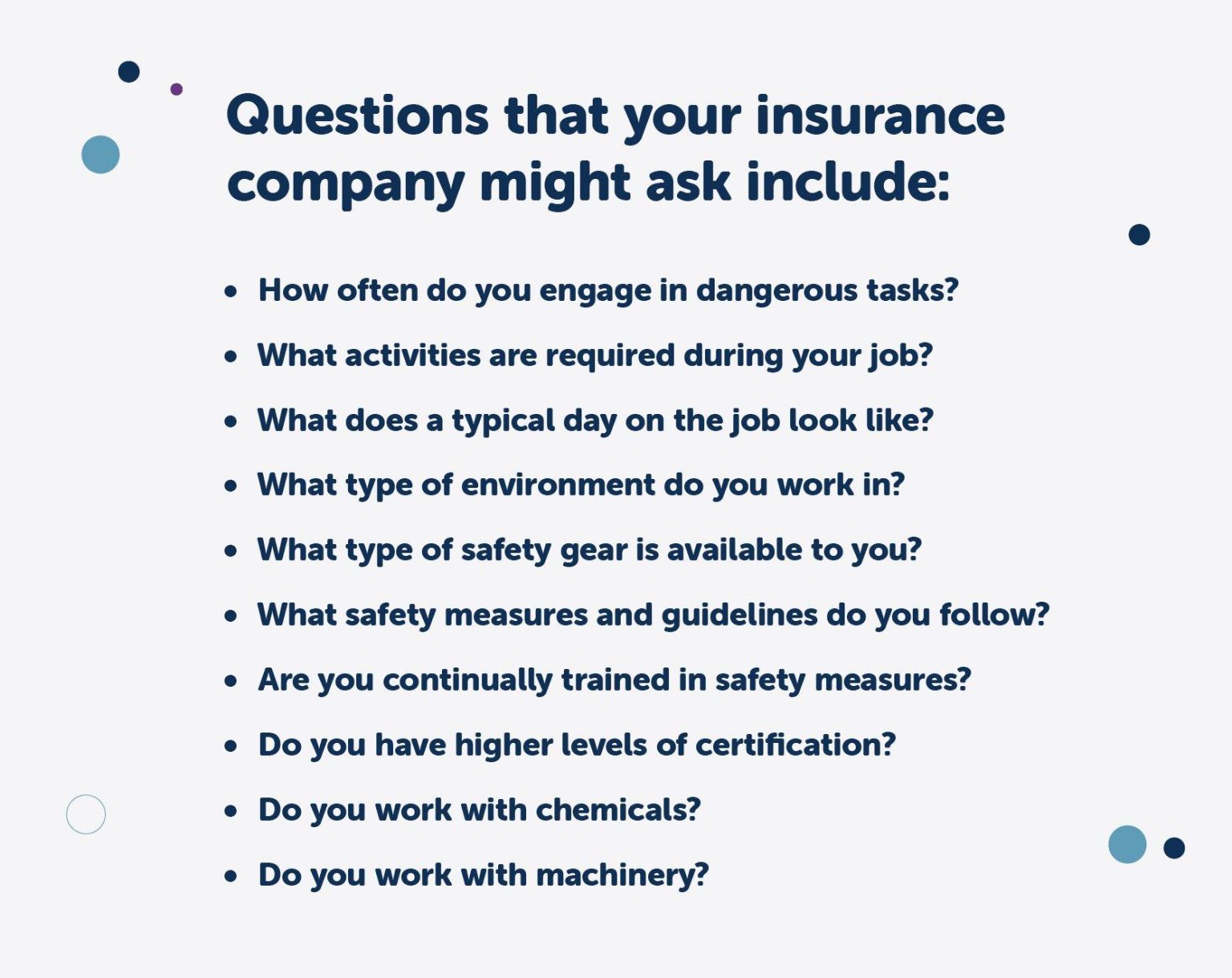

Applying for high-risk insurance can seem daunting, but breaking the process into manageable steps can make it more approachable. First and foremost, understand your risk factors—these may include health conditions, driving records, or previous claims. Gathering documented evidence of your situation is crucial, as insurers will rely on this information to assess your application accurately. Prepare your personal details, such as your Social Security number, home address, and employment history, to streamline the process. It may also be beneficial to review your credit history, as low credit scores can impact your premiums.

Once you have your information ready, comparative shopping becomes essential. Not all insurers treat risk the same way, so consulting with multiple providers can lead to better coverage options at varying rates. Consider using the following tips to help guide your search:

- Utilize online tools to compare quotes quickly.

- Work with an insurance broker who specializes in high-risk policies.

- Ask about available discounts for safety features or completing defensive driving courses.

Don’t hesitate to engage in dialogue with your preferred insurer about any concerns regarding your application. Many companies may be willing to discuss your specific situation, potentially leading to tailored solutions that could benefit both parties.

Strategies for Managing Costs and Securing Coverage

Managing costs while securing adequate coverage in high-risk insurance can be challenging. One effective strategy is to thoroughly assess your risk profile. Understanding the specific risks associated with your situation allows you to identify which areas may require more or less coverage. Additionally, consider comparing quotes from multiple insurers to find the best deal without sacrificing essential coverage; using a reputable insurance broker can also help navigate these options effectively.

Another approach is to implement loss prevention measures to potentially lower your premiums. Insurers are often willing to provide discounts for clients who engage in practices that minimize risks. For instance, installing security systems, regular maintenance checks, or safety training can be beneficial. Furthermore, it’s imperative to take advantage of any available discounts for bundling policies or maintaining a good claims history. Below is a concise overview of potential discount opportunities:

| Discount Type | Description |

|---|---|

| Bundling | Combine multiple policies for a discounted rate. |

| Claims-Free | Discount for a specified number of claims-free years. |

| Safety Features | Reductions for properties with safety or security installations. |

| Membership | Discounts available for members of certain organizations. |

To Conclude

navigating the world of high-risk insurance policies can seem daunting at first, but with the right information and resources, it becomes much more manageable. Understanding the factors that contribute to being classified as high-risk, the types of coverages available, and the potential costs involved can empower you to make informed decisions tailored to your unique needs.

As you explore your options, remember that working with knowledgeable insurance agents can provide valuable insights and help you find the best policy for your situation. While high-risk insurance policies carry their challenges, they also offer essential protections that can safeguard your assets and provide peace of mind.

We hope this comprehensive guide has shed light on the complexities of high-risk insurance and equipped you with the tools to proceed confidently. If you have any questions or need further assistance, don’t hesitate to reach out or explore more resources available to you. Your journey to understanding high-risk insurance is just the beginning—stay informed and proactive in your quest for the right coverage!